Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The market has seen choppy and flat price action, yet Long-Term Holders (LTH) remain unfazed, continuing to HODL and accumulate Bitcoin (BTC) instead of selling, according to the latest report by analytics firm Glassnode.

At the same time, Short-Term Holders (STH) were on the losing end of the market downturn, though certain metrics suggest an overreaction.

Meanwhile, the Bitcoin market dominance has continued to increase.

Prices Are Flat, But Long-Term Holders HODL

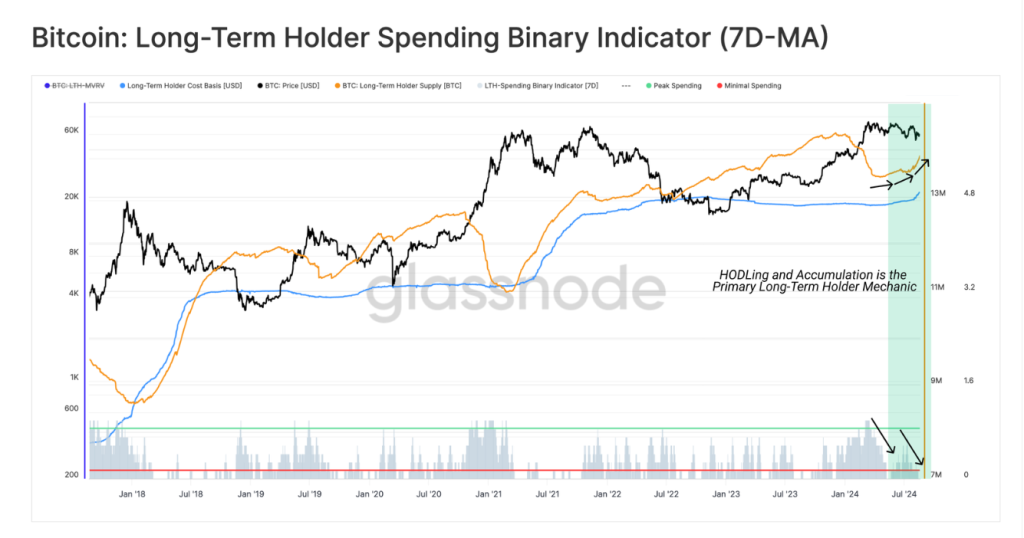

Glassnode researchers stated that there is a notable slowdown in LTH spending.

Instead, their supply is currently increasing – and fast.

It is evident that “HODLing behavior is significantly outpacing spending behavior,” the report argued.

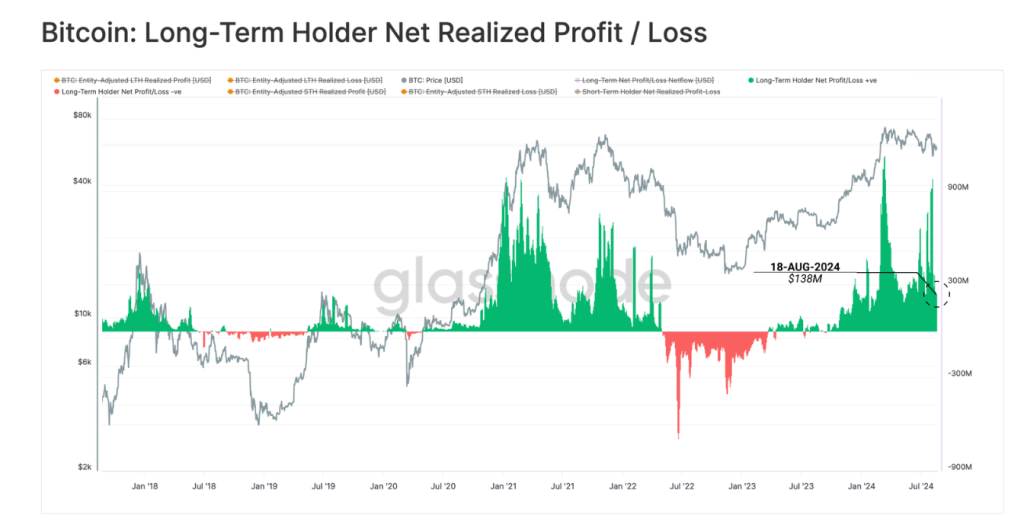

Moreover, Long-Term Holders have been locking in “a reasonably consistent” $138 million in profit a day.

Analysts noted that this LTH sell-side pressure is “a read for the daily capital inflows required to absorb supply and keep prices steady.”

Accordingly, despite the choppy market conditions, “prices are generally flat over the last few months, suggesting a form of equilibrium is being reached.”

Furthermore, the team looked into the metric known as the Realized Profit / Loss Ratio.

They found that, despite dropping from its peak, the metric remains high.

Based on this, the report concluded that long-term investors are “in the process of cooling off profit-taking activities.”

Meanwhile, the metric declined to similar levels in earlier cycles before the renewed price rise.

“From the perspective of Long-Term Holder SOPR, we can see that coins are locking in an average profit margin of +75%, and LTH-SOPR remains elevated at this time,” the report added.

You might also like

Short-Term Holders On The Losing End

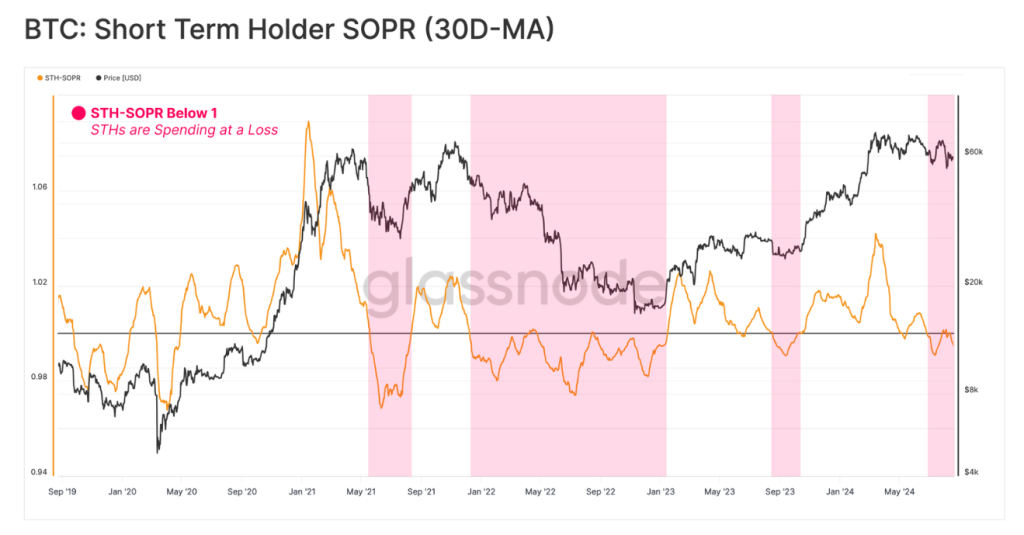

The researchers moved to measure the intensity of unrealized financial stress experienced by recent buyers and short-term holders.

The metric called STH-MVRV (Market Value to Realised Value) suggests that average new investors now hold an unrealized loss.

Also, the metric known as STH-SOPR (Spent Output Profit Ratio) shows some realized loss-taking activities by new investors.

“This adds weight to the case that the market is at a decision point, and the price is marginally below the comfort point of STHs,” the report concluded.

While periods of brief unrealized loss pressure are common during bull markets, sustained periods can result in investor panic. A “more severe bearish market trend” could follow.

Therefore, Glassnode argued, new investors can “overreact to their portfolio being held at a relatively high unrealized profit (or loss).”

These overreactions, however, are “a key feature of markets.” The investors’ emotional response results in an excessive profit or loss at inflection points, forming both local and macro tops or bottoms.

“It could be argued a modest overreaction may have occurred as the market sold off below $50k,” the report added.

Bitcoin Dominance Rises, Ethereum’s Falls

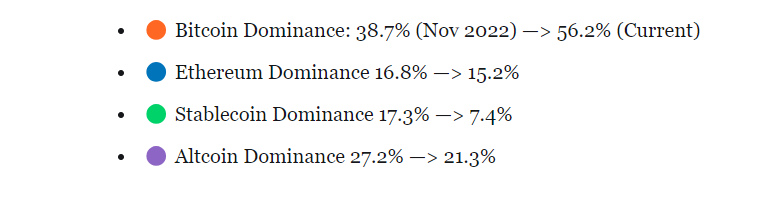

Meanwhile, since November 2022, Bitcoin Dominance has risen from 38% to 56% of the total digital asset market today, the report found.

At the same time, Ethereum’s dominance fell 1.5%. It remained “relatively flat” over the past two years, the researchers said.

Additionally, stablecoins and altcoins have seen “a more pronounced decline” of 9.9% and 5.9%, respectively.

Observing the Net Capital Change across the major assets, Glassnode continued, Bitcoin, Ethereum, and stablecoins show a net positive capital inflow.