Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

Lawrence Summers, a former US Treasury Secretary, has criticized President-elect Donald Trump’s proposal for the US government to establish a Bitcoin reserve, labeling the idea as impractical.

Speaking on Bloomberg Television’s “Wall Street Week,” Summers voiced concerns about the plan, which he believes serves primarily to appease campaign donors rather than to support the nation’s financial health.

According to Trump’s proposal, the government would retain ownership of approximately 200,000 Bitcoins, currently held due to past asset seizures.

Bitcoin Reserve Could Help Reduce National Debt

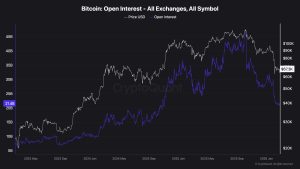

Advocates suggest that this reserve could expand and potentially help in reducing the national debt through its appreciation over time.

Additionally, Trump has appointed cryptocurrency advocate Paul Atkins to lead the Securities and Exchange Commission (SEC), signaling a pro-crypto administration.

Summers, who also serves as a Harvard University professor and a Bloomberg TV contributor, said that there may be instances where the crypto industry has faced excessive regulation. He said that he supports the need for financial innovation but questions the rationale behind a national Bitcoin reserve.

Summers commented: “Of all the prices to support, why would the government choose to support, by accumulating a sterile inventory, a bunch of Bitcoin?”

Separately, Summers addressed another significant challenge facing the upcoming administration: the ambitious plan by Elon Musk, set to co-chair the Department of Government Efficiency advisory panel alongside Vivek Ramaswamy, to slash federal spending by $2 trillion.

Summers pointed out that such a figure surpasses the entire federal government payroll, and most government expenditures are dedicated to national defense and senior support—areas difficult to cut without severe political backlash.

US Needs to Either Reduce Entitlements or Increase Taxes

Summers argues that the US must either bravely reduce entitlements that Americans have long expected or opt to increase taxes, with Summers personally advocating for the latter.

He also touched upon broader global fiscal challenges, citing recent governmental collapses in France, South Korea, and Germany over budget disputes.

As the demographic of older people grows and healthcare costs surge, the burden of entitlements continues to rise, complicating budget management further.

“We have entitled societies that haven’t come to peace with what’s necessary to meet the entitlement,” he said.

Summers also noted the importance of leaders clearly communicating to the public about the need for fiscal adjustments, such as spending cuts or increased taxes. “I don’t think our leaders have been able to persuade people of that need. That’s what is fundamentally behind the conflict.”

However, it is worth noting that selling Bitcoin might prove to be a very bad decision. As reported, Germany’s decision to sell off nearly 50,000 Bitcoin in July at $53,000 per coin has led to a substantial financial loss, as Bitcoin has recently surged to a new all-time high of $104,000 per coin. If the Bitcoin had been retained until now, the 49,858 BTC sold could have been valued at approximately $5.18 billion. Instead, the sale conducted between June 19 and July 12 generated about $2.64 billion for the German authorities, resulting in an estimated loss of around $2.54 billion.