Your browser does not support the <audio> element.

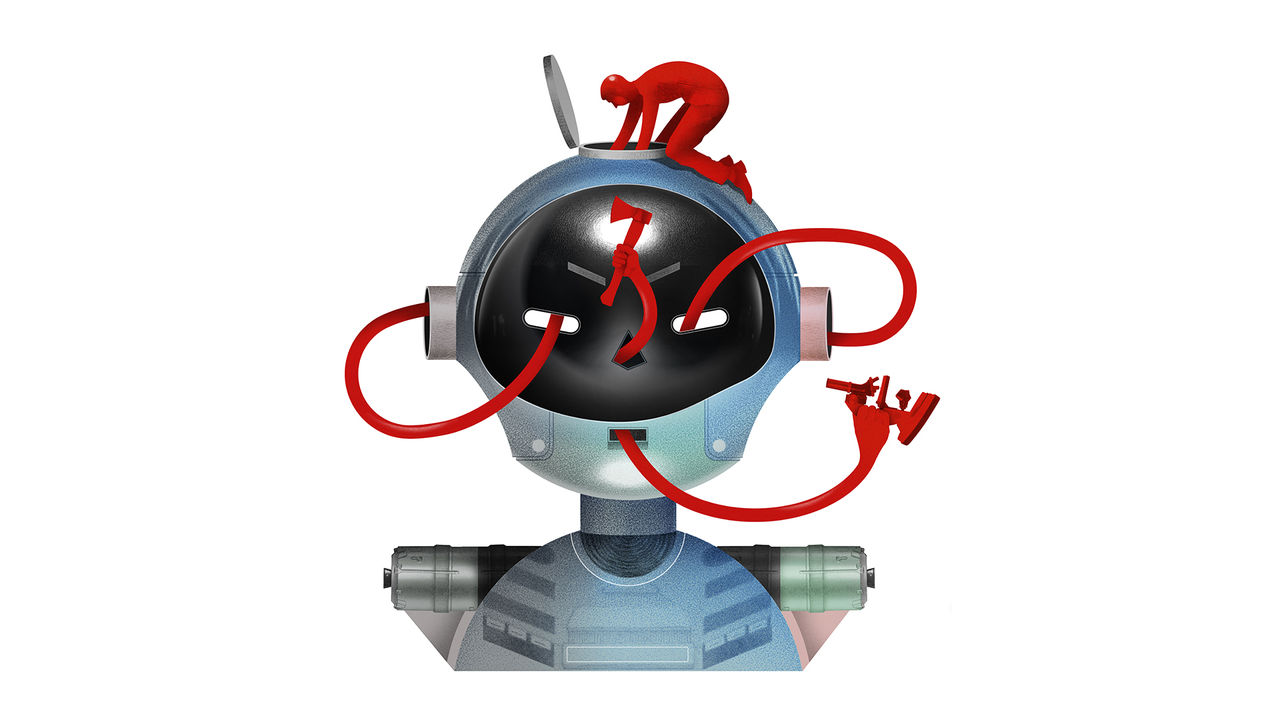

When ChatGPT took everyone by storm in November 2022, it was OpenAI, the startup behind it, that seized the business world’s attention. But, as usual, big tech is back on the front foot. Nvidia, maker of accelerator chips that are at the core of generative artificial intelligence (AI), is duelling with Microsoft, a tech giant of longer standing, to be the world’s most valuable company. Like Microsoft, it is investing in a diverse ecosystem of startups that it hopes will strengthen its lead. Predictably, given the “techlash” mindset of the regulatory authorities, both firms are high on the watch list of antitrust agencies.

Don’t roll your eyes. The trustbusters may have infamously overreached in recent years in their attempts to cut big firms down to size. Yet for years big-tech incumbents in Silicon Valley and elsewhere have shown just as infamous a tendency to strut imperiously across their digital domains. What is intriguing is the speed at which the antitrust authorities are operating. Historically, such investigations have tended to be labyrinthine. It took 40 years for the Supreme Court to order E.I. Du Pont de Nemours, a large American chemical firm, to divest its anticompetitive stake in General Motors, which it first started to acquire in 1917 when GM was a fledgling carmaker. The Federal Trade Commission (FTC), an American antitrust agency, is still embroiled in a battle with Meta, a social-media giant, to unwind Facebook’s acquisitions of Instagram and WhatsApp, done 12 and ten years ago, respectively.

This time, rather than waiting until deals are done and markets are stitched up, the preference is to be nimble. It is now the trustbusters who are trying to move fast and break things.

Broadly speaking, the authorities have two areas of concern. The first is whether the world’s biggest companies are trying to tie businesses into their products in anticompetitive ways. The second is about control: are some of the largest generative-AI investments poorly disguised acquisitions intended to sidestep antitrust consideration?

Nvidia faces scrutiny on the first count. It is under the gaze of America’s Department of Justice, which is understood to be examining allegations that it locks users of its graphics processing units (GPUs) into its software, and that a scarcity of GPUs is the result of anticompetitive conduct. Nvidia declined to comment.

The attention on Microsoft is more over the second category. The FTC has launched a market inquiry of the software-provider’s $13bn investment in OpenAI, which gives it a 49% share of the profits. It is also investigating Microsoft’s hiring in March of most of the staff of Inflection, a rival to OpenAI (the most significant hire was Mustafa Suleyman, Inflection’s co-founder, who sits on the board of The Economist’s parent company). Microsoft also declined to comment. The FTC has other big-tech firms under the spotlight, too. It is looking at investments by Alphabet and Amazon in Anthropic, another maker of large language models (LLMs).

Inevitably, there is little public information concerning this antitrust scrutiny. Yet Britain’s Competition and Markets Authority, a regulatory agency that is also probing the two Microsoft deals, has recently published a study of LLMs (it refers to them by their alternative name, foundation models) that illustrates the main concerns. The biggest one, it says, is the potential role of a few tech giants to shape the market in anticompetitive ways. It notes that Alphabet, Amazon, Apple, Meta, Microsoft and Nvidia have forged over 90 partnerships with LLM-makers since 2019, mostly by taking minority stakes. It expresses concerns that they may exert leverage on their partners through supply of critical inputs, such as computing power and data, as well as controlling access to consumers via their platforms. It also notes that some of the deals may have been structured to avoid merger scrutiny.

In America, the government’s concerns are similar. But the trustbusters are not just looking at LLMs. They have their eyes on the whole caboodle—from the GPUs at the bottom to consumer applications at the top of the generative-AI “stack”. The FTC’s investigation of Microsoft’s Inflection deal is yet another type. The agency is probing whether Microsoft failed to supply the correct merger paperwork when it hired most of Inflection’s employees and paid for a non-exclusive licence to its technology. In other words, it suspects it was an acquisition in disguise aimed at avoiding an antitrust review. For Microsoft, it was not an acquisition at all. What is left of Inflection remains an independent company.

This is all tricky terrain. Building LLMs is capital-intensive, like drilling for oil. The requirements for computing power, digital information and human expertise are such that model-builders justifiably turn to tech giants for support. Big tech has the balance-sheets, data and cloud infrastructure to help, as well as providing a seal of approval. Moreover, it is hard to assert that a tech giant has an exclusive hold over any generative-AI startup when so much polyamory is taking place. Satya Nadella, Microsoft’s boss, once declared with regard to OpenAI that his firm was “below them, above them, around them”. That sounded suspiciously like monogamy. When OpenAI recently announced a partnership with Apple, a Microsoft rival, Mr Nadella was reportedly miffed.

The other type of competition

It is tough political territory as well. If intervention is too heavy-handed, China hawks will accuse the trustbusters of suffocating American innovation in favour of its strategic rival. Yet there is room, at the very least, for a light touch. Generative AI will cause big technological upheaval, though in what ways is still unclear. If the incumbents are left to their own devices, they will surely use their imperial might to try to bend it to their advantage. Regulators have a duty to prevent them squashing competition. So, by all means move fast. Just don’t break things too badly. ■

If you want to write directly to Schumpeter, email him at [email protected]

To stay on top of the biggest stories in business and technology, sign up to the Bottom Line, our weekly subscriber-only newsletter.