Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

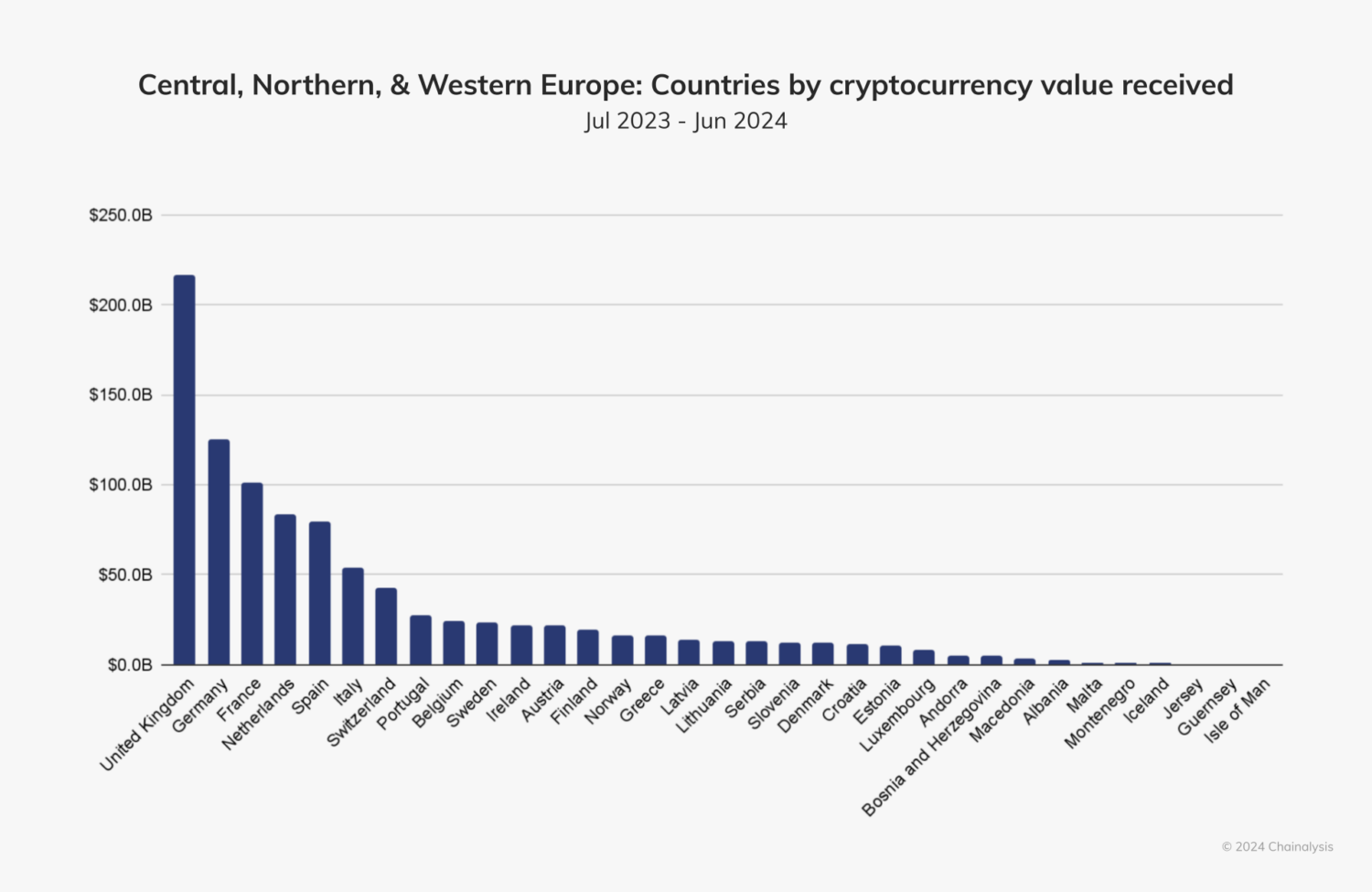

Central, Northern, and Western Europe (CNWE) is emerging as a global powerhouse in the cryptocurrency market, ranking second only to North America.

A new report by Chainalysis reveals a vibrant crypto economy in the region, with $987.25 billion flowing in on-chain value between July 2023 and June 2024, representing 21.7% of global transaction volume.

The United Kingdom (UK) stands out as the undisputed leader in CNWE’s crypto space, attracting a hefty $217 billion in crypto value during the period. The UK is also a key driver of innovation, particularly in areas like merchant services and stablecoins.

Stablecoins Outpace Bitcoin and Drive CNWE Crypto Growth

Stablecoins, cryptocurrencies pegged to traditional assets like the euro or US dollar, have become the undisputed king in CNWE, growing 2.5 times faster than North America for transfers less than $1 million. They constitute nearly half of all crypto inflows, valued at $422.3 billion, showcasing a significant rise in both retail and professional use.

In the past year, average monthly stablecoin transfers below $1 million in CNWE ranged between $10 billion and $15 billion.

Interestingly, stablecoins have far surpassed Bitcoin (BTC) for fiat currency trade, with the euro accounting for a whopping 24% of global stablecoin purchases.

The European Union is actively shaping the future of crypto in CNWE with the implementation of its Markets in Crypto-Assets Regulation (MiCA), as per the report. While the impact on stablecoins is already underway, the full effect on crypto-asset service providers (CASPs) is yet to be seen, with regulations for this sector coming into effect in December 2024.

More Than Just Stablecoins: CNWE’s Growing Crypto Landscape

Despite the dominance of stablecoins, CNWE’s crypto landscape offers more. For transactions below $1 million, Bitcoin saw a significant 75% growth, the highest of all asset types in the region. Overall, Bitcoin accounted for roughly one-fifth of CNWE’s total crypto value received.

While still in its infancy, the real-world assets (RWA) tokenization is starting to take hold in CNWE. Experts see this as a potential game changer in the traditional securities market. “Across Europe, we see tokenization projects for RWAs gaining traction, particularly in sectors such as real estate, intellectual property and collectibles such as art, cars or wine,” said Philipp Bohrn, VP, Public and Regulatory Affairs at Bitpanda, a cryptocurrency exchange based in Austria.

CNWE’s decentralized finance (DeFi) activity grew faster than the global average, ranking fourth in the world. The region outperformed North America, Eastern Asia, and MENA in year-over-year growth, accounting for $270.5 billion of all crypto received in the region.

Decentralized exchanges (DEXs) were the primary catalyst for DeFi growth in CNWE, outperforming other DeFi services.