Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Key Takeaways:

- Malaysia’s central bank plans to explore asset tokenization and digital assets.

- Collaboration and regulatory discussions will shape its approach.

- Authorities remain cautious about crypto risks and foreign exchanges.

Malaysia’s central bank, the Bank Negara Malaysia (BNM), outlined in its latest annual report plans to explore asset tokenization and digital asset technologies in 2025.

The initiative will run alongside research into domestic and cross-border central bank digital currencies (CBDCs) and other emerging financial technologies.

Malaysia’s Central Bank Strategy for Asset Tokenization And Regulatory Sandbox for Digital Assets

According to the March 24 report, BNM is examining the potential of asset tokenization to drive innovation in Malaysia’s financial ecosystem as part of its forward-looking financial sector blueprint (2022-2026).

Malaysia’s central bank believes tokenized deposits could be a reliable on-chain settlement asset to complement wholesale CBDCs. The bank is also exploring broader applications such as programmable payments, supply chain finance, and treasury management.

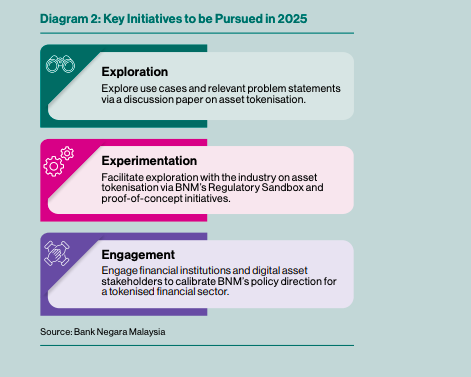

BNM stated that it plans to issue a discussion paper in 2025 outlining high-level principles and use cases to guide the industry’s approach to asset tokenization.

To facilitate innovation, BNM’s Regulatory Sandbox will support live testing of solutions leveraging distributed ledger technology (DLT).

This initiative aims to evaluate the feasibility and risks of tokenization within a controlled environment, ensuring that financial stability remains intact.

BNM also highlighted the importance of collaboration with the private sector to capitalize on tokenization benefits while mitigating associated risks.

Malaysia’s Crypto Market and Regulatory Stance

Despite increasing interest in digital assets, Malaysia is cautious about cryptocurrencies.

Malaysia’s central bank emphasized that crypto assets are not recognized as legal tender and are not a regulated means of payment due to their price volatility and risk factors.

According to the bank’s report, Malaysia’s crypto asset market remains small, representing less than 1% of total banking system deposits as of 2024.

However, crypto trading volume surged from MYR 5.4 billion ($1.22 billion) in 2023 to MYR 13.9 billion ($3.14 billion) in 2024.

To safeguard investors from the risks linked to crypto, the Securities Commission Malaysia (SCM) has been cracking down on foreign exchanges providing crypto assets to Malaysian citizens.

In December 2024, Bybit was ordered to disable its website and mobile apps for operating without proper registration.

A similar action was taken against Huobi Global Limited in 2023, forcing the exchange to cease operations in Malaysia.

Investor Caution Amid Rising Crypto Scams

Despite regulatory efforts, Malaysia has seen a sharp rise in crypto-related investment scams.

A recent report revealed that professionals and senior investors above 60 years old have been primary targets of fraudulent schemes promising high returns from volatile assets.

Authorities have urged investors to conduct transactions only through officially registered exchanges to mitigate risks.