Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

Brazilian funds could get the green light to invest in crypto and buy Bitcoin (BTC) if parliament approves a lawmaker’s draft private member’s bill.

The bill, uploaded to the Brazilian parliament’s official website, is the brainchild of Adriana Ventura.

Could Bill Let Brazilian Funds Invest in Crypto?

Ventura is an MP for São Paulo and a member of the liberal/libertarian New Party (NOVO).

In her draft bill, Ventura wrote that her “proposal aims to meet [Brazilian] investment funds’ growing demand and interest in cryptocurrencies.”

“This measure could contribute to financial innovation. It could encourage the development of more complex products from the sector. It will develop investment strategies that incorporate cryptoassets. It will also encourage internal competition and boost creativity in the financial sector.”

Brazilian lawmaker Adriana Ventura

She added that the measure would “provide a regulated and safe environment.” And this, she said, would let funds “expand the diversification of their investment portfolios.”

The bill’s main focus is allowing investors to offset losses and upping the exemption limit for net gains in stock-related transactions.

But the draft law also includes a clause that would let “investment funds registered in Brazil acquire” crypto from firms registered to operate in the nation.

At present, major Brazilian institutional investors cannot make direct crypto investments. This, some believe, is out of sync with the fact that the Brazilian retail crypto market is expanding rapidly.

Many claim that the Brazilian crypto market is the largest in the entire Latin America region.

“Letting investment funds include cryptocurrencies in their portfolios would align Brazil with the global trend of adopting these digital assets. It would recognize their importance as a legitimate asset class. And it would reinforce the competitiveness of the domestic market.”

Ventura

What Are the Bill’s Chances of Passing?

It is currently unclear how much support Ventura’s bill will gain, or if it will pass the committee stage.

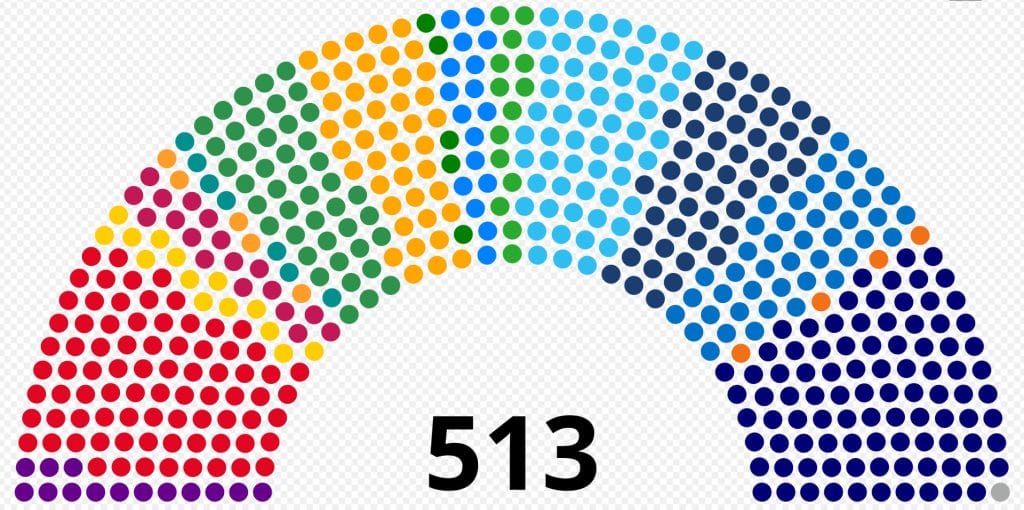

NOVO has just four lawmakers in the Chamber of Deputies and a single seat in the Senate.

However, it is better represented at the local level and in 2022 won the governorship of the state of Minas Gerais.

But crypto communities are growing fast in Brazil, with more lawmakers at both the national and local levels beginning to take progressive stances on regulation.

Regulators last month announced plans to reform the nation’s crypto tax laws. They have vowed to unveil their new measures by the end of “the first quarter of 2025.”