Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The stablecoin market has expanded to over $172 billion by October 2023, with the European Union’s Markets in Crypto Assets Regulation (MiCA) playing a key role in shaping its direction.

Recent data from DeFiLlama shows that stablecoins accounted for $123 billion in transactions during that month, reflecting the growing influence of stablecoins in global finance.

Stablecoins make up about 50% of all value settled on public blockchains, surpassing Bitcoin, which only accounts for 25% of such transactions.

Additionally, CryptoQuant reports that stablecoins held on exchanges have surged by 20% this year.

MiCA Regulations to Impact Stablecoin Issuers Across Europe

A major shift is underway as the European Union introduced the Markets in Crypto Assets Regulation (MiCA) in June 2023.

This regulatory framework establishes uniform rules for crypto assets across the EU, and while it isn’t fully implemented yet, its effects are already being felt within the stablecoin market.

Martin Bruncko, Founder and CEO of Schuman Financial, explained to Cryptonews that MiCA mandates compliance with stringent anti-money laundering (AML) policies and numerous other requirements for any stablecoin issuer operating in the EU.

“This covers such areas as custody, protection and investment of reserve assets, risk management, security policies, incident management, data protection, business continuity, complaint management, and many others,” Bruncko said.

He emphasized that compliance with MiCA is non-negotiable for stablecoin issuers.

“Either you become MiCA compliant, or it will be illegal for any business to distribute your product to consumers and businesses in Europe,” he added.

As a result, Bruncko predicts a major reduction in USD-backed stablecoins available in Europe, with companies like Coinbase already removing support for Tether’s USDT stablecoin in the EU due to non-compliance.

Euro-Backed Stablecoins Set to Prevail

MiCA regulations are expected to favor euro-backed stablecoins in the medium to long term, potentially strengthening their position in the market and drawing increased institutional interest across Europe.

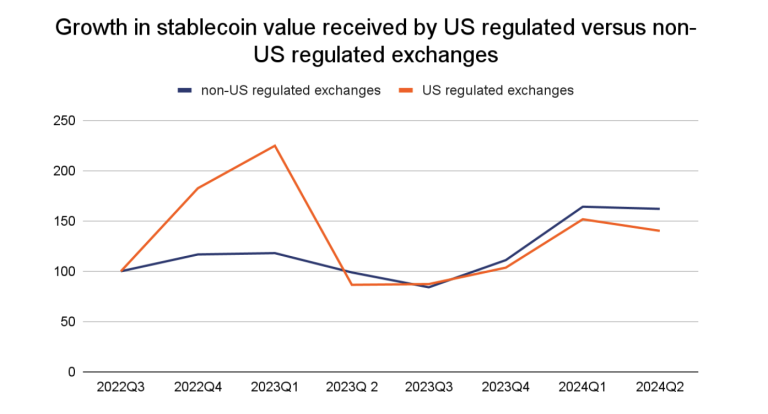

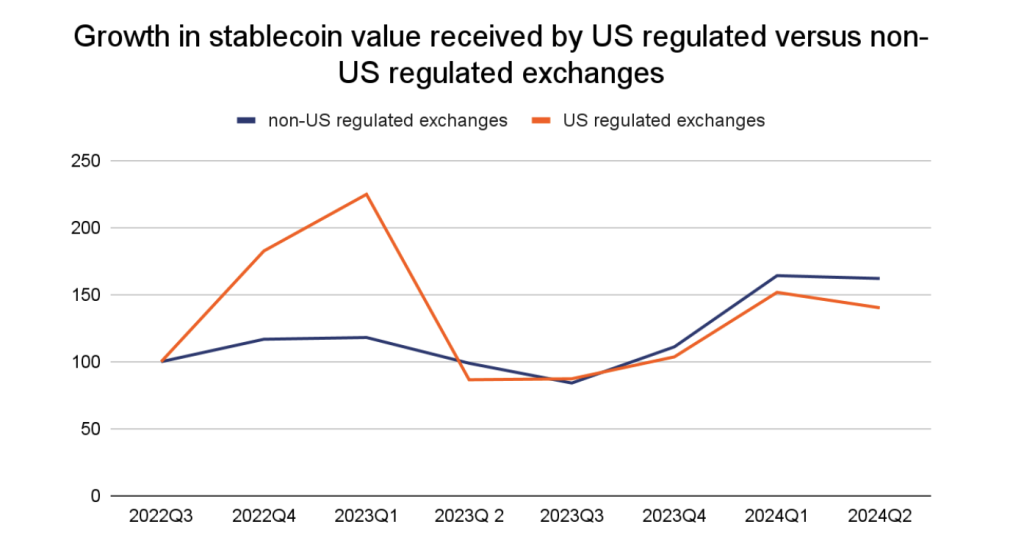

The effects of this shift are already visible; a recent report from Chainalysis indicates that stablecoin activity is moving away from US-regulated platforms, likely due to regulatory delays in the US regarding stablecoins and other digital assets.

Chainalysis notes, “Regulatory clarity in regions outside the U.S. is fueling the growth of stablecoins globally, while the U.S. risks falling behind.”

MiCA Presents Opportunities and Challenges

Tom Kiddle, Co-Founder of Palisade – a French-regulated digital asset custodian – told Cryptonews that MiCA creates both opportunities and challenges for Euro-backed stablecoin issuers.

“MiCA’s stringent requirements, including the need to maintain 1:1 liquid reserves and safeguard assets, will enhance market confidence,” he said. “But the increased compliance burden is expected to drive consolidation within the sector.”

Non-European issuers face additional challenges, particularly the requirement to establish an authorized entity within the EU.

“All issuers—European and foreign alike—must offer permanent redemption rights and maintain fully backed reserves, ensuring stability but also raising the bar for entry,” Kiddle explained.

Ripple is among the companies working to meet these regulations. Chris Myers, EMEA Senior Counsel at Ripple, shared that the company currently holds a Virtual Asset Service Provider (VASP) license with the Central Bank of Ireland and plans to convert it into a Crypto-asset Service Provider (CASP) license under MiCA.

But from a stablecoin perspective, Ripple remains focused on the imminent launch of its US stablecoin product, RLUSD.

Myers explained, “We will evaluate further market launches as we expand, taking into account developing crypto asset and stablecoin policy in different jurisdictions, but will begin with issuing our USD stablecoin product out of the US.”

MiCA Stablecoins Lead to a Fragmented Market

The EU is one of the first major jurisdictions in the world to implement comprehensive rules for stablecoins.

While MiCA provides regulatory clarity across the European Economic Area, it is also expected to fragment the global market due to varying requirements in other regions.

Myers highlighted the importance of collaboration between global regulators to prevent the fragmentation from undermining the benefits of stablecoins, such as their borderless nature, fungibility, and liquidity.

“What we need to see is collaboration between leading global regulators to establish a framework for the international operation of stablecoins,” he said.

Other industry leaders believe MiCA could encourage similar regulatory frameworks in regions like the United States.

“If the US wants to attract and develop a competitive crypto sector, it must develop a clear regulatory framework similar to that of the EU’s MiCA,” Kiddle remarked.

“MiCA provides the regulatory clarity that crypto businesses desire. It outlines licensing requirements, capital adequacy, and consumer protection measures, giving companies a roadmap for compliance,” he added.