Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

JPMorgan Chase has announced that its blockchain-based Kinexys platform, previously known as Onyx, will soon offer instant foreign exchange (FX) settlements between the U.S. dollar and the euro.

The Kinexys platform utilizes JPM Coin, JPMorgan’s in-house digital token, to enable these transactions, marking a major milestone in the bank’s use of blockchain technology to process international settlements.

JPMorgan Dollar-Euro FX Settlement: Will This Drive Millions on the Blockchain?

The announcement was made at the Singapore Fintech Festival, where Umar Farooq, JPMorgan’s global co-head of payments.

He explained:

“Our goal is to foster a more connected ecosystem to break down disparate systems, enable greater interoperability and reduce the limitations of today’s financial infrastructure.”

The dollar-euro FX conversion feature, expected to go live in the first quarter of 2025, will eventually be expanded to include sterling, pending regulatory approval.

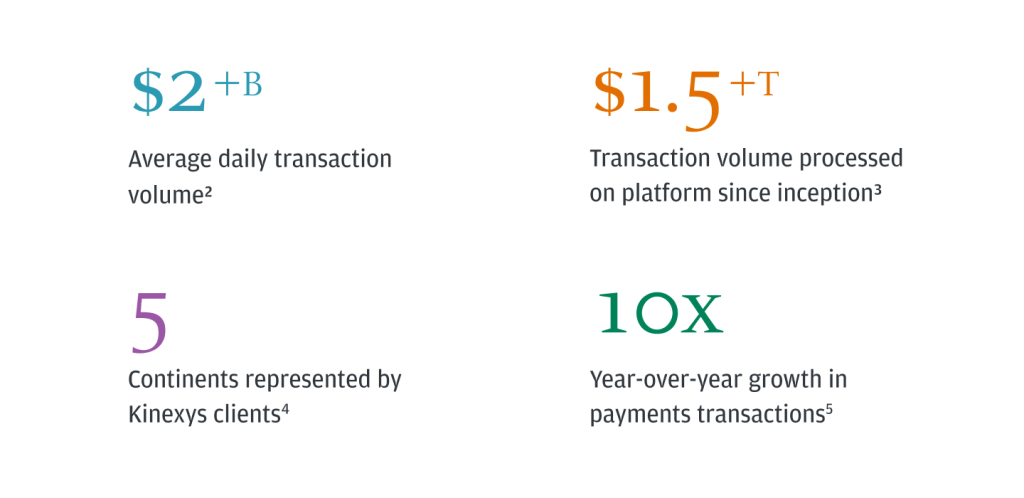

Since its inception as Onyx, the Kinexys platform has grown substantially, processing over $2 billion in daily transactions and surpassing $1.5 trillion in notional value.

The platform offers near-instant, 24/7 settlement capabilities, allowing clients to transfer assets and validate data beyond market hours.

In addition to payment efficiency, integrating FX conversion capabilities aims to streamline global transactions further, reducing the risk and time associated with traditional FX settlements, which can range from same-day to two-day settlements depending on currency pairs.

Kinexys leverages JPM Coin, a tokenized deposit system designed specifically for dollar and euro-denominated payments.

As a private blockchain ledger, Kinexys is one of the most extensive examples of blockchain technology deployed by a major bank on a large scale. JPMorgan believes it will enhance revenue generation through FX spread fees.

Naveen Mallela, global co-head of Kinexys, said on this:

“If you look at JPM Coin, we generate revenues from fees, we also generate revenue from liquidity from holding those balances.”

Farooq added that as the platform gains traction, Kinexys could operate at an even greater scale, targeting a potential tenfold increase in transaction volume in the coming years.

Farooq projected that achieving a cost-effective model for the platform may take three to five years, noting that rebranding from Onyx to Kinexys was also intended to reduce its reputation as a “mysterious” entity.

With this rebrand, JPMorgan hopes to expand client engagement and present Kinexys as a trusted, accessible platform.

Strategic Focus on Real-Time, 24/7 FX Settlement

The new FX settlement capability aims to provide clients with on-demand access to working capital by enabling real-time FX conversions.

With a growing list of global partners, such as Siemens, Ant International, and BlackRock, Kinexys facilitates programmable transactions and intragroup funding in nearly real-time.

JPMorgan’s platform seeks to optimize liquidity management and reduce counterparty risk by allowing clients to avoid pre-funding through programmable disbursements.

Kinexys reduces the friction often associated with FX transactions across time zones and regulatory jurisdictions by offering dollar-euro conversions in near real-time.

The bank’s long-term vision includes fully automated, near-real-time multicurrency clearing and settlement across a wider range of currencies.

The FX service expansion is also seen as a step toward creating a comprehensive, blockchain-powered financial ecosystem where various blockchain protocols coexist, allowing clients to transfer and manage assets across global jurisdictions seamlessly.

Farooq also noted that this multichain model could help modernize global finance by reducing dependence on traditional banking infrastructure and enhancing interoperability across financial systems.

Alongside expanding FX capabilities, JPMorgan is advancing Kinexys’ privacy, identity management, and composability on blockchain ecosystems.

The bank recently launched a proof-of-concept (POC) through Kinexys Labs, exploring privacy measures for enhanced security in digital transactions. The POC includes identity management solutions to support tokenized assets.