Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin Layer-2 (L2) projects experienced substantial growth, particularly as decentralized finance (DeFi) use cases expanded within the Bitcoin ecosystem.

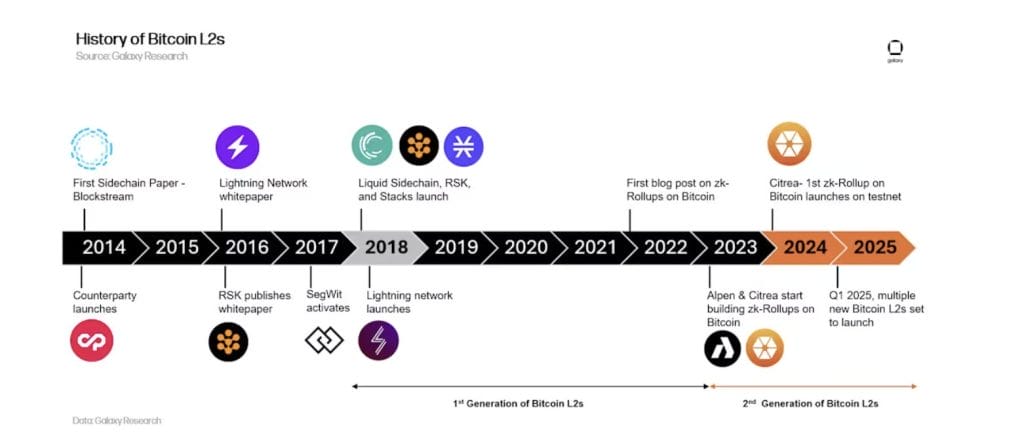

A November 2024 report by digital asset platform Galaxy revealed that Bitcoin L2 networks increased from just 10 in 2021 to 75 in 2023.

The report further stated that over 36% of all Bitcoin Layer-2 venture funding had been raised in 2024. It also projected that more than $47 billion worth of BTC could be bridged into Bitcoin L2s by 2030.

Early Bitcoin Adopters Have Yet to Fully Embrace L2s

Despite growing interest, industry experts believe Bitcoin L2s remain overlooked.

Willem Schroé, CEO and co-founder of L2 network Botanix Labs, told Cryptonews that many early Bitcoin adopters have held onto their BTC for years without utilizing its on-chain potential.

“Bitcoin ‘hodlers’ can earn passive, low-lift yield without selling their BTC,” Schroé said. “L2 programmability allows Bitcoiners to participate in DeFi-like ecosystems – whether through lending, staking, or providing liquidity – while still securing their assets on Bitcoin’s base layer.”

Despite its potential, the Bitcoin L2 concept remains complex for many users.

Rena Shah, chief operating officer of Bitcoin developer ecosystem Trust Machines, told Cryptonews that the Bitcoin community must first address what Layer-1 (L1) users need before promoting L2 adoption.

“Many have spent years in ‘hodl’ mode, believing their Bitcoin was the best hedge against things like inflation,” Shah said. “But what the Bitcoin L2 space has now done is highlight that Bitcoin shouldn’t be overlooked as a productive asset.”

Bitcoiners Will Put Their BTC to “Work” This Year

According to DeFiLlama, the current total value locked (TVL) in Bitcoin is $6.618 billion. Industry experts believe that as L2 solutions mature, Bitcoin holders will begin utilizing their BTC more actively.

“For years, Bitcoin has largely been viewed as a store of value, with most holders simply HODLing, leaving trillions of dollars in dormant capital,” Schroé remarked. “However, Bitcoin L2s are changing that by introducing programmability and financial utility without compromising security.”

Schroé added that rather than requiring users to wrap Bitcoin onto Ethereum or other chains, new Bitcoin-native solutions will allow BTC to generate yield directly on Bitcoin infrastructure through lending, staking, and liquidity provisioning.

“This opens the door for Bitcoiners to put their assets to work without losing exposure to the asset they trust most,” he said.

Bitcoin L2s Advance to Improve Secure DeFi

New standards are emerging to improve Bitcoin Layer 2 solutions. Kevin Liu, co-founder of the Bitcoin L2 firm GOAT Network, told Cryptonews that the introduction of BitVM smart contracts represents a key milestone for Bitcoin’s scalability and programmability.

“The BitVM standard seeks to advance smart contract capabilities on the Bitcoin network,” Liu said. “A Layer 2 network that builds its canonical bridge with BitVM technology aims to inherit native Bitcoin security, the same way a leading Ethereum Layer 2 network such as Arbitrum builds its bridge on a certain standard to inherit native security from the Ethereum parent chain.”

Liu added that GOAT Network recently launched its BitVM2 Playground, allowing users and developers to test an MVP version of BitVM2 technology.

“A full testnet version of GOAT Network’s BitVM2 product will go live in the next few weeks, with full mainnet deployment planned for later this year,” Liu said. “Our goal is to transform two of the most profitable and popular digital currencies – BTC and DOGE – from passive assets that you can only buy and hold into active, yield-bearing assets that deliver real BTC returns.”

Meanwhile, Bitlayer’s Finality Bridge is set to launch a testnet implementation of the BitVM protocol.

The bridge leverages BitVM smart contracts, fraud proofs, and zero-knowledge proofs, allowing Bitcoin funds to be securely locked in addresses governed by a BitVM smart contract.

This system operates under the premise that at least one participant will act honestly, reducing the trust requirements traditionally associated with third parties overseeing BTC funds.

Schroé emphasized that Bitcoiners prioritize security and decentralization over rapid expansion.

“Unlike Ethereum’s DeFi sector, which relied on new capital inflows, Bitcoin’s financial layer is tapping into existing Bitcoin holders who have been waiting for a way to activate their BTC without selling it,” he said. “This is why trust-minimized approaches are gaining momentum.”

As these solutions become more accessible and well-integrated, Schroé expects Bitcoin L2s to bridge the gap between passive holding and active participation in on-chain financial opportunities.

Value Will Be Gained From Bitcoin This Year

Long-time Bitcoin holders have been cautious about DeFi, but 2024 could offer new incentives for engagement.

Brian Mahoney, co-founder of full-stack Bitcoin solution Mezo, told Cryptonews that the Layer-2 space has matured to the point where developers can begin building decentralized applications (dApps) focused on Bitcoin liquidity.

For example, Mahoney noted that Mezo is reshaping the Bitcoin loan model by allowing users to earn yield on Bitcoin by staking it as collateral. Users can also withdraw funds instantly when needed.

“As more institutions express interest in offering Bitcoin lending as a service, L2s will play a critical role in the security and scalability of Bitcoin within a financial ecosystem where traditional finance (TradFi) and DeFi interoperate,” Mahoney said.

Bitcoin staking platforms, such as Solv Protocol, are expanding Bitcoin liquidity across multiple chains. Shah pointed out that retail investors are increasingly seeking ways to accumulate more Bitcoin.

“We’re seeing a new user persona – the ‘accumulator’ who will take moderate risk to acquire more Bitcoin, ” she commented.

Shah believes that borrowing stablecoins against BTC through platforms like Granite will be a trend this year.

“Users will then leverage those stablecoins for farming in other avenues (memecoins, restaking, yield vaults), taking profits, and ultimately acquiring more BTC,” Shah said.

However, Schroé believes that the next wave of adoption won’t come from retail speculation.

Rather, he thinks this will come from Bitcoiners discovering ways to make their BTC work for them – without compromising on security, decentralization, or sovereignty.

Bitcoin maximalists have long viewed DeFi with skepticism, but 2025 could be the year they take a second look.

With security-first solutions gaining traction, BTC holders may finally have the tools to put their assets to work while maintaining the principles that made Bitcoin dominant in the first place.

If the Layer-2 sector delivers on its promise, this year could mark a quiet but major shift in how Bitcoin is used.