Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The cryptocurrency market is experiencing renewed selling pressure, but Michael Saylor remains resolute in his Bitcoin conviction. The Strategy (formerly MicroStrategy) co-founder and vocal BTC advocate has once again encouraged investors to hold rather than sell, reinforcing his belief in Bitcoin’s long-term value.

In a recent tweet, Saylor emphasized Bitcoin’s network effect, stating:

“When you buy Bitcoin, you strengthen the network. When you sell Bitcoin, you weaken it.”

His message comes at a critical time, as Bitcoin struggles to reclaim the $100,000 mark amid inflation concerns, ETF outflows, and macroeconomic uncertainty. As BTC consolidates, investors are questioning: Is Bitcoin’s long-term trajectory still bullish, or is a deeper correction on the horizon?

Bitcoin Stagnates Below $100K Amid Market Uncertainty

At the time of writing, Bitcoin is trading just under $96,000, struggling to regain momentum after its early February rally. The market remains in a wait-and-see mode, with investors reacting to shifting macroeconomic conditions.

Recent U.S. inflation data has clouded Bitcoin’s short-term outlook. The Consumer Price Index (CPI) for January exceeded expectations, triggering a sell-off in risk assets, including cryptocurrencies. Bitcoin briefly dipped to a weekly low of $94,090 before rebounding slightly.

Adding to market pressure, Federal Reserve Chair Jerome Powell reaffirmed the Fed’s cautious stance on interest rates, signaling that monetary policy will remain tight until inflation shows consistent improvement. This has dampened Bitcoin’s near-term prospects, as higher interest rates typically weaken demand for speculative assets.

Meanwhile, investors have been pulling capital from Bitcoin ETFs. From Monday to Thursday, Bitcoin ETFs saw outflows totaling $650.8 million, before a modest inflow of $70.6 million on Friday provided slight relief. However, the overall trend suggests waning institutional interest in the short term.

Bitcoin (BTC/USD) Technical Analysis: Bearish Patterns Forming

Bitcoin’s price action remains trapped within a symmetrical triangle, signaling ongoing consolidation before a potential breakout.

Immediate resistance sits at $97,350, aligning with both the triangle’s upper boundary and the 50-day EMA at $97,100, acting as a key barrier to further upside.

If Bitcoin fails to hold above $96,800, selling pressure could increase, pushing BTC down to $95,400 and possibly $94,100. A further decline could bring $92,680 into play, reinforcing the downward channel’s bearish bias.

Key Technical Levels:

- Immediate Resistance: $97,350

- Next Resistance: $98,920, $100,750

- Immediate Support: $96,800

- Next Support: $95,400, $94,100

Technical indicators present a mixed picture. The Relative Strength Index (RSI) remains neutral, reflecting market indecision, while the MACD is weakening, hinting at further price compression before a decisive move.

Bitcoin’s short-term outlook remains uncertain. A break above $97,350 could reignite bullish momentum, while a drop below $96,800 may push BTC toward deeper support levels. Investors should watch for a breakout from the symmetrical triangle to confirm the next trend direction.

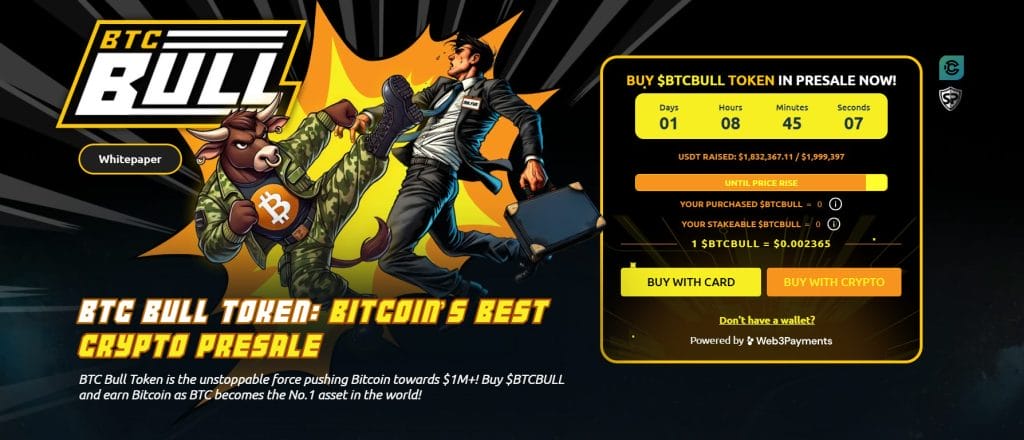

BTC Bull: Earn Real Bitcoin Rewards

Missed out on Bitcoin’s early days? BTC Bull ($BTCBULL) offers a second chance to earn real BTC through automatic airdrops as BTC hits key price milestones.

This meme-powered, community-driven token has captured significant attention, raising $100K within minutes of its launch and now surpassing $1.8M in presale funds.

The project stands out by rewarding holders with Bitcoin whenever the price of BTC reaches predefined targets. This unique approach provides a tangible incentive to participate early and stay invested.

Additionally, BTC Bull introduces a staking feature with an impressive 363% annual yield, allowing users to generate passive income while supporting the token’s growth. The presale is currently live, with tokens available at $0.002365 each.

With over $1.8M already raised and a price increase just around the corner, now is the ideal time to secure your share of $BTCBULL and maximize potential rewards.