Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

It’s been a quiet start to the year in crypto markets, with the Ethereum (ETH) price moving sideways in the $3,300s now for around one week.

But volatility is coming, and is likely to hit very soon. Chart analysis suggests ETH could experience declines in the short-term.

The Ethereum price is currently below both its 21 and 50DMAs and below the key short-term resistance area around $3,500.

A retest of key support in the form of the 200DMA around $3,000 could be on the cards. But traders would do well not to expect the downside to last long.

US President Donald Trump’s November election victory tees up the prospect of a new golden age for the US crypto industry and broader markets over the next four years, which is set to spur adoption at an unprecedented rate.

Moreover, historic price patterns suggest that an Ethereum price surge could be right around the corner.

Ethereum Price Explosion Imminent?

Incoming pro-crypto US President Donald Trump is set to land in the White House with an administration packed with crypto industry supporters and advocates.

Meanwhile, anti-crypto sitting SEC Chair Gary Gensler is set to depart in favor of Trump’s pick Paul Atkins, which should kickstart a new era of SEC/crypto industry cooperation, rather than the current adversarial environment.

Meanwhile, the incoming pro-crypto Congress is expected to approve pro-crypto industry regulations to give the industry clarity.

They may even vote in favor of legislation to build a strategic Bitcoin reserve, which Trump could also kickstart via an executive order.

All of this is great for Bitcoin. But its even better for altcoins like Ethereum. While anti-crypto forces in the US in the last few years weren’t able to block the establishment of Bitcoins ETFs (or Ethereum ETFs), they were able to substantially stifle innovation and suppress altcoins prices.

That means altcoins have great room for a recovery versus Bitcoin, which already flew to record highs at $108,000 in December.

All of this means that January could be a great month for ETH. Indeed, the Ethereum price could quick fly back to multi-year highs above $4,000 if it is able to get above $3,500 resistance.

While the fundamental outlook for ETH is great, its worth also considering historical price patterns, which also paint a bullish picture.

This Key Historical Price Pattern Suggests Ethereum ATHs Are Near

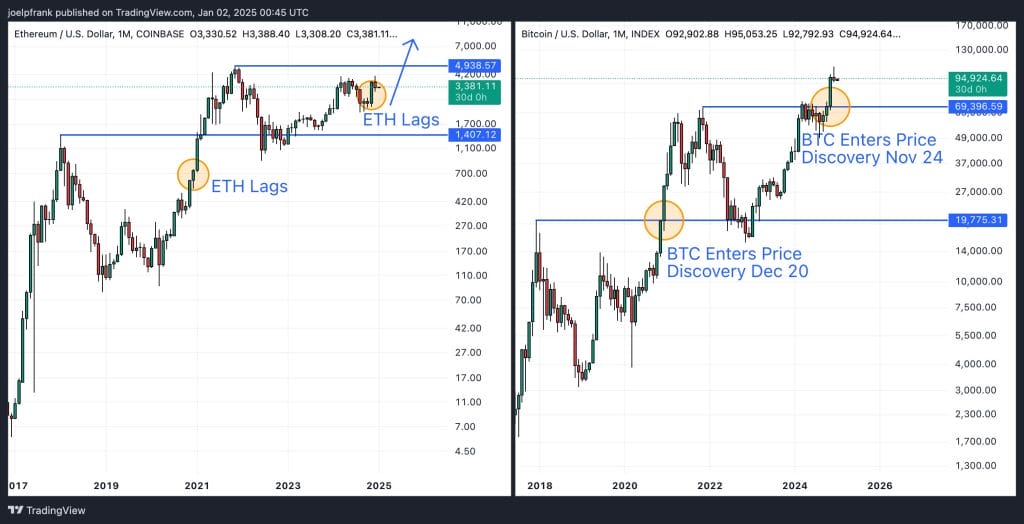

During the past crypto bull market cycle, when Bitcoin entered a new and aggressive phase of price discovery in December 2020, Ethereum was lagging behind and still well below its 2017 record highs.

Whilst ETH performed well in January 2021, it didn’t enter full-blown price discovery until February 2021.

In 2024, Bitcoin entered full-blown price discovery in November and Ethereum is still languishing well below its record highs.

If history is set to repeat itself, which the strong fundamental backdrop suggests is likely, the Ethereum price could be close to surging back to retest record highs.

That could potentially tee up an ETH entering a new phase of price discovery in February above $5,000.

There remains plenty of Ethereum hate and FUD out there. Yes, other chains are faster, cheaper and are processing more transactions, and there is a lot of development going on outside of the Ethereum ecosystem.

But to think this means that Ethereum won’t remain a dominant player is misguided. Firstly, it remains the oldest and most trusted DeFi chain with a commanding 56% of TVL in smart contracts, per DeFi Llama.

Dozens of the world most influential businesses are building on it.

This includes Wall Street leader BlackRock, with Ethereum essentially their chosen DeFi chain.

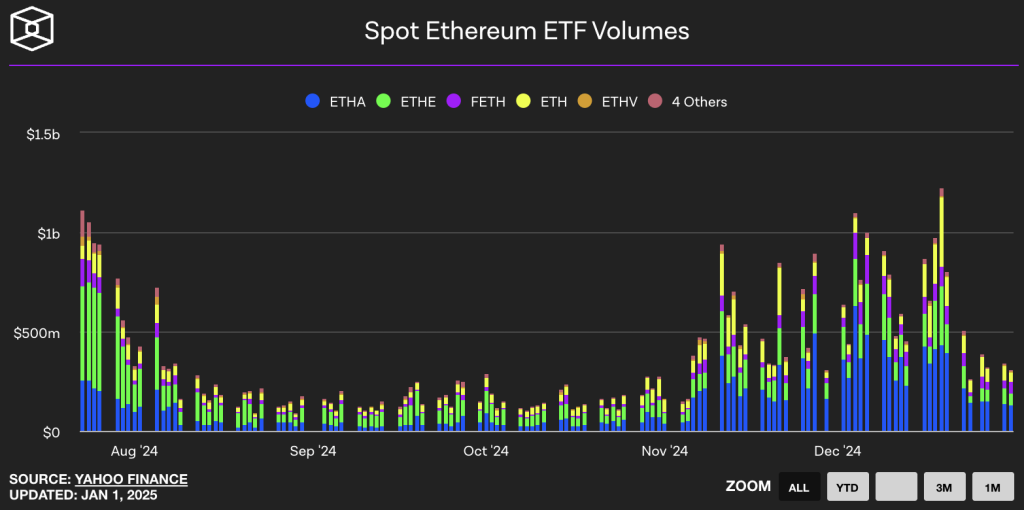

With BlackRock’s backing, and given its status as the only other major crypto other than Bitcoin to have secured spot ETFs in the US, Ethereum is primed for substantial institutional inflows, which have already been picking up in recent weeks, per The Block.

Per Steno Research, the Ethereum price is set to rocket up more than 2x to above $8,000 in 2025.

Bears beware. This bull market likely has a lot of gas left in the tank. Short at your own peril.