Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Over the past 24 hours, the Ethereum price has mounted a recovery, now down just 0.29% after a significant decline. Meanwhile, one analyst believes that a breakout is due, setting eyes on a new all-time high.

Despite this lapse, Ethereum continues to outpace most other major altcoins, rising 9.57% since last Thursday as the broader market shows strength in its recovery from last week’s sell-off.

However, trader interest in Ethereum appears to have dipped slightly, with the altcoin’s trading volume falling by 14.16% to $14.14 billion over the past 24 hours.

Analyst Believes Ethereum Price is “lagging” Behind

In an August 15th Schwab Network interview, Khelp Financial CEO Boomer Saraga highlighted Ethereum’s recent price performance as “lagging” behind its fundamental growth, with strong on-chain activity suggesting the network is nearing peak performance.

Saraga pointed to metrics showing over 2 million active users across Ethereum’s layer-1 and layer-2 solutions, more than double the daily active users seen in Q4 2021 when Ethereum set its all-time high of $4,891.70.

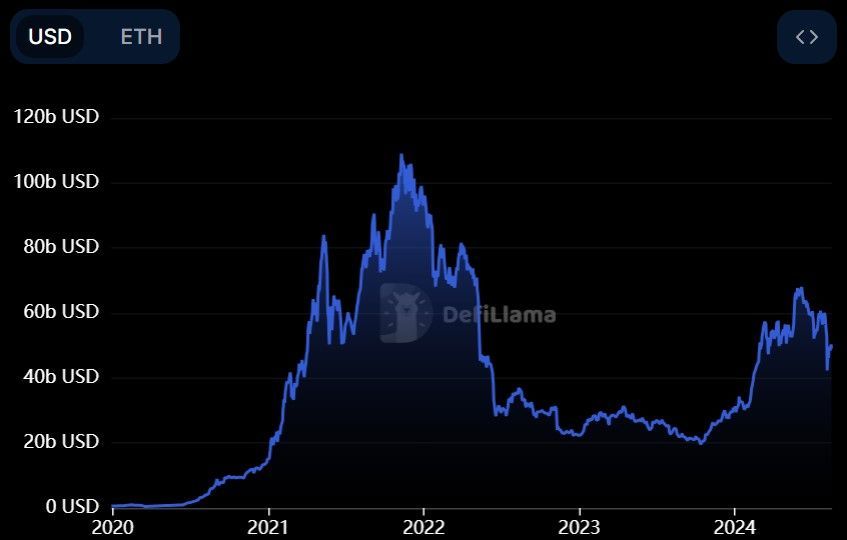

Meanwhile, the Ethereum “ Network is securing more in collateral, we call this total value locked, than it ever has before.” According to DefiLlama data, Ethereum’s total value locked (TVL) now stands at $49.02 billion, higher than it has been on any day throughout 2023 – though not at its highest level ever.

He also noted a “large discrepancy” in the initial performance of Ethereum ETFs compared to Bitcoin ETFs, with $400 million in outflows and $1.3 billion in inflows respectively.

However, Ethereum ETFs are gaining traction with three consecutive days of inflows this week, according to fairside data, following their first week of net-positive activity.

Saraga highlighted this fundamental growth as an inevitable catalyst for price growth, expressing confidence that Ethereum will exceed its current all-time high. He stated:

“From a fundamental standpoint, Ethereum is reaching all-time highs, and I expect the price to follow”

Ethereum Price Analysis – Can Ethereum Reach New All-Time Highs?

Ethereum remains bound in an expanding triangle pattern, characterized by its widening swings that signal increasing volatility as the asset remains in a period of fear, uncertainty, and doubt (FUD).

After touching the lower support of this pattern last week, the recent influx of volume has propelled Ethereum back on the path to retesting the pattern’s upper resistance.

However, this momentum has been subdued as it encounters strong resistance at $2700. This point of contention coincides with weak momentum indicators, suggesting that the current demand for Ethereum may not be enough to trigger a rally.

Most Notably, the Relative Strength Index (RSI) (purple) remains below its neutral line at 40. While the asset isn’t deeply oversold, it leans bearish.

Likewise, Ethereum’s Chaikin Money Flow (CMF) is struggling to break out of negative territory, currently sitting at -0.10. This indicates persistent selling pressure, making any potential price rally challenging.

Despite this, other indicators suggest that this pressure is weakening as the bulls take control. Notably, the MACD line (blue) has successfully crossed above the signal line (orange) in an uptrend, an indicator of a potential shift in momentum from bearish to bullish.

Meanwhile, the dots that make up the Parabolic Stop and Reverse (SAR) indicator have been below the Ethereum price since August 11th. This serves as an uptrend, with the SAR providing support, suggesting that the price is likely to continue rising.

If Ethereum can maintain this momentum, the immediate resistance at $2,700 becomes the next key barrier.

From there, Ethereum can advance to the next resistance level at $2,830 and potentially test a breakout of the upper boundary of the expanding triangle pattern, setting its eyes on new highs.

Why Pepe Unchained ($PEPU) Is a Strong Addition to Your Crypto Portfolio

Ethereum is likely to see notable gains later this year, but it won’t be the only altcoin driving profits. Traders may find a strategic advantage by diversifying into smaller-cap coins, which have the potential to rally exponentially.

Enter Pepe Unchained ($PEPU), a meme coin that transcends conventional utility. It addresses two of the most significant pain points in the current crypto landscape – transaction speeds and fees.

This liberated evolution of Pepe operates on its own Layer 2 chain, freeing itself from Ethereum’s shackles, offering lower fees and 100x faster transaction speeds.

It’s not just a meme coin, it’s a meme chain! Something that may be credited to its instant success, raising over $8.5 million in its presale so far.

This confidence can also be attributed to Pepe Unchained’s commitment to transparency. It has undergone two audits and features its own block explorer, allowing users to track all transactions on its unique chain.

At a temporary fixed presale price of $0.0090901, those who act quickly stand to benefit the most. Investors are currently earning an impressive 221% APY. This presents a valuable passive income opportunity, even amidst recent market volatility.

Join the Pepe Unchained community on X and Telegram to stay up to date on the latest announcements.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.