Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Key Takeaways:

- The company is embracing a non-traditional funding strategy to expand its digital asset portfolio.

- This approach reflects a broader industry trend of using creative financing methods in the crypto space.

- The move illustrates both the potential rewards and inherent risks of tying corporate strategy closely to cryptocurrency markets.

Japanese investment company Metaplanet has announced the issuance of $13.6 million in Zero-Interest bonds to fund additional Bitcoin investment.

The Tokyo-listed firm is allocating 2 billion JPY in bonds to EVO FUND, seeking to bolster its digital asset portfolio.

In a regulatory filing dated February 27, Metaplanet detailed that these Zero-Interest bonds are set for redemption at face value on August 26.

EVO FUND has the option for early redemption, provided one business day’s notice is given.

The funds for bond redemption are expected from the 13th to 17th Series of Stock Acquisition Rights exercise.

Upon reaching increments of 50 million JPY from these exercises, partial early redemption of the bonds may occur.

The entire bond issuance is designated for EVO FUND, with no attached guarantees or collateral.

Despite this strategic financial maneuver, Metaplanet’s shares have experienced a nearly 25% decline, coinciding with a week-long downturn in cryptocurrency prices.

Alongside this bond issuance, Metaplanet also purchased 135 Bitcoin for about $13 million at an average price of $96,185 per coin.

This acquisition came just before Bitcoin dropped below $91,000 on February 25.

Despite the dip, the company’s total Bitcoin holdings have reached 2,225 BTC, valued at over $205 million.

Comparative Insights: Strategy’s Approach

Metaplanet’s Bitcoin investment strategy mirrors that of U.S.-based firm Strategy (formerly MicroStrategy).

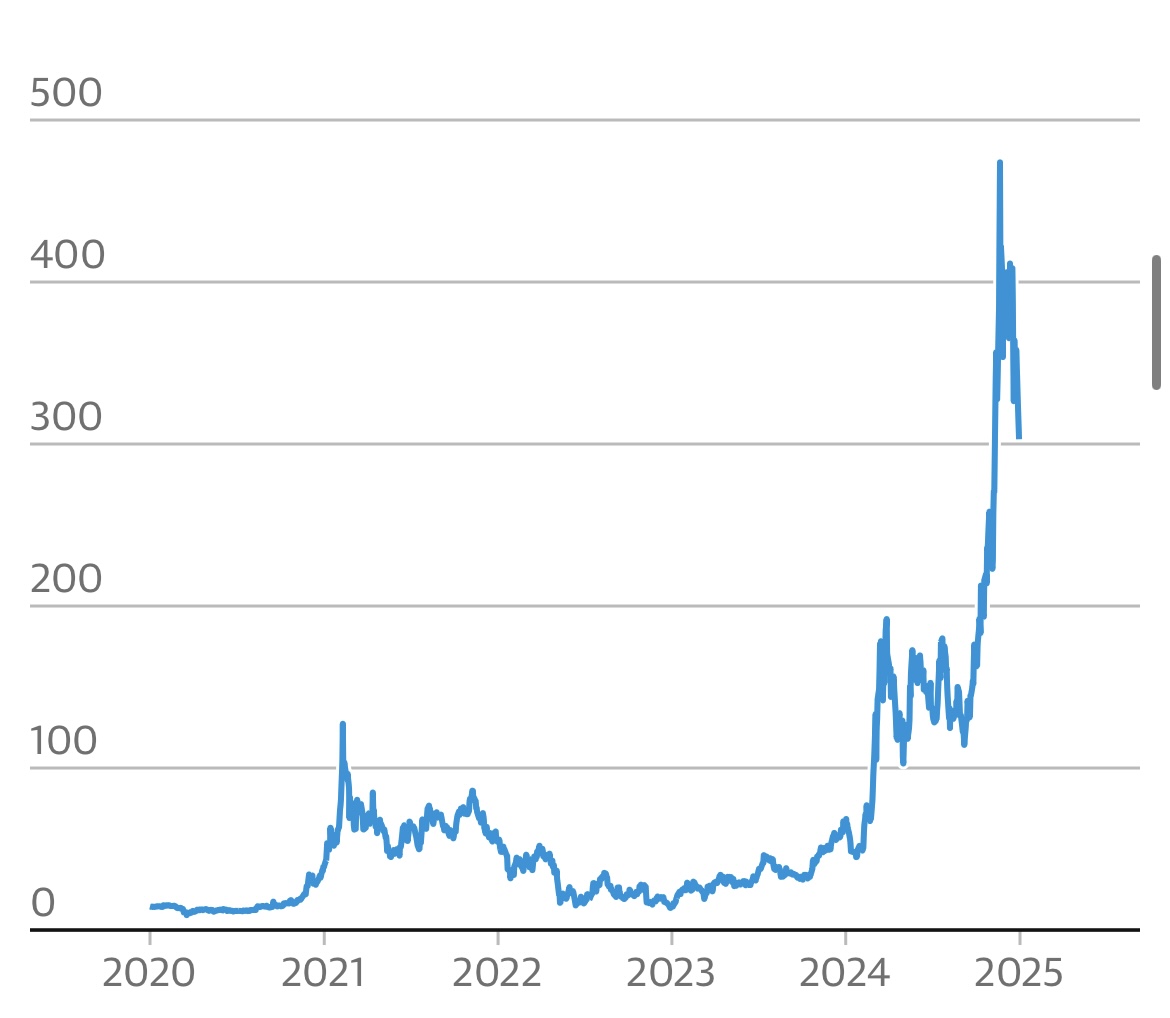

Since 2020, Strategy’s value has substantially grown after becoming the world’s first company to hold Bitcoin as its main asset.

Strategy has become renowned for its substantial Bitcoin investment, transforming into a “Bitcoin treasury company.”

The company has consistently acquired Bitcoin, funding purchases by issuing bonds and new shares.

This approach has led to significant fluctuations in Strategy’s stock price, which is closely tied to Bitcoin’s market performance.

Notably, Strategy’s stock exploded over 600% in the past year, attracting short-sellers who question the sustainability of such a premium.

However, the company’s moves are not without risks. Strategy’s major reliance on Bitcoin has made it vulnerable to market volatility.

A major drop in Bitcoin’s value could severely impact the company’s financial stability.

Metaplanet’s Bitcoin investment strategy carries similar risks. The company’s issuance of Zero-Interest bonds to finance Bitcoin purchases exposes it to the cryptocurrency’s inherent volatility.

A sharp decline in Bitcoin’s price could lead to financial challenges, especially if its value drops below critical levels.

This could affect the company’s ability to meet its bond redemption obligations.

Additionally, the lack of guarantees or collateral on the issued bonds may raise concerns among investors regarding the security of their investments.

The recent 25% drop in Metaplanet’s share price amidst declining crypto markets underscores the potential vulnerability of such an aggressive investment approach.

Strategy’s recent decision to rebrand shows how much it has shifted away from its original software business to focus on Bitcoin investment.

Since late 2024, the company has spent over $20 billion on Bitcoin, making it more of a Bitcoin holding company than a tech firm.

While it has increased the company’s stock price, it also ties its future to Bitcoin’s price.

Metaplanet seems to follow a similar path by using zero-interest bonds to fund its Bitcoin investment.

Frequently Asked Questions (FAQs)

Companies are increasingly viewing Bitcoin as a hedge against economic uncertainties, such as inflation and currency devaluation. By allocating funds to Bitcoin, firms aim to diversify their assets and potentially enhance returns, leveraging the cryptocurrency’s growth potential. This strategy reflects a broader trend of corporate adoption of digital assets to strengthen financial resilience.

Metaplanet’s approach is similar to that of U.S.-based firm Strategy, which has become renowned for its substantial Bitcoin investments. Strategy has consistently acquired Bitcoin, funding purchases by issuing bonds and new shares, transforming into a “Bitcoin treasury company.” This strategy has led to significant fluctuations in its stock price, which is closely tied to Bitcoin’s market performance. However, it also exposes the company to heightened financial risks, especially during market downturns.

Issuing zero-interest bonds to finance Bitcoin acquisitions can expose companies to several risks. These include market volatility, which can potentially affect the company’s ability to meet bond redemption obligations, and liquidity concerns, as allocating substantial funds to a volatile asset like Bitcoin may impact a company’s liquidity, affecting its capacity to respond to unforeseen financial needs. Another risk is the lack of investors’ confidence in the security of their investments.

A decline in Bitcoin’s price can have several implications for companies with significant holdings. This can result in asset devaluation, which can potentially lead to financial losses. Other consequences are stock price fluctuations as a result of the effect on investors’ sentiment and financial instability in the company.

The integration of Bitcoin into corporate financial strategies signifies a shift towards accepting digital assets in traditional finance. This trend could lead to increased mainstream adoption, the establishment of clearer regulatory frameworks governing digital asset investments, and market dynamics.