Key opinion leader Tom Lee claims the broader market has got it wrong; smart money is sticking to their guns on bullish Ethereum price predictions.

Outspoken Ethereum advocate Tom Lee claims that the altcoin is at or near its bottom, arguing that downside has overshot as price action detaches from strengthening fundamentals.

During a Monday CNBC interview, Lee said crypto had “taken it much worse than we expected,” pointing to aggressive liquidity wipes that flushed excess leverage and left the market broadly deleveraged.

He framed the issue as weakening risk appetite, with capital rotating out of crypto into traditional safe havens like gold and silver as the hedge of choice against the macro narrative.

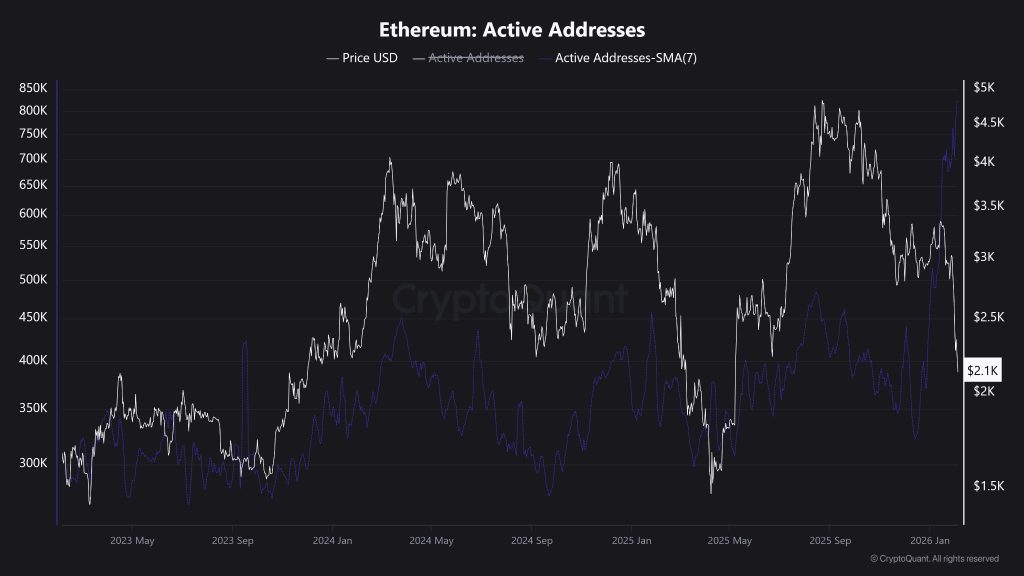

Yet beneath the surface, network activity tells a very different story. Weekly active addresses have surged to fresh all-time highs, overtaking peak participation seen during the 2021 bull market at 825,000.

When fundamentals continue to accelerate while price lags behind, Lee says it is only a matter of time before they sync back up and the market finds its footing.

His actions speak to his conviction. Tom Lee-headed ETH treasury company BitMine increased its holdings by 20,000 ETH during Tuesday trading, even as unrealized losses reach $7 billion post-crash.

Ethereum Price Prediction: First a Bottom, Then a Boom

The argument that Ethereum is near a bottom may have a technical basis, as it approaches the lower support trendline of the ascending triangle that has guided price action throughout this cycle.

The RSI approaches the 30 oversold threshold, a sign that capitulation may be setting in, raising the probability that the pattern still carries the same historical significance.

While the liquidation event over the past week has pushed the MACD further from a golden cross above the signal line, it does not undermine the momentum it built in the months before

Ethereum nears a potential pivot point. With a bounce, focus immediately shifts to an 130% push towards the pattern’s upper boundary, past all-time highs around $5000.

If higher and firmer support is found here, Ethereum can enter new price discovery, with the next major milestone to watch being 365% higher at $10,000.

But the pattern lays the groundwork for a multi-year surge. Fully realised, it could see gains extend 1,300% towards the $30,000 mark, though that is more likely next cycle.

Bitcoin Hyper Presale: Solana Technology is Coming to Bitcoin

Those who opted for alternative layer-1s like Ethereum over the leading cryptocurrency may see a need to reconsider as the Bitcoin ecosystem addresses its biggest limitation: scalability.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security with Solana tech, creating a new Layer-2 network that unlocks faster, cheaper, and more flexible use cases that Bitcoin couldn’t support alone.

This upgrade positions Bitcoin to re-enter high-growth narratives like DeFi and real-world asset tokenisation – where throughput and efficiency are non-negotiable.

The project has already raised almost $31 million in presale, and post-launch, even a small fraction of Bitcoin’s massive trading volume could send its valuation significantly higher.

By addressing slow settlement times, elevated fees, and limited programmability, Bitcoin Hyper removes long-standing barriers for Bitcoin.

To buy $HYPER at the presale price, visit the official Bitcoin Hyper website and connect a wallet (such as Best Wallet).

You can swap existing crypto or use a bank card to complete the transaction in a few clicks.

Visit the Official Bitcoin Hyper Website Here