Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

The XRP price took one of the biggest tumbles among top altcoins yesterday, falling to as low as $2.16. However, it has recovered somewhat, trading at $2.34, down 13.65% in the past 24 hours.

Talk of crypto beginning to decouple from stocks has proved premature but sentiment is still strongly bullish for Ripple’s XRP token.

Crypto succumbed to selling pressure yesterday after chair Jerome Powell indicated that the Fed was minded to slow down on rate cuts and would need to see more progress on inflation.

Still, stocks are in the green at the time of writing, so there’s a fair chance crypto will make up more lost ground.

The drawdown came as a rude awakening for high-flying stocks, especially the Magnificant Seven tech stocks, with Tesla, for instance, down 10% yesterday.

An attempt to make a concerted recovery from what is a mild correction by crypto standards began to falter at the beginning of the US session, with bitcoin holding on above $100k.

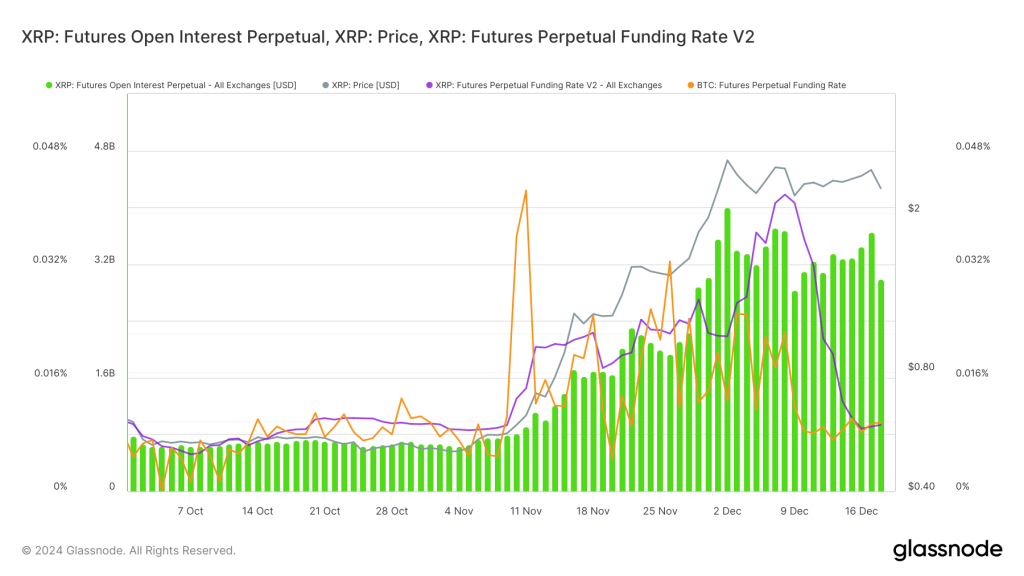

Funding rates in BTC and XRP in decline since December 8th

Those who have been watching the BTC and XRP funding rates in the perpetual futures market could be forgiven for saying I told you so.

As can be seen in the Glassnode chart below, funding rates for both XRP and bitcoin have been falling since Sunday, December 8. Although still in positive territory, a declining funding rate means weakening near-term confidence in long positions.

Traders going long who didn’t heed the warning by taking countervailing measures to hedge their positions, fell victim to what, in hindsight, we can see as inevitable liquidations.

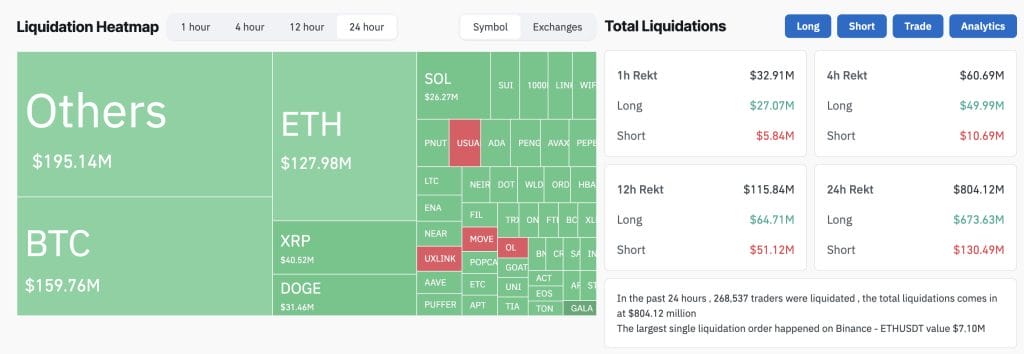

Liquidations across crypto were in the region of $804 million, according to Coinglass data. Most of the damage was in BTC and ETH, but XRP, erstwhile third-placed crypto by market cap (it has now slipped back below Tether into fourth place), suffered liquidations of $40 million.

As we would expect, most of the $40 million in liquidations were longs. According to Coinalyze there were $27 million longs vs $9.2 million shorts.

XRP price predictions – $3, $7, $10, $100 in 2025?

Despite the Fed-induced correction, most market watchers expect the XRP price to bounce back and haven’t given up on end-of-year predictions approaching $3.

Bulls are encouraged not just by the prospect of a pro-crypto administration in 2025, but also by the adoption progress of Ripple, the issuer of XRP.

This week’s launch of RLUSD, the Ripple stablecoin that runs on the same XRP Ledger blockchain as XRP and uses the liquidity token as a bridging currency, was a positive development.

Expectations around the stablecoin before and after its approval by the New York Department of Financial Services (NYDFS) on December 10, helped push the XRP price up to $2.71 earlier this month.

However, Antonio Di Giacomo at XS.com is an exception to the generally positive pricing outlook seen by most analysts.

He’s wary of calling a swift recovery for bitcoin, and although he sees the next price target for XRP at $3, that is unlikely to happen until next year. In his view, the latest Fed backdrop is decidedly negative for the crypto complex as a whole.

“The decline’s impact wasn’t limited to Bitcoin; the broader cryptocurrency market was dragged down by the poor performance. Major altcoins such as Ethereum and Binance Coin also recorded significant losses, while analysts warn of a potentially prolonged period of volatility.

“This phenomenon has also raised doubts about the sector’s short-term recovery capabilities, especially given the macroeconomic backdrop.”

He adds: “Although bitcoin has demonstrated remarkable recovery capability in the past, experts suggest that current conditions could hinder a swift rebound. Opinions remain divided: some see this downturn as a buying opportunity, while others warn of further potential declines.”

XRP price $5 to $7 range in first half of 2025

Arthur Azizov, CEO of B2BinPay, arguably with skin in the game, remains strongly bullish: “XRP could reach a price range of $5 to $7 in the first half of 2025.”

Meanwhile, Bitget Research’s Ryan Lee posits a wide range of price options, insisting that both adoption and regulatory developments are wild cards that could be particularly impactful on XRP’s price direction. “Looking ahead to 2025, XRP’s price projections range broadly, with an average forecast between $1.8 and $8.4, and some optimistic scenarios suggesting peaks above $10,” said Lee.

On the perhaps more outlandish side, predictions going into multiples of $100 for the XRP price have been reported.

XRP ETF will melt faces

The prospect of an XRP ETF has also got bulls salivating. Ripple CEO Brad Garlinghouse sees such a product as inevitable, opening the door to greater institutional adoption.

Eric Balchunas from Bloomberg Intelligence also expects an XRP ETF to be approved by the Securities and Exchange Commission in 2025.