Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

While sentiment in the Ethereum (ETH) market remains in the dumps as the world’s second-largest crypto by market cap slides back under $2,600, the bears could be in for a surprise in the months ahead.

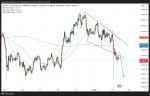

Short-term chart analysis suggests a deeper pullback in the days ahead could ensue. After breaking below its downtrend from the mid-December highs last week, Ethereum was rejected at a retest of this trend line on Tuesday.

That suggests elevated risks of a deeper drop back towards $2,000 in the weeks ahead.

If Wednesday’s US CPI data comes in hotter-than-expected, this could be the next major catalyst for downside as Fed rate cut bets are wound down.

Ethereum doesn’t just face the possibility of further declines in its USD price, but also against Bitcoin (BTC).

Since the hugely successful US Bitcoin ETF launch in 2024, ETH/BTC has slumped from around 0.055 to current levels around 0.027.

And if the crypto market is set to face headwinds in the coming weeks, BTC dominance is only set to rise as traders shift towards the relative safety of the world’s largest and oldest crypto.

However, while short-term sell pressure could remain elevated, some analysts say that traders would do well to continue stacking ETH.

Here’s why ETH’s streak of consistent underperformance could end soon.

Ethereum (ETH) Underperformance Won’t Last – Here’s Why

Analysts at 10x Research posited on Monday that Ethereum might be approaching oversold levels and could present a good short-term risk-reward bet.

Meanwhile, analysts at Citi just published a bullish research note on the coin, noting how its poor price performance this year stands at odds with growing on-chain activity (including TVL), strong ETF inflows this year, and growing search interest.

Citi also noted what could be one of Ethereum’s most important bullish narratives right now – that the Trump family (via their World Liberty Financial DeFi project) has been stacking ETH and now hold over $200 million.

The arrival of the Trump administration in the White House has already kickstarted a new era for crypto in the USA, with bolstering the Ethereum ecosystem likely to be central to plans given the Trump family’s investments in the coin.

A recent increased in ETH whale purchases, noted by X analyst Ted Pillows, could reflect a view amongst “smart money” investors that, as noted by 10x Research, risk reward at the current ETH price is very good.

It’s also worth noting that ETH recently printed a golden cross on the weekly chart, which has historically proven to be a great buy signal.

Crypto Rover, meanwhile, notes that ETH could be on the cusp of breaking out of a long-term pennant pattern that could see it 2-3x from current price levels.

Ethereum Will Have Its Day

Ethereum has been dogged by concerns about competition from up-and-coming rivals like Solana, Sui, and its layer-2 ecosystem of blockchains like Base and Arbitrum.

Thanks to its technical flaws (like relatively high gas prices and slow transactions), fears remain elevated that ETH is going to get left behind – Uniswap, the biggest DEX operating on Ethereum, recently launched its own layer-1 protocol, an example of these concerns.

That, plus an underwhelming Ethereum ETFs launch in 2024, have resulted in lackluster price action even as BTC surged to new record highs above $100,000.

Ethereum’s underwhelming performance is fueling a cycle where price declines generate FUD, which in turn leads to further underperformance.

However, Ethereum still has so much going for it that it would be foolish to count the blockchain out.

As noted, it’s a Trump family-owned coin, suggesting there will be efforts to bolster its ecosystem specifically under the Trump administration.

It’s also BlackRock’s chosen coin – they have specifically said they want to focus on promoting their BTC and ETH ETFs rather than launching more for more coins.

That reflects the fact that Ethereum is far and away the most secure and trusted smart-contract-enabled blockchain in the space, and remains the dominant leader in DeFi.

Per DeFi Llama, Ethereum’s TVL is currently around $56.4 billion, a 53% share of overall TVL in the space.

Unlike retail investors, major financial institutions like BlackRock prioritize security and decentralization over transaction speed and cost.

When moving large amounts of assets, they value a blockchain that offers a high level of security and reliability.

Outside of Bitcoin, Ethereum stands out as the most trusted smart contract-enabled blockchain for institutional use.

Ethereum might be in the dumps right now. But with so much going for it behind the scenes, its fortunes may shift as market conditions evolve.