Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

TRUMP coin is facing a steep decline, mirroring the broader crypto market downturn. Currently trading at $11.61, TRUMP has dropped 2.49% in the last 24 hours and is down 17.2% over the past week. The decline is largely tied to Bitcoin’s pullback, which has dragged down the entire market, raising concerns among traders.

However, beyond BTC’s weakness, TRUMP’s decline is also linked to disappointment surrounding former President Donald Trump’s executive order to create a Bitcoin Strategic Reserve.

While the order was expected to boost crypto sentiment, the lack of direct BTC purchases by the U.S. government failed to impress investors, further weighing on market confidence.

Trump’s Crypto Order Fails to Spark Market Confidence

Trump’s latest executive order was intended to strengthen the U.S. position in crypto by creating a Bitcoin Strategic Reserve. However, the market reaction was underwhelming, as the reserve will only hold assets seized from criminal and civil cases, rather than purchasing Bitcoin outright.

- No government BTC purchases disappointed investors.

- Bitcoin dropped 6% post-announcement, hitting $84,900 before recovering to $87,700.

- Altcoins, including TRUMP, followed BTC’s decline, reinforcing bearish sentiment.

Many investors expected a bolder pro-crypto move, such as direct acquisitions or regulatory clarity. Instead, the cautious approach added uncertainty, contributing to the market downturn.

Weak U.S. Job Data Adds to Crypto Pressure

Beyond Trump’s policy, macroeconomic factors are also impacting crypto. The latest Nonfarm Payrolls (NFP) report showed that the U.S. added only 151,000 jobs in February, missing expectations of 160,000. While slightly better than January’s 125,000, the slow hiring pace raised economic concerns.

- Unemployment rose to 4.1%, signaling potential labor market weakness.

- Wage growth slowed, with Average Hourly Earnings increasing just 0.3% (down from 0.4%).

- Federal Reserve Chair Jerome Powell reiterated no rush for rate cuts, keeping markets cautious.

A weaker job market, combined with a hawkish Fed, has created risk-off sentiment, making investors less willing to pour money into speculative assets like crypto and TRUMP.

Can TRUMP Coin Recover?

Despite the steep decline, TRUMP remains highly volatile, meaning a rebound is possible. Several factors could fuel a recovery:

- Bitcoin’s price action: If BTC stabilizes and moves higher, TRUMP could follow suit.

- Stronger market sentiment: A shift in investor confidence, possibly driven by regulatory clarity or economic data, could support TRUMP’s price.

- Trump’s crypto policies: If future policy announcements bring positive momentum, TRUMP could regain investor interest.

For now, TRUMP remains under pressure, with its recovery tied to broader market conditions. Until Bitcoin regains strength or investors find renewed confidence, the coin may struggle to reverse its recent losses.

TRUMP/USD Analysis – Bearish Trend Persists Below Key Resistance

TRUMP coin remains under selling pressure, trading at $10.97, after breaking below $11.70 support. The descending trendline continues to cap upside moves, while the 50 EMA at $12.15 acts as resistance.

If TRUMP fails to reclaim $11.70, further downside toward $10.52 and $9.63 is likely. A breakdown below $9.63 could accelerate losses toward $8.75.

For bulls, a breakout above $12.15 would shift sentiment, opening the door to $12.61 and $13.89. Until then, the bearish structure remains intact, and sellers remain in control.

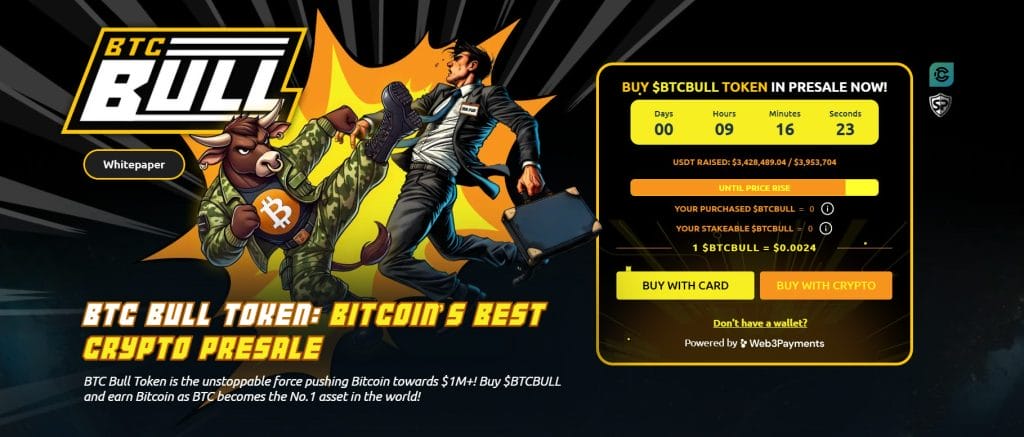

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is gaining traction as a community-driven token that rewards holders with real Bitcoin. Unlike conventional meme tokens, BTCBULL airdrops BTC automatically when Bitcoin reaches key price milestones, offering a strong incentive for long-term investors.

Staking & Passive Income Opportunities

BTC Bull features high-yield staking, allowing users to earn passive income with an impressive 154% APY. This staking system has already seen strong community participation, with millions of BTCBULL tokens staked.

- Current Presale Price: $0.0024 per BTCBULL

- Total Raised: $3.4M / $3.66M target

With investor interest surging, this presale offers an opportunity to secure BTCBULL at early-stage prices before the next price jump.