Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

A new survey of over 2,400 crypto investors in the DACH region (Germany, Austria and Switzerland), conducted by German crypto media platform BTC-ECHO and Big Four accounting firm KPMG, paints a picture of strong optimism for the future of Bitcoin (BTC) and the broader digital asset market.

Bitcoin Price Predictions Soar

The survey’s most striking finding is the overwhelming bullishness of German-speaking investors regarding Bitcoin’s price trajectory.

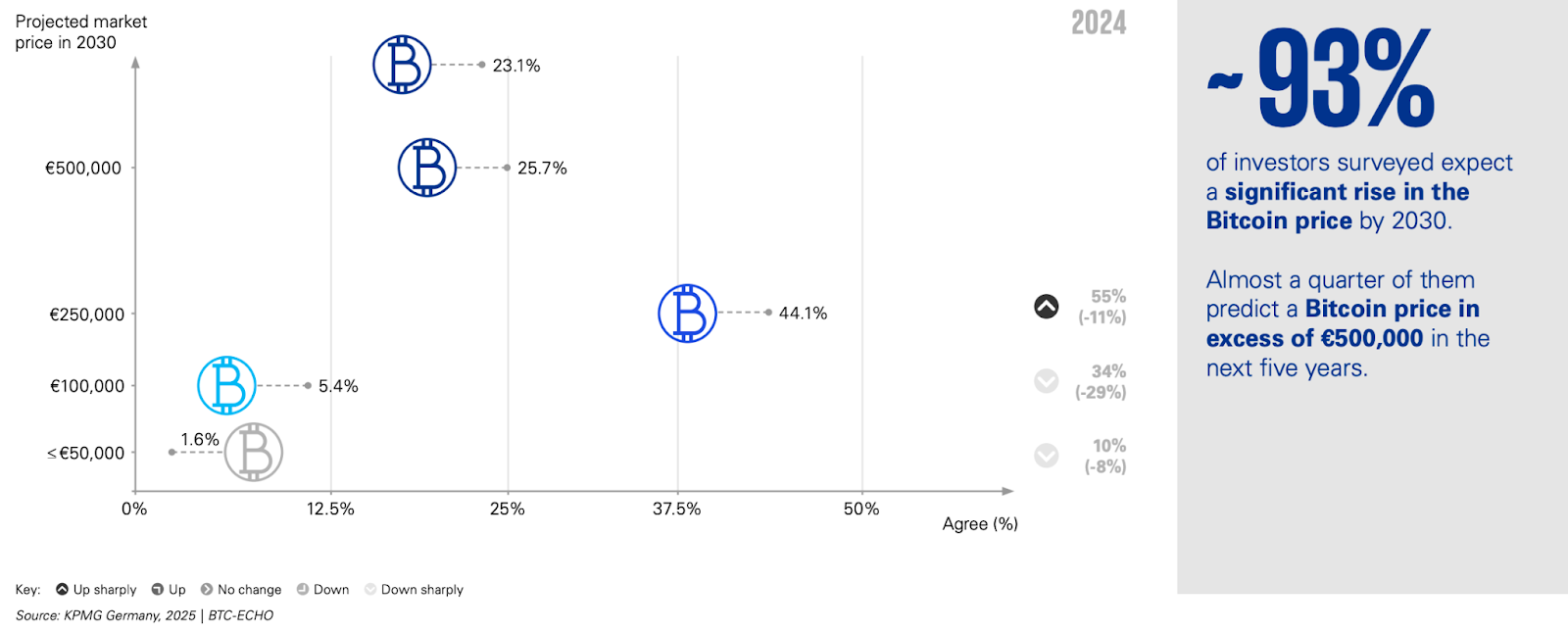

A remarkable 93% of respondents anticipate a significant Bitcoin price surge by 2030, demonstrating a strong belief in the cryptocurrency’s long-term value.

The optimism extends to near-term predictions as well. Nearly a quarter (26%) of the surveyed investors foresee Bitcoin exceeding $500,000 within the next five years. Furthermore, 44% of investors believe Bitcoin will reach at least $250,000, indicating a widespread expectation of substantial gains.

While the vast majority of investors are bullish, a small minority holds a more conservative outlook. Over 5% of respondents predict a consolidation around the $100,000 mark, suggesting a period of price stability. Less than 2% of investors have essentially written off Bitcoin’s growth potential.

Bitcoin Dominates, Solana Gains Ground

Bitcoin remains the undisputed king of German crypto portfolios. The survey confirms that 90% of investors hold Bitcoin, solidifying its position as the most popular cryptocurrency. This dominance reflects Bitcoin’s first-mover advantage, widespread recognition, and perceived store-of-value properties.

However, the survey also highlights the growing popularity of other cryptocurrencies. Ether (ETH) maintains its position as the second most popular choice (79%), attracting a significant portion of investor funds.

Solana (SOL) claims the third position this year with 60%, a significant increase of 13% compared to the previous year. Ripple (XRP) is the fourth most popular digital asset (48%), followed by Cardano (ADA) in fifth place (46%).

Overall, 80% of investors are invested in the top 10 cryptocurrencies, indicating a concentration of investments in the leading digital assets.

The inclusion of meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) in the top ten cryptocurrencies held by respondents is also a noteworthy trend. This indicates a growing appetite for diverse and often speculative assets within the crypto space.

Investor Archetypes and Risk Perception

The study also identifies three distinct investor archetypes, providing a nuanced understanding of investor behavior and motivations:

- NextGen Investors: These are young individuals, often before entering the workforce, who are new to the market. They typically exhibit high trading volumes and are less concerned about risk.

- High-Earners: This group comprises income-driven investors primarily focused on generating high returns. They tend to be active on multiple exchanges and plan to increase their digital asset investments.

- Best Agers: These are experienced investors with a focus on long-term financial planning, particularly for retirement. They typically exhibit lower trading frequency.

Investors’ perception of risk remains significant, with 68% acknowledging the inherent risks of digital assets, while 32% see them as rather safe. Regulation (57%), financial crime (51%), and market manipulation (47%) are identified as the greatest risks.

However, 74% of investors, regardless of their initial investment timing, intend to further invest in digital assets. While this figure remains high, it represents a slight decline from previous years, potentially reflecting a more cautious approach in the face of market volatility.

Additionally, 46% of investors express a willingness to invest in tokenized securities, such as equities, bonds, and funds.

In contrast, interest in tokenized assets related to real estate (22%), gaming (9%) and art (7%) has declined, suggesting a shift in focus towards more mainstream financial applications of tokenization.