Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Digital asset products saw inflows reaching $2.2 billion last week, bringing year-to-date (YTD) investments to a record-breaking $33.5 billion.

Since interest rates were first cut in September, cumulative inflows have climbed to $11.7 billion, marking a sustained upward trend, according to a recent report from CoinShares.

The week’s activity was marked by notable volatility, with $3 billion in inflows during the first half.

However, Bitcoin’s price reaching all-time highs triggered profit-taking, leading to $866 million in outflows by the end of the week.

Total AuM Reaches Record $138 Billion

Notably, total assets under management (AuM) in the digital asset space hit a new peak of $138 billion.

Analysts attribute the increased interest to a combination of looser monetary policies and the Republican Party’s recent victory in the U.S. elections, which boosted market sentiment.

Geographically, the United States led with $2.2 billion in inflows, followed by Hong Kong, Australia, and Canada, which recorded $27 million, $18 million, and $13 million respectively.

Meanwhile, European markets showed contrasting trends as investors in Sweden and Germany opted to lock in profits, resulting in outflows of $58 million and $6.8 million respectively.

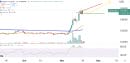

Bitcoin remained the primary driver of inflows, attracting $1.48 billion last week. However, its record-breaking rally above $90,000 prompted some investors to diversify their strategies.

This was evident in the $49 million allocated to short Bitcoin products, reflecting hedging moves amid the heightened market euphoria.

Spot Bitcoin ETFs, particularly in the U.S., also demonstrated robust performance.

Between November 11 and 15, these funds saw net inflows of $1.67 billion, marking six consecutive weeks of positive movement.

BlackRock’s iShares Bitcoin Trust (IBIT) now leads cumulative inflows with $29.3 billion.

In contrast, the Grayscale Bitcoin Trust ETF has seen outflows totaling $20.3 billion since the launch of spot Bitcoin ETFs in January.

The total assets under management for spot Bitcoin ETFs have now reached $95.4 billion, representing 5.27% of Bitcoin’s $1.8 trillion market capitalization.

This aligns with Bitcoin’s historic climb to over $93,400 on November 13.

Ethereum and Solana Join the Spotlight

Ethereum also experienced a resurgence, recording $646 million in inflows last week, representing 5% of its AuM.

Analysts suggest that the inflows were spurred by the recent Beam Chain upgrade proposal by Ethereum developer Justin Drake and positive momentum from the U.S. elections.

Solana followed suit with $24 million in inflows, continuing to build on its strong year.

The spot Ether ETF market mirrored Bitcoin’s positive trend, with $515 million in inflows last week.

Over the past three weeks, Ether ETFs have attracted a total of $682 million, demonstrating sustained investor confidence.

Institutional players have been a driving force behind the recent inflows.

For one, hedge fund manager Paul Tudor Jones has increased his exposure to BlackRock’s IBIT in the third quarter, adding $130 million worth of shares.

With total holdings now valued at $160 million, Jones is among the top 10 IBIT shareholders.

Similarly, Goldman Sachs boosted its holdings by 71% in Q3, bringing its total to $710 million.