Over the past 24 hours, the PEPE price has experienced a notable 4.84% increase amid market growth, with meme coins up an average of 3.66%. Meanwhile, indicators hint towards a surge preceding a bearish reversal ahead.

This comes as PEPE holds steady in its recent gains, rising 2.44% since last Monday. Notably, this growth contrasts with losses from most notable altcoins during the same period.

This resilience has allowed PEPE to recover from its rut in recent weeks, now standing at a 5.12% gain over the past month.

Despite this notable price increase, trader interest in PEPE appears to be waning. The meme coin’s 24-hour trading volume has fallen 23.48% to 508.47 million over the past 24 hours.

Pepe Price Indicators Hint Towards a Bearish Reversal – Time to sell?

After consolidating over the past 12 days, Pepe appears poised for a breakout before a bearish reversal.

Over the past 12 days, the PEPE price has been bound by consolidation. It has ranged between strong support at $0.0000127, and resistance at $0.0000113.

However, PEPE’s chainlink money flow (CMF) (green) has reached the +11.0 mark after holding below +0.05 since the 25th of July, indicating renewed bullish momentum.

This is supported by the asset’s relative strength index (RSI) (purple), which has increased from 40 to 60 over the same period. Though neutral, it now leans bullish, escaping its downtrend since July 15th.

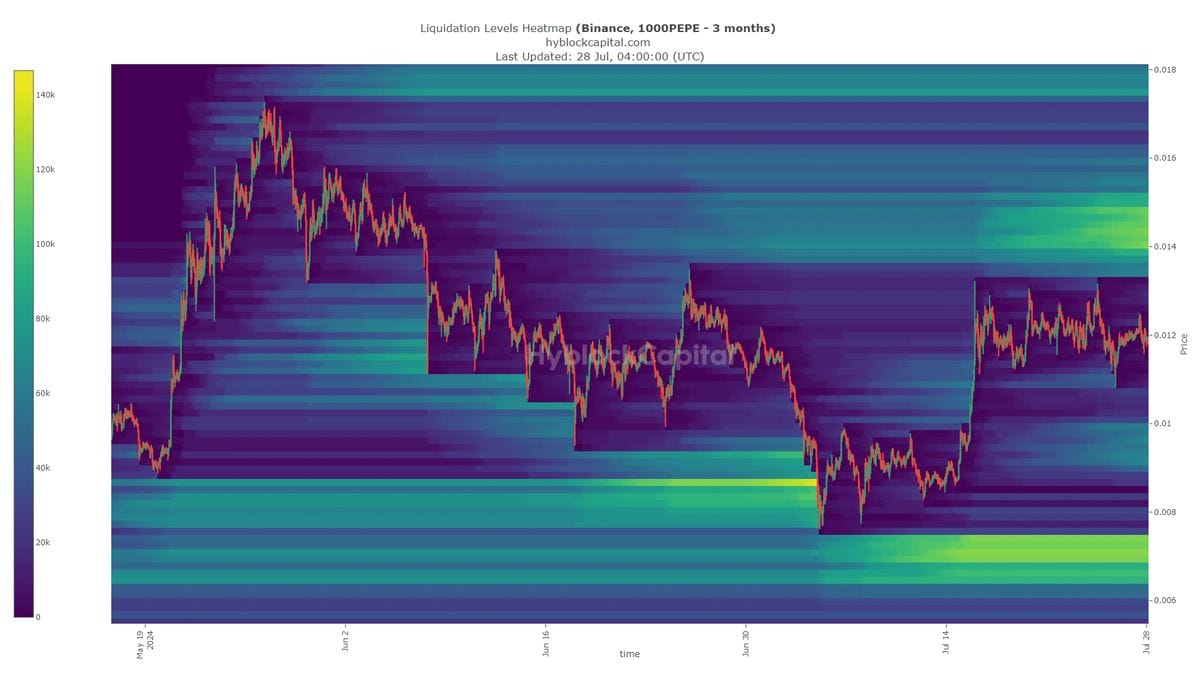

A look at PEPE’s liquidation heatmap reveals that this may be credited to a magnetic zone formed between $0.000014 and $0.0000148 as it has become densely populated with liquidation levels.

The stability brought by the recent consolidation has built up liquidation levels, making it more likely to be swept in the coming weeks.

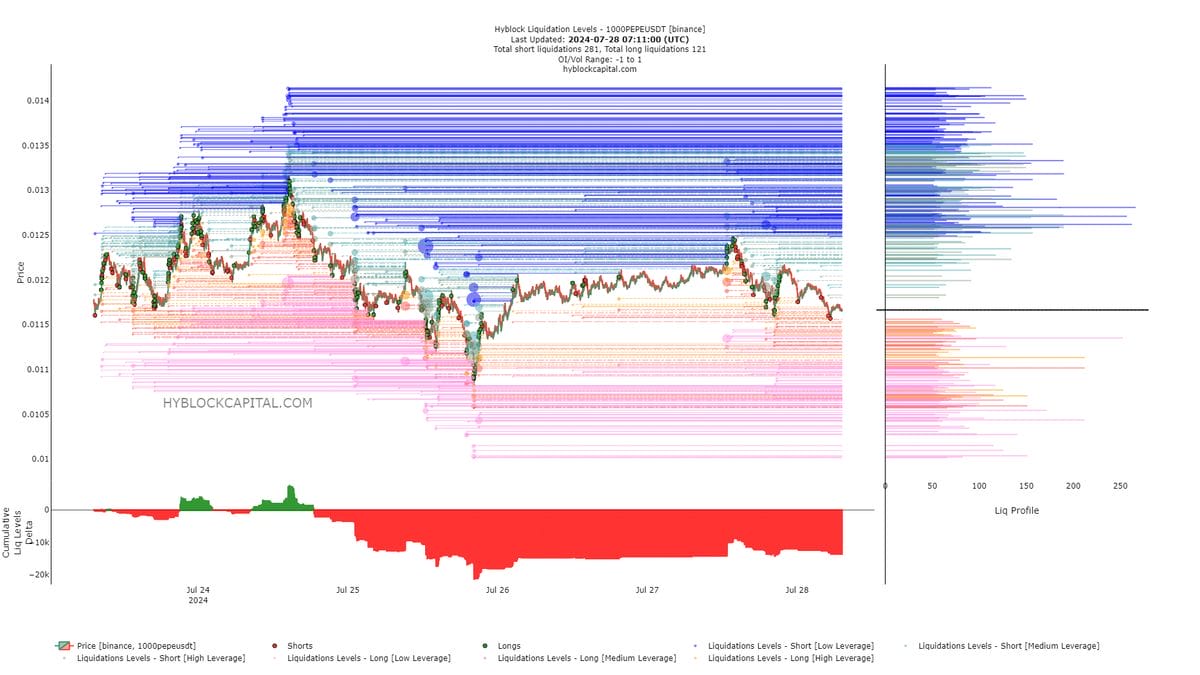

However, short positions have set a target of the $0.000007-$0.0000076 for a price decline,

The liquidity levels chart shows that short positions outnumber longs. This could hint at a short squeeze or an upward move to target short-sellers.

Such a move could increase buying pressure and drive the price higher. Therefore, reaching $0.000014 seems plausible before a potential bearish reversal.

However, the chances of a breakout appear slim, especially with Bitcoin retreating from the $69k resistance recently.

Traders Are Looking To A New PEPE Coin

Although traders may want to cling to PEPE for further gains, the meme coin landscape has evolved. The best opportunities now leverage real utility alongside a strong community.

As the leading hype-based coins reach multi-billion dollar market caps, their biggest gains are behind them, and traders are hungry for the next meme coin set for explosive growth.

Enter Pepe Unchained ($PEPU), a meme coin that transcends conventional utility. It addresses two of the most significant pain points in the current crypto landscape – transaction speeds and fees.

This liberated evolution of Pepe operates on its own Layer 2 chain, freeing itself from Ethereum’s shackles, offering lower fees and 100x faster transaction speeds.

It’s not just a memecoin, it’s a memechain! Something that may be credited to its instant success, raising almost $6 million in its presale so far.

Chain after chain is broken! 🐸⛓️

Pepe has raised $6M! The revolution continues! pic.twitter.com/555bPCkWdE

— Pepe Unchained (@pepe_unchained) July 28, 2024

This confidence can also be attributed to Pepe Unchained’s commitment to transparency.

It has undergone two audits and features its own block explorer, allowing users to track all transactions on its unique chain.

At a temporary fixed presale price of $0.0082596, those who act quickly stand to benefit the most. Investors are currently earning an impressive 312% APY. This presents a valuable passive income opportunity, even amidst recent market volatility.

Join the Pepe Unchained community on X and Telegram to stay up to date on the latest announcements.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.