Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Vitalik Buterin, co-founder of Ethereum, has once again been linked to the sale of a significant amount of ETH, which has drawn attention and speculation within the crypto community.

According to blockchain data, a wallet associated with Buterin executed a sale of 190 ETH, equivalent to $441,971 in USDC, in a recent transaction. This adds to a series of sales totaling 950 ETH, valued at approximately $2.28 million, since August 30, with an average price of $2,396 per ETH.

This series of transactions has triggered various reactions among market watchers, who question the timing and implications of these sales for the broader market sentiment.

Vitalik’s Series of Transactions Now Add Up to Over $9.8M Worth of ETH

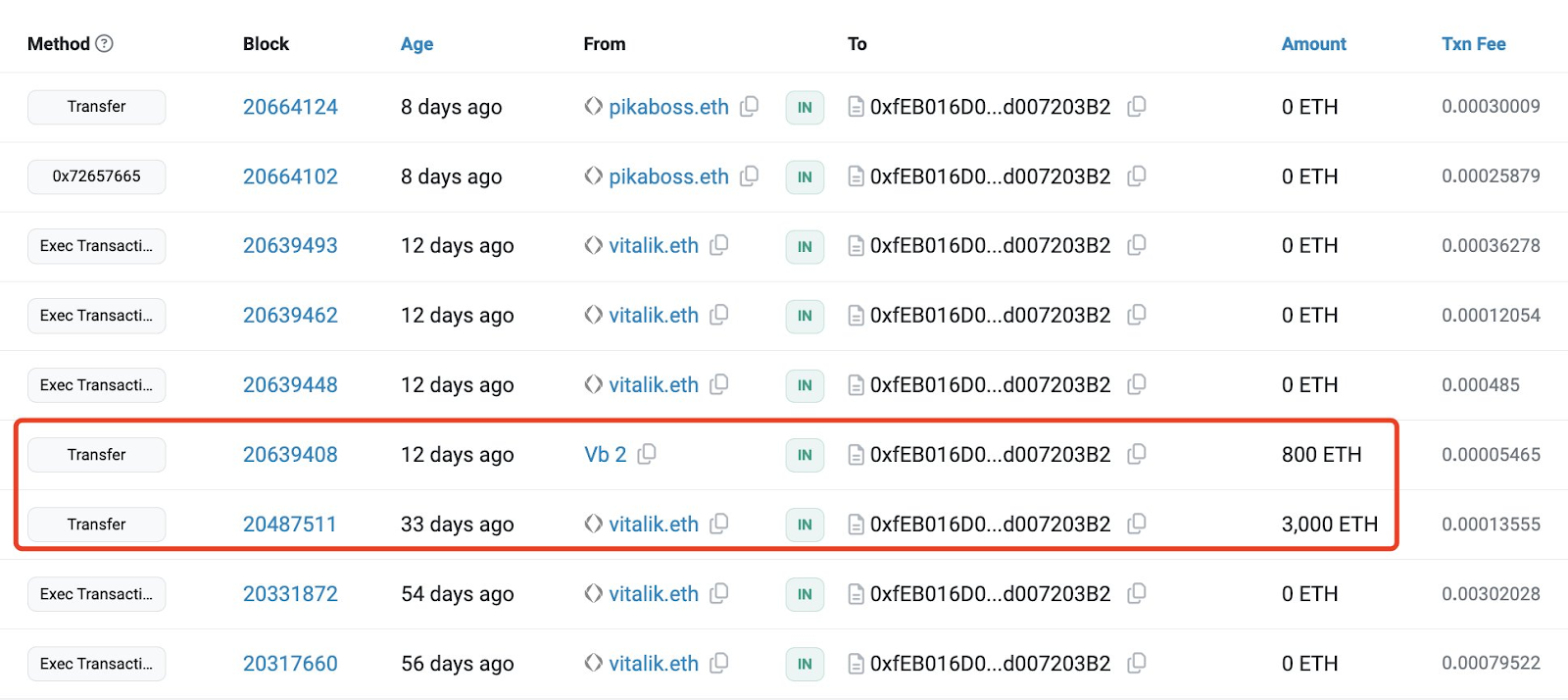

The recent series of ETH transactions linked to Vitalik Buterin began on August 30, when his associated wallet received 3,800 ETH, valued at approximately $9.8 million.

Since receiving the funds, Buterin’s wallet has executed multiple sales, offloading ETH in smaller, strategic batches rather than in a single large transaction.

The first sale occurred shortly after the deposit, where 350 ETH was sold for approximately $839,600, averaging around $2,398 per ETH.

Following this, another batch of 410 ETH was sold on September 2, fetching roughly $983,800 at a similar price point.

The most recent sale involved 190 ETH, converted into $441,971 USDC, completed just 20 minutes before LookOnChain’s announcement on X.

This latest transaction brings the total amount sold to 950 ETH, valued at approximately $2.28 million at an average price of $2,396 per ETH.

As the community suggests, the systematic pattern of these sales—spanning multiple days and averaging a consistent price—suggests a deliberate strategy to avoid drastic price drops, which could occur if larger amounts were sold in a single transaction.

Each sale has been executed using decentralized platforms, which adds a layer of transparency to the process but also invites speculation about Buterin’s intentions.

The community has been tracking the wallet’s activity with keen interest, noting the precise timing of each transaction and the choice to convert ETH to USDC, a popular stablecoin.

This decision might indicate a preference for stability or liquidity, possibly for funding ongoing projects, charitable contributions, or other undisclosed initiatives, which Buterin has claimed to be doing.

The structured approach to these transactions contrasts with more typical behavior seen from whale accounts, where sudden large-scale movements often disrupt markets.

By spreading out the sales over several days and keeping each batch relatively small, Buterin seems to be maintaining a balance between liquidity needs and market stability, avoiding the pitfalls of causing panic or drastic price fluctuations.

The repeated ETH sales by Buterin have sparked various responses across the community, from concerns over potential bearish signals to interpretations that Buterin might be diversifying his holdings or funding specific projects.

The market impact of such significant sales from a high-profile figure like Buterin is always a topic of intense scrutiny.

While some view these transactions as Buterin’s routine financial decision, others speculate on deeper strategic reasons behind the timing and amounts sold, especially now that Ethereum is preparing for a bullish break.

Ethereum is currently attempting a recovery above $2,300, trading above the 100-hourly Simple Moving Average with a bullish trend line support at $2,335.

While the price cleared the $2,320 resistance, it faces hurdles around the $2,380 level, with a major resistance at $2,400. A successful break above $2,400 could push Ether toward $2,465, with subsequent resistance levels at $2,500 and $2,550.

The ongoing ETH sales come at a time when the market is particularly sensitive to actions by influential figures within the crypto ecosystem. Given Buterin’s foundational role in Ethereum, his trading activities often serve as a barometer for investor sentiment.

Buterin has yet to comment on the transactions. It seems he has left the community to interpret the implications based on the available data.