Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ethereum has dropped to $1,874, testing a key support level as selling pressure intensifies across the broader crypto market. With prices inching dangerously close to critical liquidation thresholds around $1,805, analysts warn that a sharper correction could be on the horizon.

This downturn places $238 million worth of ETH at risk, as two major MakerDAO whales face potential liquidation. As the market braces for volatility, traders are closely watching whether bulls can defend current levels—or if bears are preparing to force a deeper breakdown.

Whales at Risk: $238M ETH Faces Liquidation

The latest ETH sell-off is testing the resilience of highly leveraged DeFi positions. According to blockchain analytics firm Lookonchain, two large Ethereum holders on MakerDAO are on the verge of liquidation. Combined, they hold 125,603 ETH, currently valued at $238 million.

As Ethereum trades near $1,874, their positions are approaching liquidation triggers at $1,805 and $1,787. The health rate of these vaults—a key indicator of collateral stability—has now dropped to 1.07, raising the likelihood of forced asset sales.

If ETH falls below these levels, the Maker protocol will automatically liquidate collateral, potentially flooding the market with ETH and triggering a broader wave of sell pressure across DeFi.

This scenario could amplify bearish momentum and rattle confidence in leveraged on-chain strategies.

Ethereum Price Action Signals Further Weakness

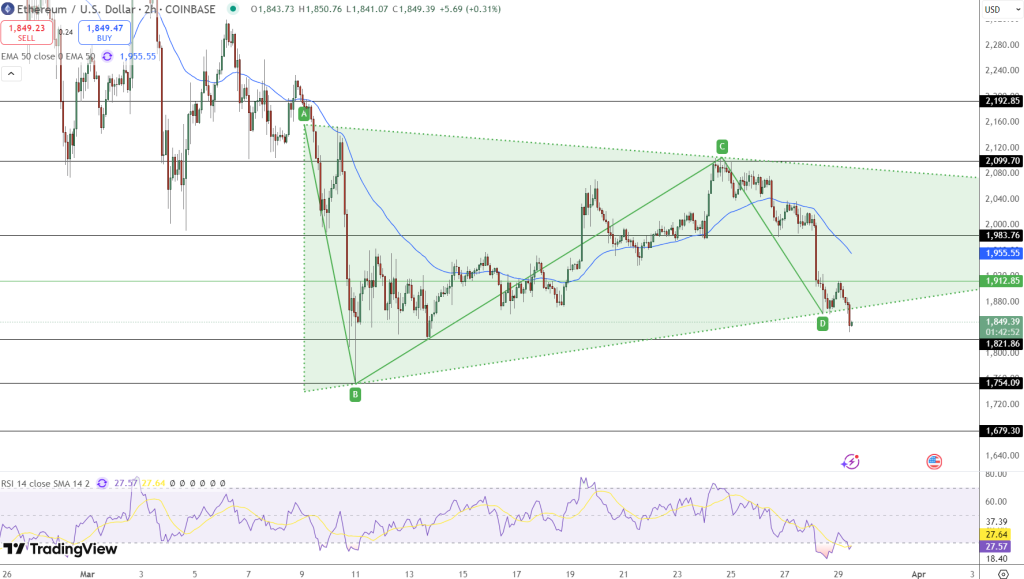

Ethereum has broken below its symmetrical triangle support near $1,880, a key level that had held for weeks. The current price action around $1,850 suggests increasing selling pressure. Technical indicators provide little comfort for bulls:

- Relative Strength Index (RSI) has plunged to 28, signaling extreme oversold conditions.

- The 50-period EMA on the 2-hour chart sits at $1,955, well above current price levels.

- An ABCD harmonic pattern completed near the recent low, hinting at continuation of the bearish move.

If Ethereum breaks decisively below $1,822, the next support zones lie at $1,754 and $1,680. Only a recovery above $1,880 and a close above $1,955 would indicate a meaningful trend reversal.

Market Outlook: DeFi Liquidations in Focus

The potential liquidation of whale-sized positions highlights a persistent risk in decentralized finance—automated liquidations with no manual stop-losses. While DeFi offers transparency, its rigid mechanics can lead to sharp, sudden moves during periods of volatility.

Key Points to Watch:

- A breakdown below $1,805 could trigger liquidation of 125K ETH.

- RSI suggests conditions are oversold, but recovery remains uncertain.

- ETH must reclaim $1,880–$1,955 to regain bullish structure.

While oversold readings could prompt a temporary bounce, the looming threat of major liquidations suggests downside risks remain elevated unless sentiment shifts swiftly.

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

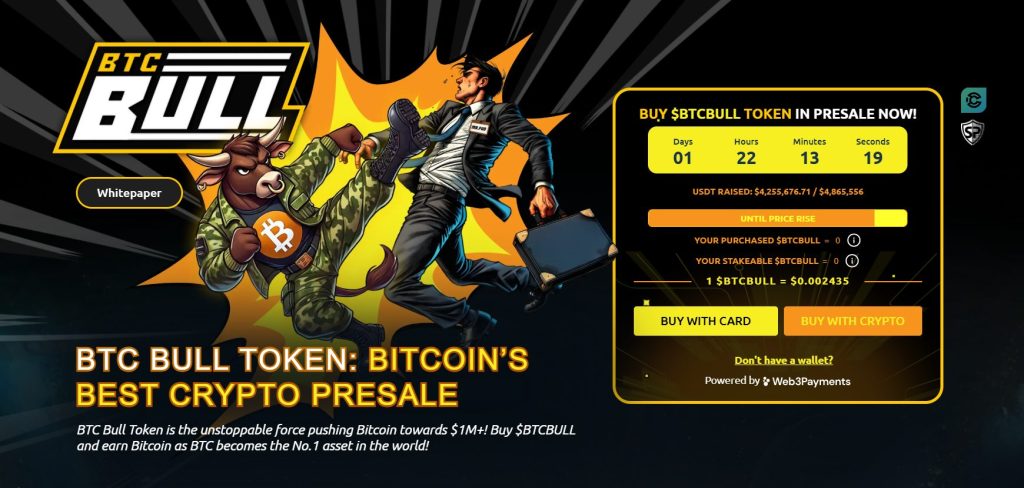

BTC Bull ($BTCBULL) is making waves as a community-driven token that automatically rewards holders with real Bitcoin when BTC hits key price milestones. Unlike traditional meme tokens, BTCBULL is built for long-term investors, offering real incentives through airdropped BTC rewards and staking opportunities.

Staking & Passive Income Opportunities

BTC Bull offers a high-yield staking program with an impressive 119% APY, allowing users to generate passive income. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting strong community participation.

Latest Presale Updates:

- Current Presale Price: $0.002435 per BTCBULL

- Total Raised: $4.2M / $4.8M target

With demand surging, this presale provides an opportunity to acquire BTCBULL at early-stage pricing before the next price increase.