Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The Japanese crypto exchange Coincheck is nearing a NASDAQ listing after obtaining US Securities and Exchange Commission (SEC) Form F-4 approval.

Per a press release from the Monex Group, Coincheck’s operator, and a report from the Japanese media outlet CoinPost, the SEC has issued a filing approval.

This means the SEC has “reviewed the submitted documents and determined they meet the legal listing requirements.”

This means that the SEC “deems” the documents “valid.” However, the exchange is still waiting for the final green light from NASDAQ.

Coincheck NASDAQ Listing Set for Mid-December

The operator claimed that the listing schedule has now been finalized. Thunder Bridge Capital Partners IV will hold a shareholders’ meeting on December 5.

Thunder Bridge IV is a so-called special purpose acquisition company (SPAC), a NASDAQ-traded company created to merge with an existing company. In its own press release, Thunder Bridge IV said:

“The proposed business combination is anticipated to close on or about December 10, 2024. It is subject to stockholder approvals, Nasdaq approval, and satisfaction of customary closing conditions.”

After listing, Thunder Bridge IV said Coincheck would “retain its experienced management team.” Oki Matsumoto will continue as Executive Chairman.

The firms said the new company would be named Coincheck Group. The company will likely trade under the ticker symbol “CNCK.”

Thunder Bridge IV said its units would separate into their “component securities in connection with the completion of the proposed business combination.”

Following the merger’s completion on December 10, trading is slated to begin on the NASDAQ exchange on “the following business day.”

CoinPost said that “significant hurdles” remained ahead of the proposed listing, with the shareholders meeting, checks on “minimum cash requirements,” and NASDAQ compliance protocols ahead.

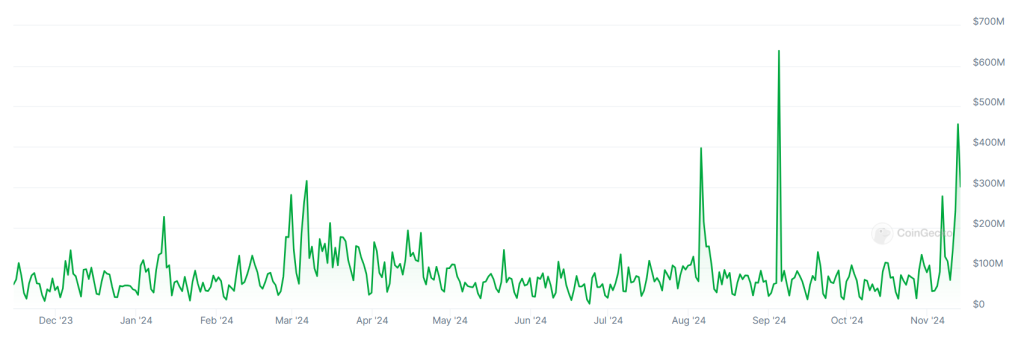

The filing mentions the “risks” involved. These include the price volatility inherent to the crypto markets and the uncertain future of the regulatory landscape.

Several Japanese crypto exchanges have unveiled their global expansion plans this year. These include the Coincheck rivals DMM, Bitbank, and bitFlyer.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.