The Stamp Duty Land Tax discount will end in March as Chancellor Rachel Reeves failed to extend it in Wednesday’s Autumn Budget.

Stamp Duty relief was temporarily increased by the former Conservative Government, raising the nil-rate threshold to £250,000 for general buyers and £450,000 for first-time buyers.

However, this threshold is set to be reduced back to £125,000 in March 2025, increasing the tax bill on an average-priced home in England from £2,619 to £5,119.

First-time buyers currently pay Stamp Duty if their home costs more than £425,000. This threshold is set to drop back to £300,000 in March, too.

In the lead-up to the Budget, experts were calling for targeted relief for downsizers, with some suggesting a stamp duty exemption for people moving from larger family homes to smaller properties.

Others were urging for Ms Reeves to at least keep the larger amount of relief for first-time buyers, amid concerns many more will be priced out of the market.

Ms Reeves chose not to extend the larger relief threshold and instead, increased the stamp duty surcharge for second homes to 5% from Thursday.

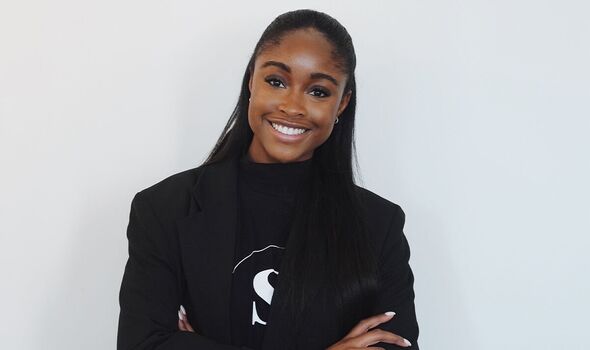

For Ivie, 24, from London, the soon-to-be-reduced Stamp Duty support for first-time buyers has been particularly “frustrating”. The TikTok content creator has always aspired to get a foot on the property ladder, but the added costs associated with it are leading her to question if it’s still a venture she’d like to pursue.

Ivie told Express.co.uk: “It’s a huge shame,” noting that the goal of buying a house feels increasingly unattainable for many.

She said: “You would hope the Government would help you in as many ways as they can. Having the Stamp Duty discount is a great way to continue to support first-time buyers and help them reach their goals.

“You think about things like the rent crisis. I live in London and most of my friends are paying £1,000-plus in rent a month. If you can aspire to buy a house, it’s almost a bit demoralising having something like stamp duty not extended.

“It would have been great for it to be in place. I want to get out of the cycle of paying extortionate prices on rent and put that towards building equity in my own home, which is still a goal for me and many people around me.”

From a social perspective, Ivie said the surging house prices in the south are presenting another challenge. She said: “We still want to be as close to our friends and family as possible. But is that always possible? Everything is very expensive, so we might be pushed out slightly further.”

Ivie added: “It’s definitely frustrating, especially for people that are wanting to buy and don’t feel like they have all the support to do so.

“I will say I’m fortunate enough that it’s not going to be crippling or the end of the world. It is just unfortunate that it hasn’t been extended.”

Nick Leeming, chairman of the estate agency group Jackson-Stops, said the Budget “missed a clear opportunity” to introduce Stamp Duty reform, adding that it’s “something that could have also helped to stimulate greater activity within the market.”

Laura Suter, director of personal finance at AJ Bell, added: “A decision by Labour not to extend temporary cuts to stamp duty rates in the Budget means those buying a new home will pay thousands more in tax from next April.

“First-time buyers will be hit the hardest as they see their tax-free band dramatically reduced. At the same time, those buying a more expensive first home will no longer be eligible for the stamp duty break.”

“Currently first-time buyers benefit from reduced stamp duty rates if they buy a property worth £625,000 or less. It means they pay no stamp duty on the first £425,000 of the value of the property and then 5% stamp duty on any remainder up to £625,000.”

However, the finance expert explained that from April 1, 2025, the property limit to be eligible for the discount will reduce to £500,000 and people will only get the first £300,000 of the value of the property stamp duty-free, with 5% paid on any remainder up to £500,000.

Ms Suter continued: “It means a first-time buyer purchasing a property at the current limit of £625,000 will face a £11,250 hike to their stamp duty bill from April, as they would no longer be eligible for the first-time buyer tax break. Those moving on to their next home will also pay thousands more but will face a less severe hike.”

She noted that a “flurry” of people will likely be looking to lock in their home purchase before the deadline next March, with the rush to complete in time having the potential to “push prices up and lead to more competition in the housing market.”

Tips for first-time buyers

While getting a foot on the property ladder is shaping up to become even more difficult, NerdWallet UK’s personal finance expert, Adam French, shared seven tips to help people attain their goal against the odds.

-

Get your finances in order: Taking straightforward steps like checking your credit report, correcting any errors, repaying any debts you owe and ensuring payments are made on time can make a big difference to your mortgage application.

-

Set a budget (and stick to it): Go through your income and outgoings to figure out exactly how much you can afford each month, and don’t forget the additional costs of buying and owning a home such as stamp duty, legal fees and insurance.

-

Boost your deposit: Make the most of your Lifetime ISA allowance. You can tuck away up to £4,000 each year and the government will add a 25% bonus to what you save, up to a maximum of £1,000 per year. However, it does come with some limitations, for example, the property you’re buying must cost £450,000 or less.

-

Shop around for the best mortgage deal: Mortgage rates can move quickly, so comparing the best deals – or even getting a mortgage broker to do it for you – can lead to big savings.

-

Stick to borrowing only what you need: For example, it’s best not to add stamp duty to a mortgage (although, many people may find they have to) not only could it affect your Loan-to-value making it more expensive to borrow in the first place, but a bigger mortgage debt also costs more over the long term – an extra £3,000 borrowing will cost more than £7,000 in interest over a 25-year term at a rate of 5%.

-

Research the area and local house prices: Think about the kind of property you need now and in the future and the location you want to live in. Sometimes, a property in the postcode next door can mean a big drop – or rise – in prices, so consider your location needs against your budget.

-

Get a survey. Once you’ve found the property you want to buy, getting a survey is always money well spent. A property survey may reveal any big problems or confirm the property you want is structurally okay. That being said, you can usually skip getting a survey if you’re buying a newly built property.