Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

Kyrgyzstan, a Central Asian country known for its crypto mining industry, has experienced a serious decline in mining tax revenue, with the government collecting 50% less in 2024 compared to the previous year, according to a local report.

In its latest budget report, Kyrgyzstan received 46.6 million soms (approx $512,600) in cryptocurrency mining tax compared to 93.7 million soms (approx $1 million) received back in 2023. In Kyrgyzstan the cryptocurrency mining tax rate is 10% of the electricity bill.

Rise in Electricity Costs Impacts Kyrgyzstan

This sharp decline in tax income is linked to a combination of factors, including rising electricity costs, which have made crypto mining less profitable.

As energy prices increase, many miners have scaled back operations or relocated to countries with more favorable conditions. The decline in mining activity has severely impacted the government’s ability to generate revenue from this sector.

In December, Kyrgyzstan urged its residents to use less electricity, as it struggled with record-high winter demand, as reported by AP news.

Once-Booming Crypto Mining Sector Sees Decline

These challenges are not only straining households and industries but are also causing a decline in tax revenues from the once-booming crypto mining sector.

Crypto mining, the process of validating cryptocurrency transactions and adding them to a blockchain, requires huge amounts of computational power and, by extension, electricity.

Kyrgyzstan’s historically low energy costs made it an attractive destination for mining operations, attracting both domestic and international players. These operations generated significant tax revenues for the government, as crypto miners were subject to specific taxation policies.

Why Are Electricity Costs Rising?

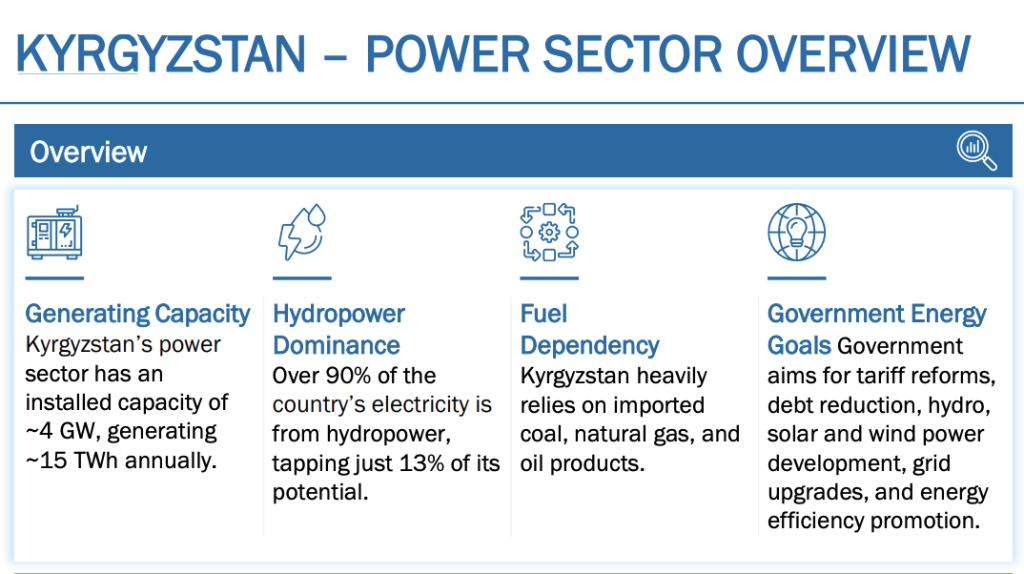

Kyrgyzstan’s energy sector faces several structural challenges. The country relies heavily on hydropower, which accounts for over 90% of its electricity generation, according to data from the World Bank.

However, aging hydropower infrastructure and fluctuating water levels have limited its capacity to meet growing demand. Kyrgyzstan also imports electricity during peak consumption periods, exposing the country to global energy price fluctuations.

In recent years, the government has introduced higher tariffs to address financial shortfalls in the energy sector and fund infrastructure upgrades. While these measures are necessary for long-term sustainability, they have made electricity less affordable for crypto miners.

Some countries such as Russia are addressing energy concerns by implementing seasonal restrictions in key mining areas to prevent power outages.