Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

In the wake of Donald Trump’s re-election as U.S. President, crypto analysts are eyeing a breakout moment for Ether (ETH), with projections suggesting a climb to $3,200 in the short term.

The market’s confidence has seen a boost with Trump’s win, stirring a fresh wave of optimism and driving positive inflows into U.S. spot Ether exchange-traded funds (ETFs).

Ether Benefits from Pro-Crypto Sentiment and Bitcoin Dominance

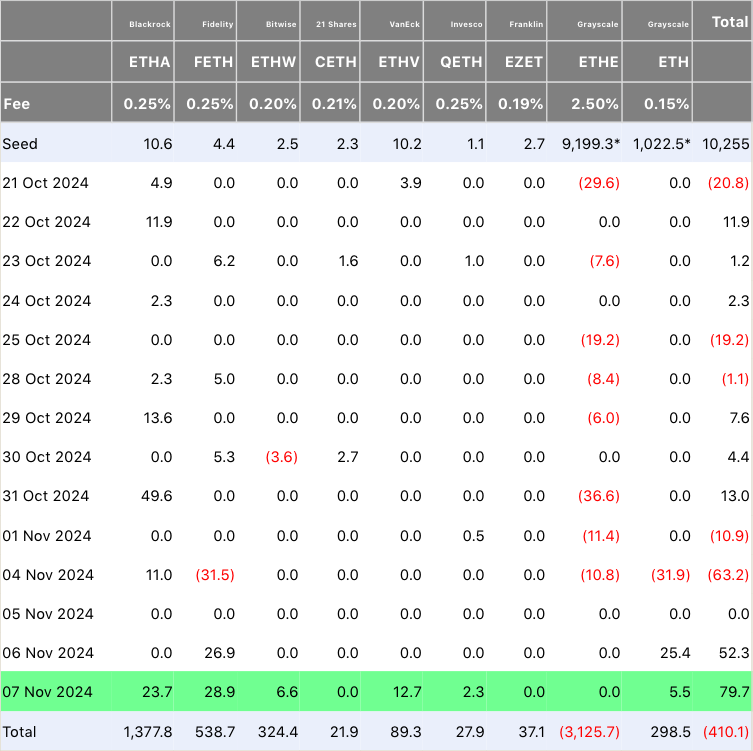

On Nov. 6, spot Ether ETFs recorded $52.3 million in net inflows, followed by an impressive $79.7 million the next day, according to data from Farside Investors. This influx of investment, combined with growing investor risk appetite amid a pro-crypto political climate, has fueled bullish outlooks for Ether.

Analysts at Bitfinex told Cointelegraph that Ether is set to break out of its range and hit $3,200 soon, and “as soon as Bitcoin’s market cap ratio against the total market cap tops – our expectation is that it will be around 60% – we can expect Ether to have a run.”

Bitcoin’s dominance now hovers around 59.7%, signaling what many see as an impending rally for Ether.

ETH Faces Volatility as 82K ETH Flood Derivative Exchanges

However, despite the recent inflows into Ether ETFs, traders are buzzing as a massive 82,000 ETH has poured into derivative exchanges. This significant influx has sparked concerns about potential price swings.

As a CryptoQuant analyst pointed out, “historically, following previous large netflows, the price of Ethereum tends to experience a downturn or increased volatility.” This latest surge, the analyst warned, “could signal another period of heightened market activity, potentially a price correction or a sharp move based on trader positioning.”

Significant spikes in Netflows, with 82,000 $ETH moving to derivative exchanges

“Historically, following previous large netflows, the price of #Ethereum tends to experience a downturn or increased volatility.” – By @3AMRTAHA_

Read more 👇https://t.co/xFhNdLClfx pic.twitter.com/QmwATzxyvO

— CryptoQuant.com (@cryptoquant_com) November 5, 2024

With traders on edge, the crypto market is bracing for what could be a volatile period ahead.

Trump’s Win: A Green Light for Crypto Innovation?

Beyond price projections, Trump’s administration could accelerate regulatory support for crypto innovations, including the launch of the first staked Ether ETF.

Nate Geraci, President of The ETF Store, wrote in his X post on Nov. 4 that staking for ETH ETFs would inevitably occur, regardless of the specific administration. However, the analysts suggested that this process would accelerate under a Trump administration.

Additionally, Geraci mentioned the possibility of in-kind creation and redemption for spot Bitcoin (BTC) and Ether ETFs.

Crypto ETF items new admin should immediately address…

1) Approving options trading on spot btc & eth ETFs (if doesn’t happen before year-end).

2) Allowing in-kind creation & redemption for spot btc & eth ETFs.

3) Allowing staking for spot eth ETFs.

Very basic stuff here.

— Nate Geraci (@NateGeraci) November 7, 2024

Is Ethereum Poised for a New All-Time High?

Currently, Ether price is growing and reached $2,914 at the time of writing. This represents a remarkable 16% increase over the past week and a solid 3.6% gain in the past 24 hours.

As investor enthusiasm ramps up, Ether’s open interest hit a high of $11.7 million, also indicating strong positioning for a breakout. With the market seemingly aligned, Ether appears set to capitalize on favorable conditions and head towards its 2021 all-time high of $4,800.