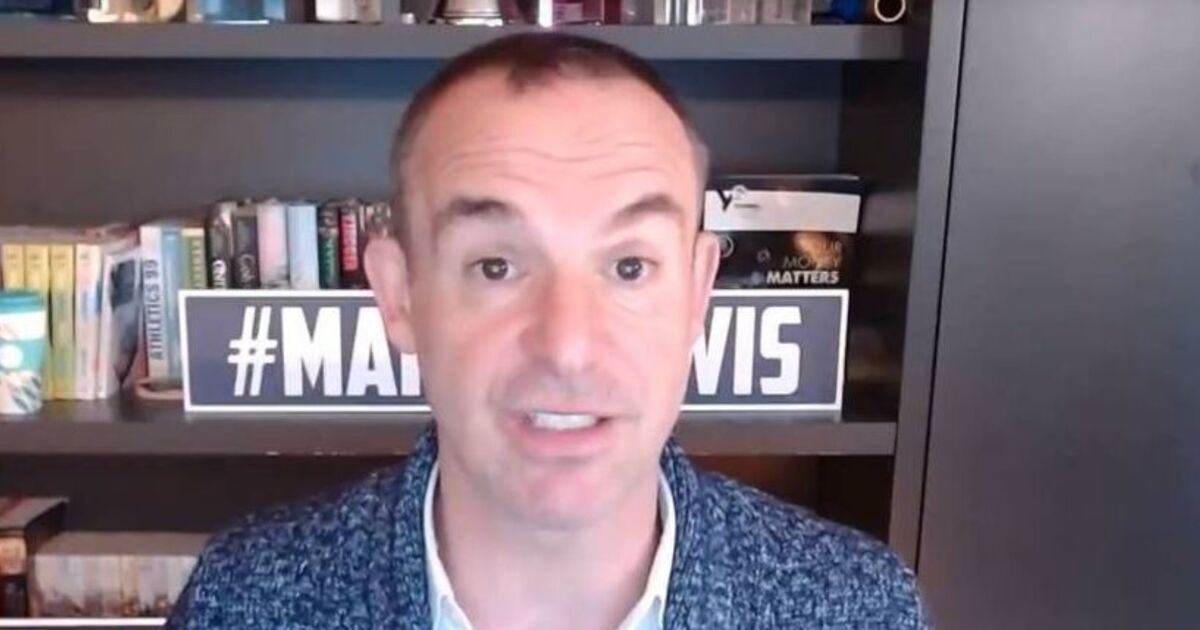

Martin Lewis, the personal finance guru, has delivered some blunt guidance for those utilising Premium Bonds as an alternative to a traditional savings account to avoid an HMRC tax raid. In his latest financial insights video released on X, Lewis tackled the subject of saving money and how individuals can sidestep paying tax on their hard-earned cash.

Mr Lewis pointed out that an ISA should be the first port of call for savers. He highlighted that for earners between £12,500 and £50,000, the personal savings allowance is capped at £1,000—meaning tax becomes payable on savings over £20,000.

Those with incomes ranging from £50,000 to £125,000 will encounter taxation once savings hit £10,000 due to a lower allowance of £500.

Lewis then offered what might come as an unexpected piece of advice regarding Premium Bonds as a strategy to guard savings against tax: “The other thing that you can look at that’s very easy to do is premium bonds. The prizes that you earn from premium bonds, premium bonds are where you put your money away, the money you put in is safe, but you then get paid interest depending on a prize draw.

“And the prizes that you get from premium bonds are also tax free. Now I would always go for a cash ISA first.”

“The rate on premium bonds for most people, you will earn less in premium bonds than you would in a top cash ISA. But if you are going to be paying tax on your savings and you’ve got a decent whack you could put in premium bonds, then they could become a pretty interesting option for you. Not my first option, but an interesting option.”

Discussing the superior alternative of ISAs over Premium Bonds, Mr Lewis elaborated: “A cash ISA is simply a savings account you don’t pay tax on. You can put £20,000 in per tax year.

“Now the important thing about a cash ISA is you can put your money in, it’s then protected from tax, so money in there, you don’t pay tax on it and it doesn’t count towards the interest in the personal savings allowance, this is on top of that.”

“As long as it stays inside the cash ISA, you could put £20,000 in this year. Well, let’s say you can then put £20,000 in the next tax year, so that’s £40,000. And then in the next tax year, so that’s £60,000, so if you are lucky enough to be able to max it out each year, you could protect more and more and more of your savings inside the cash ISA without having to pay tax on it.

“So for those who’ve got a good whack of savings, it’s very worthwhile to look at a cash ISA because, well, as a 20% rate taxpayer, you’ll be 20% of your interest would be taken away in tax if you’re above the personal savings allowance.”