Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

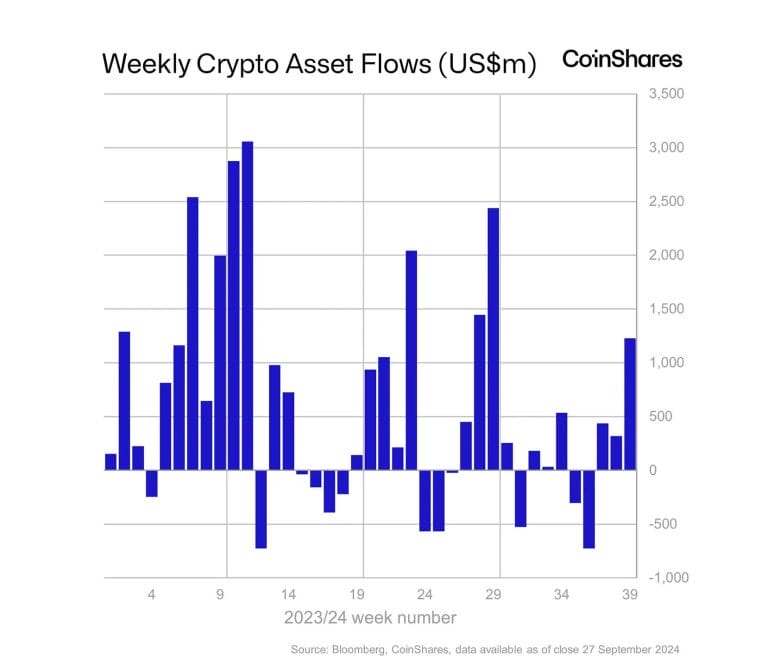

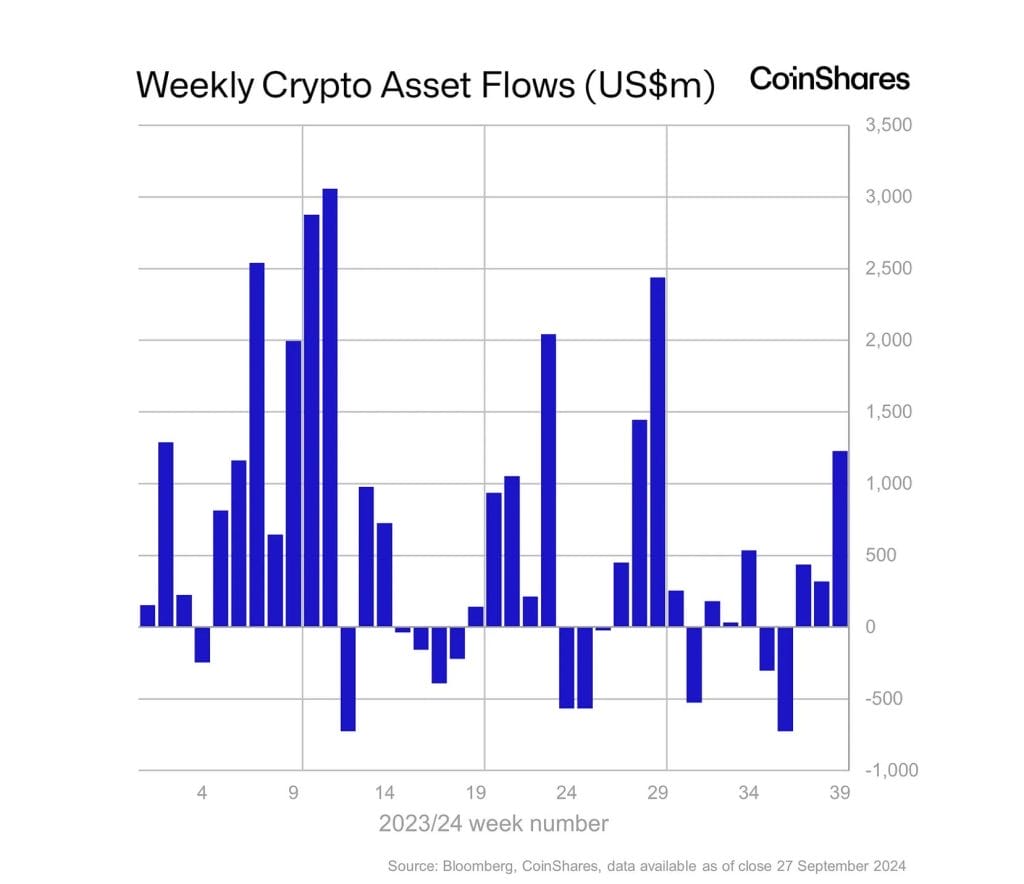

Digital asset products have seen a third consecutive week of inflows, with a total of $1.2 billion, triggered by the continued expectations of dovish monetary policy in the US, according to CoinShares.

Market expectations of dovish monetary policy from the U.S. Federal Reserve and positive price momentum in digital assets are influencing trading activity.

The overall assets under management (AuM) in digital asset products saw a notable 6.2% increase last week, reflecting renewed investor confidence and market optimism.

One of the factors driving positive sentiment was the approval of options for certain U.S.-based digital investment products, which likely spurred further inflows, identifies CoinShares research analyst James Butterfill in his report.

Despite this growing interest, trading volumes showed a slight decline, down by 3.1% compared to the previous week. This discrepancy between increased investment and reduced trading activity may suggest cautious optimism among investors, waiting for stronger signals before increasing trading volumes.

Regional Breakdown: U.S. And Switzerland See Huge Inflows

Regionally, the sentiment surrounding digital assets was divided. The U.S. and Switzerland emerged as key players, recording inflows of $1.2 billion and $84 million, respectively.

In particular, Switzerland’s inflows marked the largest since mid-2022, seeing growing interest in digital assets across European markets. On the other hand, Germany and Brazil saw outflows, with $21 million and $3 million, respectively, indicating some regional variations in investor sentiment.

Bitcoin, the largest cryptocurrency by market capitalization, was the main beneficiary of these inflows, attracting $1 billion. The rise in bitcoin inflows also drove interest in short-bitcoin investment products, which saw inflows of $8.8 million.

The Overall sentiment toward Bitcoin remains positive, some investors are still hedging their bets, anticipating potential price corrections.

Ethereum, the second-largest cryptocurrency, broke its five-week streak of outflows by recording inflows of $87 million, signalling a resurgence in investor confidence. This marks the first significant inflows for Ethereum since early August. However, Solana, another major cryptocurrency, continued to face challenges, with $4.8 million in outflows.

The performance of altcoins was mixed. Litecoin and XRP both attracted positive inflows, with $2 million and $0.8 million, respectively. Binance and Stacks faced outflows of $1.2 million and $0.9 million, reflecting the broader uncertainty and volatility still present in the altcoin market, reports CoinShares.