Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

Terraform Labs co-founder Do Kwon entered a U.S. courtroom on Thursday for the first time following his extradition from Montenegro and pleaded not guilty to multiple fraud charges.

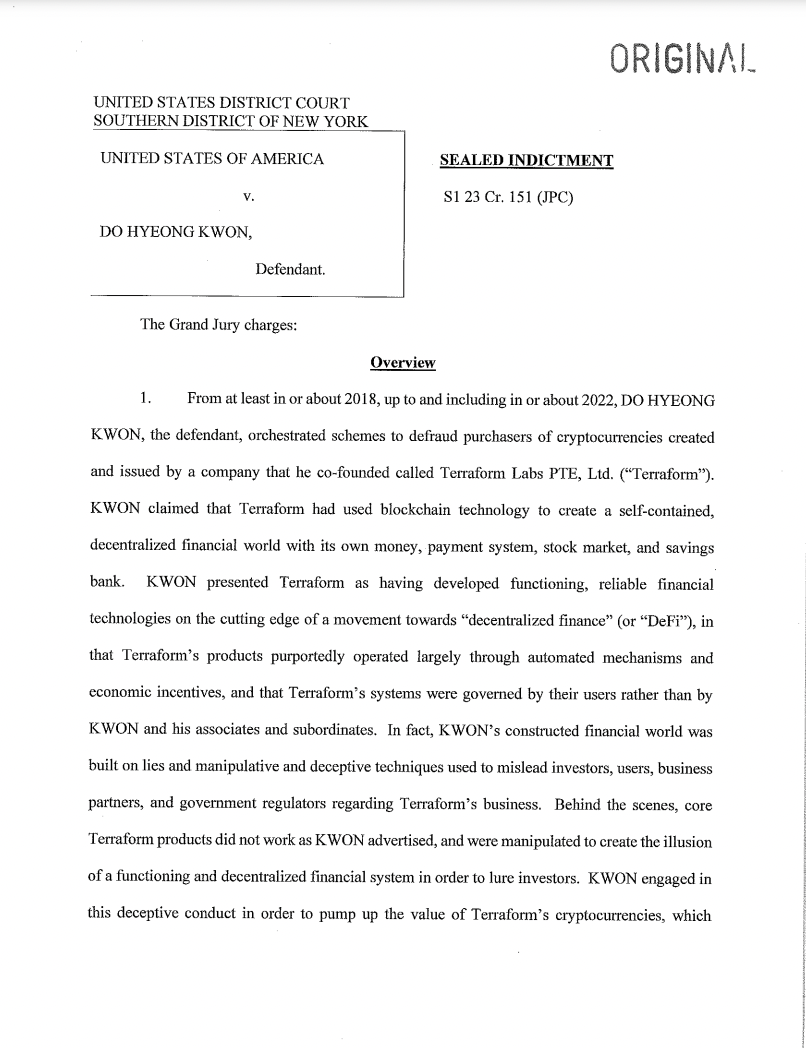

Federal prosecutors in Manhattan have charged Kwon, 33, with securities fraud, wire fraud, commodities fraud, conspiracy, and a newly added count of money laundering conspiracy.

These charges are rooted in allegations that he misled investors about the stability and security of TerraUSD, a stablecoin that was designed to maintain a value of $1.

Do Kwon and Fraud Charges: Allegations and Legal Proceedings

Prosecutors claim that Kwon falsely assured investors in May 2021 that an algorithm known as the “Terra Protocol” had successfully stabilized TerraUSD during a price slip.

However, the indictment alleges that Kwon secretly arranged for a high-frequency trading firm to inject millions into the ecosystem to sustain TerraUSD’s value artificially.

The collapse of TerraUSD in May 2022 triggered a domino effect, leading to the devaluation of Luna and widespread disruptions across the cryptocurrency market.

Bitcoin and other major tokens saw major declines as retail and institutional investors suffered heavy losses.

According to prosecutors, Kwon’s deception inflated Luna’s value, reportedly reaching $50 billion at its peak.

Thursday’s updated 79-page indictment revealed new details about the money laundering conspiracy charge, asserting that funds were transferred through various accounts to obscure the origins of illicit gains.

Internal communications cited by the Manhattan U.S. Attorney’s office suggest that when TerraUSD began destabilizing in 2022, an unidentified trading firm warned that restoring its value would be far more challenging than during the previous crash.

While the indictment does not explicitly name the trading firm, descriptions align with Jump Trading, a firm implicated in related civil cases filed by the U.S. Securities and Exchange Commission (SEC).

Jump Trading has not commented on these allegations.

Legal Background and Broader Implications

Before his extradition to the U.S., Kwon faced months of legal proceedings in Montenegro after being detained for attempting to travel with falsified documents.

The Montenegrin court ultimately prioritized the U.S. extradition request over South Korea’s bid to have Kwon returned to face charges in his home country.

This trial adds to the growing list of legal actions against high-profile figures in the crypto industry.

Kwon’s case draws parallels with Sam Bankman-Fried, the FTX founder sentenced to 25 years in prison for misappropriating $8 billion in customer funds, and Alex Mashinsky, former CEO of Celsius Network, who recently pleaded guilty to fraud charges.

Terraform Labs, the company behind the TerraUSD and Luna projects, declared bankruptcy in January 2023, further complicating investor recovery efforts.

In June 2024, Kwon reached a $4.55 billion settlement with the SEC, including an $80 million fine and a ban from participating in crypto activities.

Despite these civil penalties, Thursday’s criminal charges could result in an extended prison sentence if Kwon is convicted.