Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

The European Central Bank (ECB) has reiterated its push for a digital euro, citing US President Donald Trump’s recent executive order promoting dollar-backed stablecoins as a key driver.

According to a Jan. 24 Reuters report, ECB board member Piero Cipollone said that Trump’s order, which aims to “promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide,” could further disintermediate banks by luring customers away.

The executive order signed on Jan. 23 could establish a working group to study a regulatory framework for stablecoins.

“I guess the key word here [in Trump’s executive order] is worldwide,” Cipollone told a conference in Frankfurt. “This solution, you all know, further disintermediates banks as they lose fees, they lose clients… That’s why we need a digital euro.”

🇺🇸 US President Donald Trump issues an executive order to establish clear regulations for digital assets, prioritizing blockchain growth and rejecting CBDCs.#CryptoRegulation #Blockchain #DigitalAssetshttps://t.co/rpzizu6sMY

— Cryptonews.com (@cryptonews) January 23, 2025

Digital Euro: Mitigating Risks

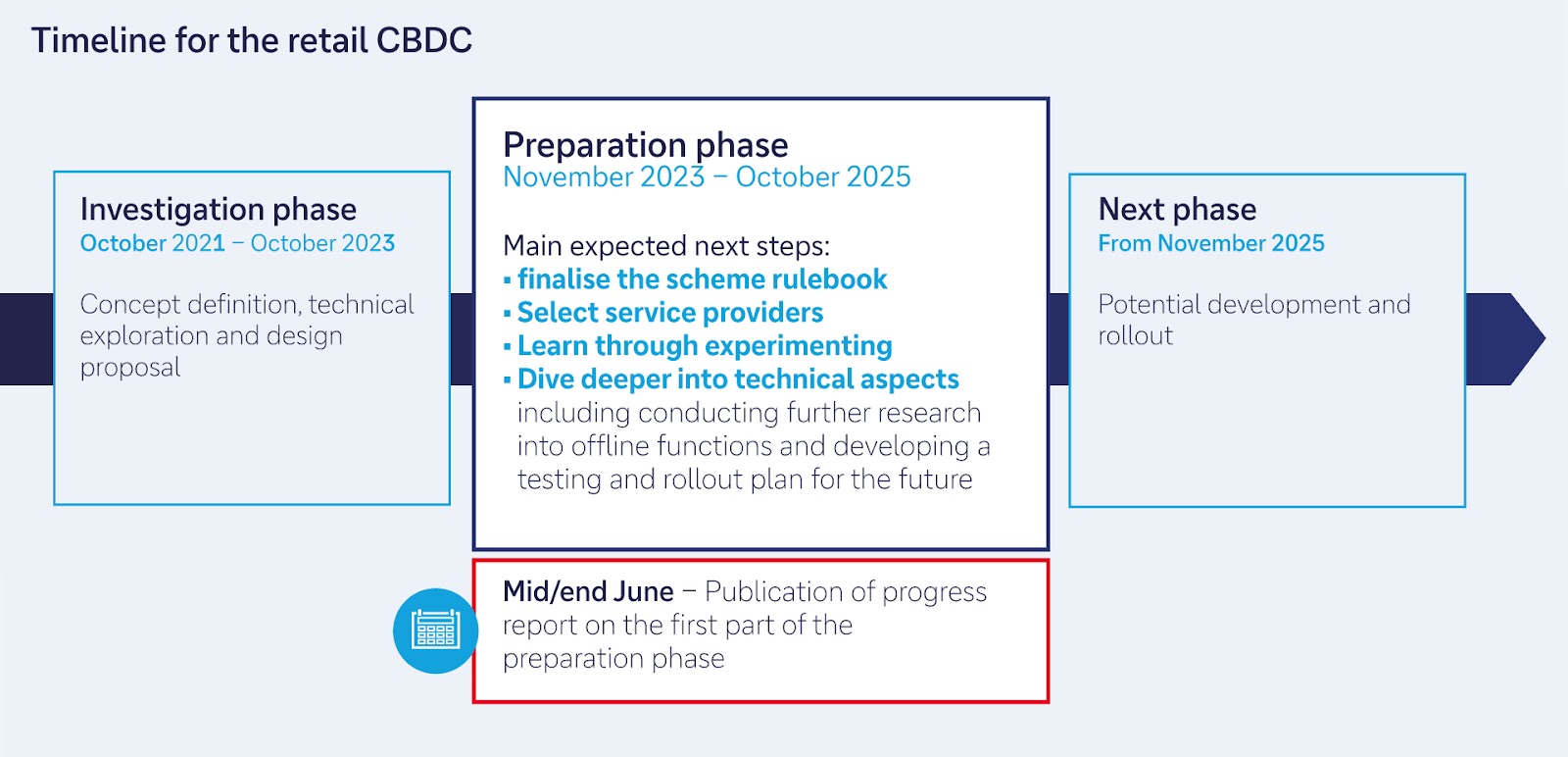

The ECB has embarked on its journey for a digital euro in October 2021. Currently, the central bank is conducting pilot programs to assess the feasibility and potential impact of a digital euro. A final decision on its launch will depend on the approval of European lawmakers.

According to the ECB, a digital euro would offer a safe and efficient alternative to private cryptocurrencies, particularly those issued by foreign entities. It would allow for easier and more inclusive payments, even for those without bank accounts.

However, banks remain concerned that a digital euro could lead to significant capital outflows, as customers shift funds to the safety of an ECB-backed digital wallet.

To prevent potential disintermediation from bank accounts and avoid excessive demand for digital euros, the ECB introduced several safeguards. One such measure is setting holding limits for users.

Additionally, a “waterfall mechanism” will be in place. This mechanism ensures that the holding limit is not exceeded. For merchants and corporations, the limit will be set to zero, meaning any digital euros they receive will automatically be returned to their bank accounts.

Finally, the ECB will not pay interest on digital euros to deter excessive holdings.

Key Drivers for the Digital Euro

Several factors are driving the ECB’s push for a digital euro.

Firstly, as consumers increasingly favor digital payments, a currency solution is needed that adapts to these evolving preferences while still maintaining the option to use cash. A digital euro would address this need by providing a convenient and secure digital alternative.

Secondly, it aims to streamline payments across the Eurozone, providing citizens and businesses with a more efficient and cost-effective payment method.

Finally, by reducing reliance on non-European payment providers, the digital euro would enhance Europe’s strategic autonomy in the global financial landscape.

US vs. EU Approaches

Notably, Trump’s executive order prohibits the Federal Reserve, the US central bank, from issuing its own central bank digital currency (CBDC). This ban is a win for US-based private stablecoins and issuers like Circle, Tether, Ripple, and even PayPal.

In contrast, the ECB advocates a different approach. While recognizing the role of private-sector payment solutions, ECB Executive Board member Ulrich Schaaf said that many of these solutions are limited in scope and fragmented, which hinders pan-European interoperability.

He suggested that a digital euro issued by the central bank could address these challenges by creating a more integrated and efficient payment system across the Eurozone.

While the digital euro would be issued as a liability of the ECB, the implementation will not be undertaken by the ECB alone. “Distributors will be mainly payment service providers, including banks,” said Schaaf. “They will take care of the exchange, customer relations, and services that go along with the digital euro. They would also be able to sell innovative solutions and services on top of the digital euro.”