THE 2015-16 season was an epic one for Nike’s athletes. LeBron James led the Cleveland Cavaliers to basketball glory in the NBA play-offs and the Denver Broncos, quarterbacked by the Nike-shod Peyton Manning, triumphed in American football’s 50th Super Bowl. In proper football, Cristiano Ronaldo won both the UEFA Champions League (with Real Madrid) and the European championship (with Portugal). In tennis, Serena Williams secured her seventh Wimbledon singles title. At the Olympic games in Rio de Janeiro, 89 track-and-field medallists plus the entire male marathon podium wore Nikes, and Simone Biles, who had clinched an endorsement deal with the sportswear giant the year before, tumbled her way to four gymnastics golds and a bronze.

Things were looking just as golden for Nike in the corporate arena. Revenue in its financial year to May 2016 clocked in at $32bn, up from $24bn in the one leading up to the 2012 London games. The firm’s operating margin was a strong 14%. In September 2015 its market capitalisation Fosbury-flopped over the $100bn bar. It was around that time that Elliott Hill was emerging as a star player on the management team of Mark Parker, then Nike’s chief executive. A couple of years later Mr Hill would take charge of the company’s commercial and marketing operations—and become a contender in the race to succeed Mr Parker. But then, in early 2020, he lost that contest to John Donahoe, a former Bain consultant tasked with ushering Nike into the digital age, and retired.

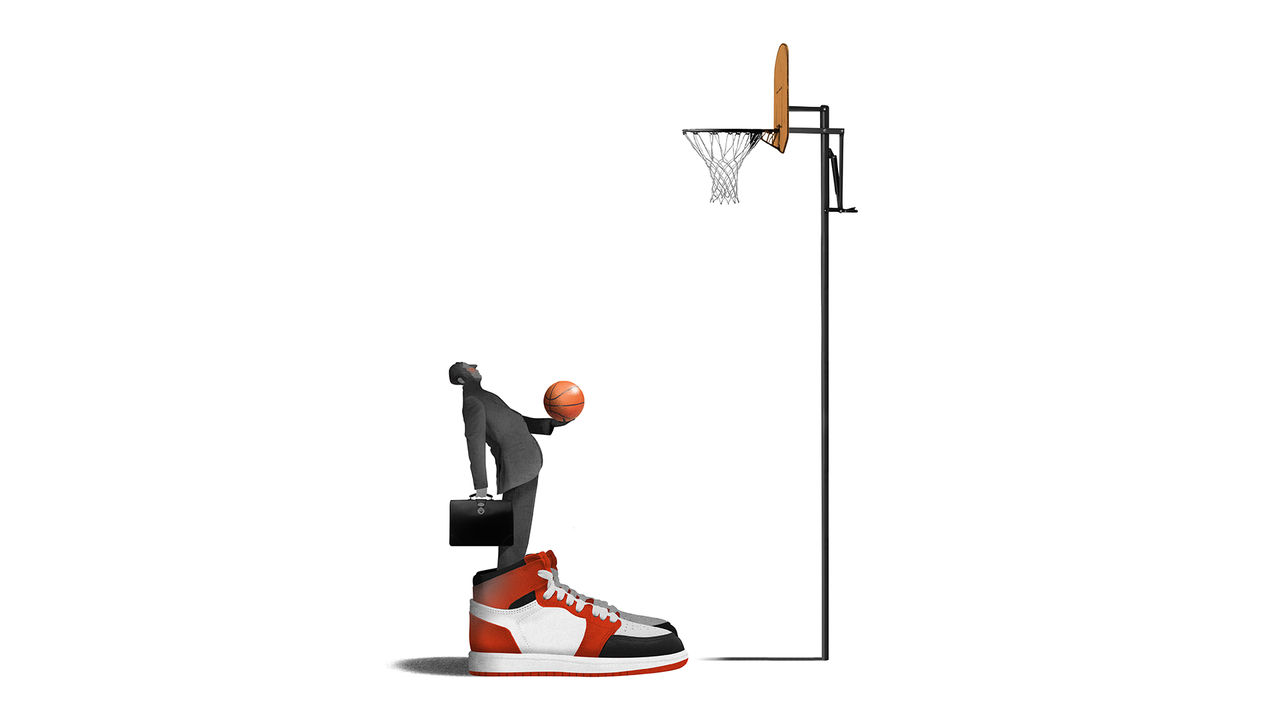

On September 19th Mr Hill was back, this time as CEO, after Mr Donahoe made a hash of his effort to make Nike less about sports, more about fashion and all about selling directly to consumers. Investors cheered their lungs out. Nike’s flagging share price leapt by nearly 10% on the news. The hope is that the Nike lifer, who began as an intern in 1988, can restore the magic of the 2010s, when product innovation was faster, morale among employees and athletes higher, and relations with retailers stronger. But is a former insider really the right man for the moment?

Choosing between insiders and outsiders is seldom easy, and never in a crisis. Insiders possess intimate knowledge of a firm’s inner workings and culture. Outsiders have less to lose. Unhelpfully for boards, literature and anecdote offer conflicting counsel.

One recent study found that internally promoted CEOs oversaw marginally better returns on assets amid the covid-19 pandemic in 2020 than external hires. Another concluded that share prices of insider-led companies were less liable to crash. Yet other studies paint a more nuanced picture. Research by Spencer Stuart, a firm of headhunters, on 300 CEO transitions at big American firms suggests that insiders are better for shareholder returns and growth in revenue and profits—except when a firm is in trouble, when outsiders outperform. Non-executive directors, who combine inside and outside views, do best of all when appointed CEO. Tell that to Nike’s board, which counted Mr Donahoe as one of their own before making him boss.

Business annals are likewise a mixed bag. For every successful insider like Arvind Krishna, who has reversed IBM’s long fall from tech grace, there is an inept one like Dave Calhoun, who failed to put an end to Boeing’s engineering failures and was ejected last month, and an able outsider like Larry Culp, who saved GE from a slide into industrial irrelevance. Go figure.

The evidence is more compelling on former bosses who ride back to the rescue. In a paper from 2019 Chris Bingham of the University of North Carolina at Chapel Hill and colleagues looked at 25 years of data on such “boomerang CEOs” in America Inc. Although Steve Jobs reimagined Apple after his return from corporate exile, the authors calculate that, in general, rehires do “significantly worse” by shareholders, especially in fast-changing industries, possibly because they “drag organisations backward instead of pushing them forward”.

Tales of boomerangs gone astray are easy to find. Think of Howard Schultz, who two years ago brought a bit of froth back to Starbucks in a third stint as barista-in-chief—but also ushered in Laxman Narasimhan, his disastrous external successor, who was sacked in August after 16 months on the job. Or of Bob Iger, who left Disney in 2020 only to return in 2022 after botching his own succession. Mr Iger has improved on his hapless heir when it comes to shareholder returns, but has underperformed some of Disney’s showbusiness rivals. Jack Dorsey’s second turn at Twitter in 2015-21 looks immaculate beside the cesspool that is now X, but shabby compared with Mark Zuckerberg’s stewardship of Meta.

A Hill to climb

Mr Hill might appear better placed. In contrast to the boomerang CEOs he is humble, never having been top dog, but shares some of their virtues. Like Mr Iger, he is loved by the rank and file. Like Mr Dorsey back in the day, he is devoted to his company, to the point of welling up when talking about colleagues. Like Mr Schultz, he helped oversee global expansion.

Yet the travails of two struggling high-profile bosses, whose careers closely mirror his own, provide a cautionary tale. Pat Gelsinger and Oliver Blume started at Intel and Volkswagen, respectively, straight out of school. Both rose up the ranks, then left (Mr Blume to run VW’s independent Porsche subsidiary). Both came back as CEOs at a time when the market was shifting: away from central processing units, Intel’s forte, and internal-combustion engines, which were VW’s. Despite their best efforts, both have been value-destroyers. After all, understanding what made firms great in the past may be less relevant now that the world around them has changed. One of Nike’s strengths in its heyday was its willingness to take risks on products and athletes. Its board may be playing it too safe with Mr Hill. ■

If you want to write directly to Schumpeter, email him at [email protected]

To stay on top of the biggest stories in business and technology, sign up to the Bottom Line, our weekly subscriber-only newsletter.