Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

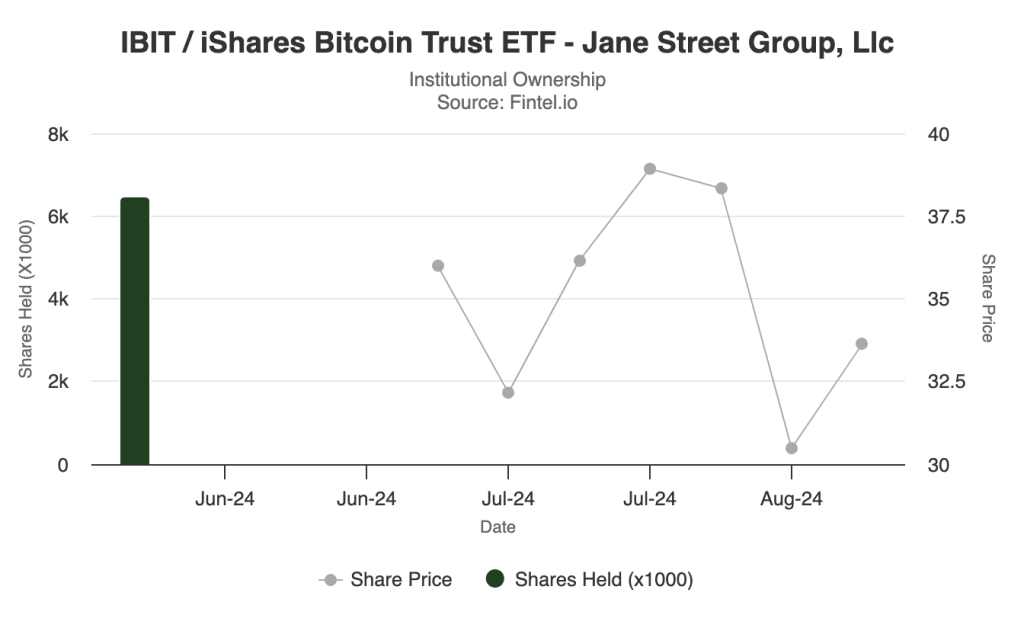

Wall Street trading firm Jane Street has significantly reduced exposure to Grayscale Bitcoin Trust (GBTC) by 85%. The firm acquired 6,474,742 shares of the BlackRock iShares Bitcoin Trust ETF (IBIT) valued at $221 million.

Latest data from Fintel shows Jane Street made its first purchase of IBIT, the newly launched spot Bitcoin exchange-traded fund (ETF) in the second quarter of this year.

Market Maker Doubles Fidelity FBTC Exposure

Jane Street also increased holdings in the Fidelity Wise Origin Bitcoin Fund (FBTC) by 1,472,906 shares up 46% with a holding value of $233 million. In the previous quarter, the firm held 2,984,656 shares.

The wall street giant increased holdings of 123,033 shares in the Invesco Galaxy Bitcoin ETF (BTCO) up 142% with a holding value of $12.53 million.

The firm increased its holdings in the Franklin Bitcoin ETF (EZBC) by 252,360 up 187% with a value of $13.48 million.

Jane Street Reduces Ark, Grayscale, VanEck Exposure

Latest data shows that in the second quarter, Jane Street sold 940,927 shares of Bitwise Bitcoin ETF (BITB) down 68%, with a holding value of $14.664 million.

The firm also sold 423,617 ARK 21Shares Bitcoin ETF (ARKB) shares -12% with a holding value of $177 million. As well as reduced exposure to the VanEck Bitcoin Trust (HODL) by 34,657 shares down -52% with a holding value of $22.04 million.