Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

In response to mounting investor concerns over the security and transparency of Bitcoin exchange-traded funds (ETFs), BlackRock has amended its agreement with Coinbase, demanding that the crypto custodian process Bitcoin withdrawals within 12 hours.

This move comes as the world’s largest asset manager attempts to address fears over Coinbase’s on-chain settlement practices. It focuses particularly on proof of reserve transparency.

BlackRock Amends for Faster Coinbase Withdrawals: What Is Going On?

On September 16, BlackRock filed an amendment to the Securities and Exchange Commission (SEC), outlining new terms for Bitcoin withdrawals related to its ETF products.

The amendment mandates that Coinbase, the custodian for BlackRock’s ETF assets, process Bitcoin withdrawals to a public blockchain address within 12 hours of receiving instructions from clients or authorized representatives.

The goal is to reassure investors that their assets are being appropriately managed and that there is no undue delay in accessing Bitcoin holdings.

In the filing, BlackRock emphasized,

“Subject to confirmation of the foregoing required minimum balance, Coinbase Custody shall process a withdrawal of Digital Assets from the Custodial Account to a public blockchain address within 12 hours of obtaining an instruction from Client or Client’s Authorized Representatives.”

Investor Concerns: Is Coinbase Transparent?

The demand for increased transparency and faster withdrawals was catalyzed by widespread speculation that Coinbase was potentially purchasing “paper BTC” or Bitcoin IOUs on behalf of Bitcoin ETF issuers.

This rumor, combined with Bitcoin’s stagnating price over the past three months, led many investors to question the integrity of the Bitcoin ETF system and Coinbase’s role as the primary custodian for these products.

In August, investor worries were further fueled when Coinbase announced the development of a new Wrapped Bitcoin (WBTC), dubbed Coinbase BTC (cbBTC).

Some feared it could be linked to a system of IOUs rather than actual Bitcoin.

Responding to these concerns, Coinbase CEO Brian Armstrong took to social media to address the accusations.

In a September 14 post on X, Armstrong wrote,

“This is what it looks like if you want a bunch of institutional money to flow into Bitcoin.”

Armstrong’s statement clarified that all ETF transactions are ultimately settled on-chain.

However, Coinbase has refrained from publicly sharing all ETF wallet addresses due to confidentiality agreements with institutional clients.

He reassured investors that Coinbase undergoes regular audits and operates transparently within the regulatory framework expected of a publicly traded company.

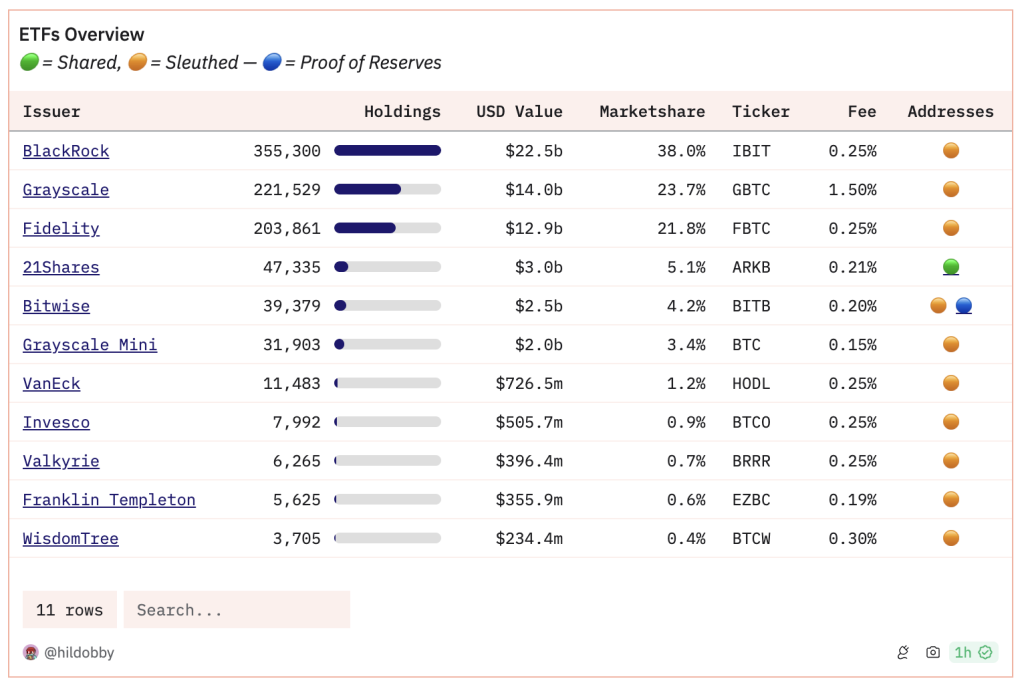

According to Dune Analytics, BlackRock’s iShares Bitcoin Trust (IBIT) had captured over 38% of the total Bitcoin ETF market, with over $22.5 billion in on-chain holdings.

Collectively, Bitcoin ETFs have accumulated more than $59.2 billion in assets, showing the growing demand for institutional Bitcoin products.

In a September 15 post, Eric Balchunas, a Bloomberg senior ETF analyst also dismissed the theory that Bitcoin’s recent price slump was linked to ETF activity, instead pointing to native Bitcoin holders as the primary sellers.

He stated;

“All the ETFs and BlackRock have done is save BTC’s price from the abyss repeatedly.”

The introduction of ETFs has brought significant institutional inflows into the Bitcoin market, accounting for 75% of new investments in early 2024.

However, the increased attention from large asset managers like BlackRock has also resulted in heightened scrutiny from investors demanding greater transparency and assurance that their investments are secure.