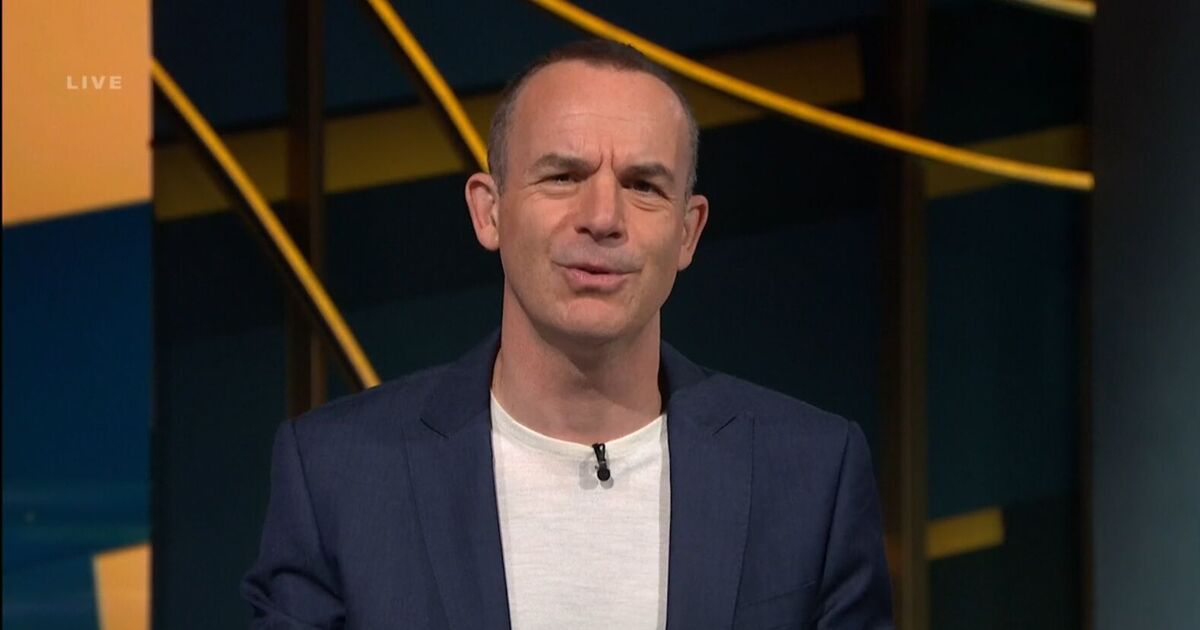

It feels like everywhere you turn, another Martin Lewis tip is popping up, with discounts, deals, warnings, urgent advice and just general money saving tips in plentiful supply.

But as someone who watches The Martin Lewis’ Money Show Live for a living, I decided 2024 would be the year I would put my money where my mouth is, and try to live by Martin’s advice for the entire 12 months to see how much I might save.

It probably helps that I’m from Yorkshire so not exactly averse to penny pinching as it is, but Martin’s advice has proved genuinely useful as I’ve opened accounts, moved money and grabbed deals based on Martin’s sage advice – and this is how much it’s saved or even made me – in some cases his advice left me better off than I was before.

Chase bank account with 1% cashback on spending – £180 made

Martin advised to open a Chase bank account because you get 1 percent cashback on day to day spending, a tip he still gives out right now.

Martin says: “A Chase account is still one of the easiest and most lucrative ways to get money back on your everyday spending – especially as it can be paired with other bank accounts offering up to £200 free cash for switching or 1 percent cashback on household bills paid by direct debit..”

Since then, I’ve loaded all of my general spending day to day onto one card. The Chase card is now the daily spending card, and everything gets 1 percent cashback up to £15 a month. If you’re spending that money anyway, then you might as well get the cashback. Crucially, cashback like this does not count towards your tax bill either as it’s not savings interest.

Linked Chase savings account – £200 made

As well as this, Chase offers a linked savings account which at one point in 2024 was paying a bumper 5.1 percent interest rate. Following Bank of England cuts, it’s gone down to around 3.8 percent now, but the account has still yielded over £200 of interest in the calendar year, which is very handy.

ISA account – £200 saved

Another tip from Martin is to open an ISA account if you’re going to max out your Personal Savings Allowance.

This has meant that savings which could have been liable to tax due to running over my Personal Savings Allowance for the year has instead gone into an ISA, which is protected from tax.

Martin, speaking on his ITV show, had said: “The best savings account on the market right now is actually an ISA from Trading212. This allows you to deposit £20,000 each tax year tax-free and pays a hefty 5.17 percent interest rate because ISAs are not taxed on the first £20,000 deposited each year.”

Phone contract – £1,344 saved

On his ITV Martin Lewis Money Show live last year, Martin advised ‘send two texts to cut bills’. So I did. And then my wife did. She got rid of her £24 a month contract and now pays £10 a month (a £336 saving), and I got rid of my £50 a month contract and dropped to a sim-only for £8 a month (a huge £1,008 saved over the 24-month duration of the contract).

I then bought a new phone in 2024, and bought a cheap deal on Black Friday, then popped my SIM card from my old phone into the new one, and I remain on an £8 contract.

Martin actually had advice on Black Friday too. He found that the best savings on most products were actually found on Black Friday, not the January sales, which is why I pulled the trigger now.

He told shoppers: “A study on 50 items, on was it cheaper to buy Black Friday or in the pre-Christmas sales that come later?

“70 percent of items were cheaper on Black Friday, 12 percent were cheaper on pre-Christmas sales and the other 18 percent were equal.

“So if you’re going to be buying before Christmas, this time of year, Black Friday IS the time that you want to be buying.”

EDF Energy fix – £103 saved

Another piece of Martin Lewis advice this year was related to the energy price cap. The cap rose by 10 percent on October 1, but Martin Lewis advised that many cheaper deals were available if you fix, all but negating the new rises.

Speaking on The Martin Lewis Money Show Live on ITV1 and ITVX, Martin warned that energy prices will go up again, and it’s worth fixing.

He said: “The important thing to look at… If you look at that prediction, across to the very end of 2025 we’re likely to be paying MORE than we are right now if, and it is an if, those predictions are correct.”

I was coming off a very cheap two-year fix which saved me an absolute fortune during the peak of the energy crisis (which not by accident was also a Martin Lewis tip back in 2022), so my bills did rise this year, but they rose £103 less on average over a year than they would have if I’d done nothing and gone onto the standard variable. Instead, I fixed at the end of September and undercut the new price cap.

Thanks, Martin!