Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

The classification of crypto could change in Japan after the nation’s top financial regulator announced plans to start viewing tokens like Bitcoin (BTC) as “financial assets.”

Per the Japanese news outlet CoinPost and an official Financial Services Agency (FSA) document, the regulator unveiled its position in its requests for tax reform in the fiscal year 2025.

Classification of Crypto Set to Change in Japan?

The FSA wrote that it wants to start considering cryptoassets as “financial assets” that “the general public can invest in.”

Currently, Japanese law classifies cryptoassets as “payment instruments” under the terms of the Payment Services Act.

The switch to a more “investment”-focused definition would represent something of a legitimization for crypto.

But such a change would seemingly be dependant on the stability of the crypto industry.

And while the document stops short of calling for crypto tax reform, CoinPost wrote that it suggests “a possibility” that Japan’s controversial crypto tax rules “will be reviewed.”

Ruling Party on Same Page?

The move comes days after the ruling Liberal Democratic Party (LDP) made similar claims in its own tax policy recommendations for FY2025.

The LDP wants the crypto industry to incorporate “regulations on accountability and investor protection” that are “equivalent to those in place for stock investment in listed companies.”

This would allow the law to start viewing “certain cryptoassets” as “financial products” commonly used in “the general public’s portfolios.”

CoinPost wrote that the tone of the FSA’s document suggests that it is “endorsing [the LDP’s]” stance.

The FSA, media outlets this year claimed, is readying a “fundamental review” of the way it regulates crypto.

However, the FSA’s move appears to suggest it thinks the Payment Services Act offers insufficient protection to crypto investors.

Differing Views on Tax Reform

There is another wrinkle for Japanese crypto traders. While the LDP appears keen to scrap Japan’s current crypto tax system, the FSA seems to have different ideas.

Under the current system, crypto traders must declare their profits as “other income” on yearly tax declarations.

That means high earners can pay up to 55% tax on their earnings. The LDP favors abolishing this system in favor of a capital gains tax on crypto earnings.

The FSA, however, seems instead keen to place crypto “within a more comprehensive framework of income tax integration,” CoinPost explained.

There does, though, appear to be a consensus about the need to change the legal classification of crypto in Japan.

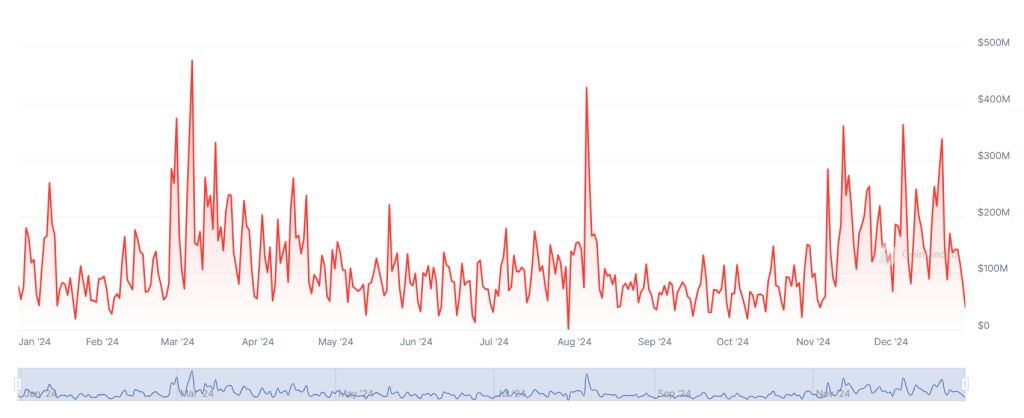

This is particularly relevant as Japanese companies like Metaplanet and Remixpoint begin to ramp up their Bitcoin-buying strategies.

Earlier this year, the LDP’s Deputy Secretary-General Masanobu Ogura claimed that the existing regulatory framework was inadequate.

Ogura said that cryptoassets were now not only “a means of payment,” but also “an investment vehicle and a source of innovation.”