Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

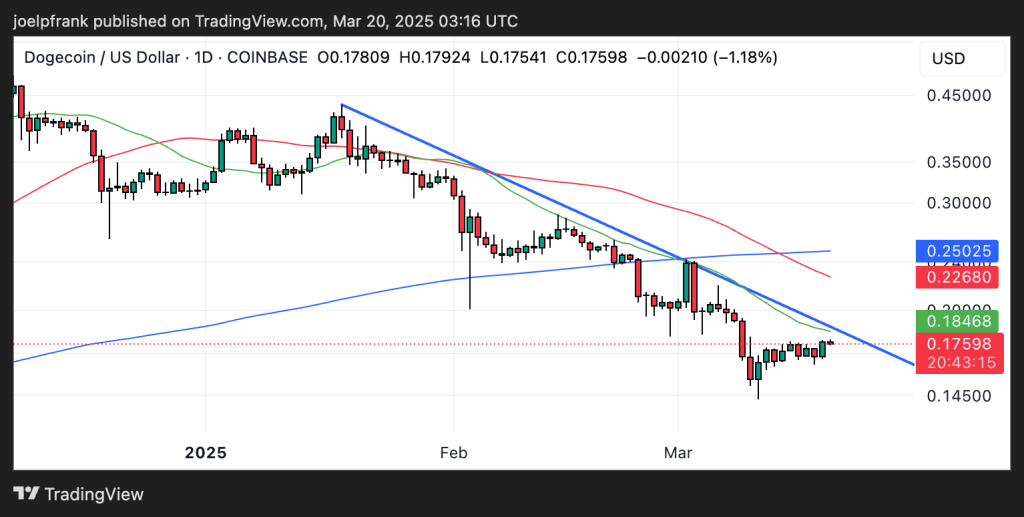

Things aren’t looking good for Dogecoin (DOGE) right now, with the crypto industry’s biggest meme coin on the cusp of testing a major short-term resistance level that could send it back to fresh multi-month lows.

Dogecoin (DOGE) was last around $0.176, a solid 20% up from its lows near $0.14 last week.

6% of those gains came in wake of Wednesday’s Fed policy meeting, which seemed to spark a modicum of optimism in the market.

The Fed announced plans to reduce the pace of its balance sheet run off, meaning liquidity will be drained from the US financial system at a slower pace.

However, the Fed’s updated economic projections weren’t pretty, with the bank expecting high inflation, a high unemployment rate and lower GDP growth ahead.

That’s unlikely to ease growing fears in the market as of late that the US economy could be tilting toward a recession.

And such fears are likely to mean that rallies in risk assets, including Dogecoin, continue to be sold in the weeks and month ahead.

In fact, Dogecoin appears to nearing a great entry level for those looking to add shorts.

DOGE is now within a whisker of its 21DMA. Since falling below this key short-term moving average in late January, DOGE has consistently rejected retests of it.

The 21DMA also coincides with a downtrend from the 2025 highs. If Dogecoin rejects this area of resistance, a swift sell-off back towards recent lows could easily ensue.

How Low Could Dogecoin Go?

An increasingly uncertain macro backdrop characterized by rising recession risk, but with no major stimulus from the Fed on the horizon, suggests now isn’t a good time to be piling into highly risk sensitive assets like Dogecoin.

Indeed, it likely means that Dogecoin has a lot lower to decline in the weeks and months ahead.

So how low could the Dogecoin price go?

Well, if the March lows just above $0.14 go, this would open the door to a swift drop all the way back to as low as the mid-2024 lows around $0.08.

And if things get really bad, a dive all the way back to the mid-2023 lows in the $0.05 area could be on the cards.

Would this be a good time to buy the dip. Well, it depends on the profile of the investor.

For those willing to hold through major volatility for years, but Dogecoin below $0.10 could be an excellent choice.

Assuming macro conditions eventually improve and the Trump administration eventually engineers an economic boom in the US, leading cryptos are likely to perform very well in the long term.

The Trump administration has specifically marked the crypto industry as a sector in which they want to support growth.

It’s very feasible that, macro conditions allowing, Dogecoin could rally to a new record high and potentially even above $1.0 by the end of Trump’s term.

So, while it might face near-term downside volatility, Dogecoin could be one of the best cryptos to accumulate for long-term holders in the coming months.