Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The HBAR price has been sliding since mid-January, with recent market conditions accelerating its downturn.

As the bull market matured, broader economic concerns—such as US President Trump’s “tariff war” and tensions among NATO allies—have weighed on even the foremost altcoins.

Hedera is among those hit the hardest, down almost 50% since its post-inauguration rally highs.

While the early week saw this downtrend accelerate in a 15% crash, briefly sending HBAR below $0.17, a rebound has limited the weekly loss to 9.55%.

HBAR Price Analysis: Is Hedera Going to Zero?

The rebound could mark the early stages of a major breakout as HBAR nears the climax of a falling wedge pattern that has been forming since mid-December.

Indicators now suggest more favorable conditions for an upward move.

The Relative Strength Index (RSI) has sharply rebounded from oversold territory at 42, while the MACD has formed a golden cross, surpassing the signal line—both signs of exhausted selling pressure.

If a breakout occurs, the pattern sets a HBAR price target of around $0.36, representing a potential 75% gain from current levels.

However, the pattern’s upper resistance continues to push back against the ongoing breakout attempt. A rejection here could lead to a retest of the pattern’s lower support.

If that fails, holding the immediate lower support zone around $0.18 will be crucial to preventing a deeper crash, though $0 seems unlikely given the project’s significant backing and partnerships.

This ICO Unlocks the Best of the Bull Cycle

Despite its potential, HBAR has overlooked this cycle, with competitors like XRP capturing market attention.

Investors who back the wrong horse are missing out on those limited bull market gains—this is the final year of the four-year halving cycle, where the real gains are made.

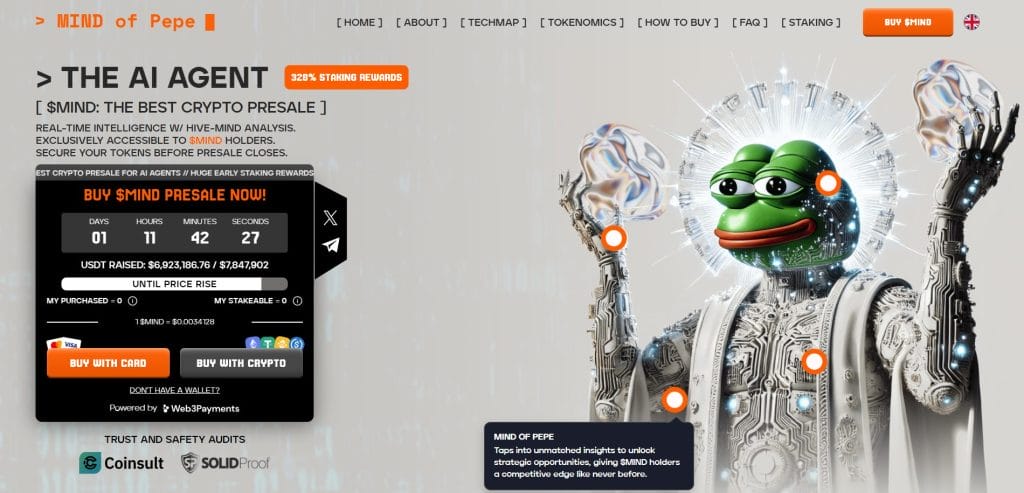

If you’ve missed out before, MIND of Pepe ($MIND) gives you the chance to get in early and stay ahead.

As a self-improving AI, MIND of Pepe is designed to deliver exceptional value to $MIND token holders.

It will actively engage with the crypto community through its X account—driving conversations, uncovering alpha opportunities, and delivering exclusive, token-gated insights.

Inside its Telegram community, holders get early access to high-potential tokens before they hit the market, keeping them ahead of the curve.

At the time of writing, MIND has raised almost $7 million in its ongoing presale, capitalizing on one of this cycle’s strongest meme coin narratives: AI agents.

You can keep up with MIND of Pepe on the mentioned socials, or join the presale on the MIND of Pepe website.