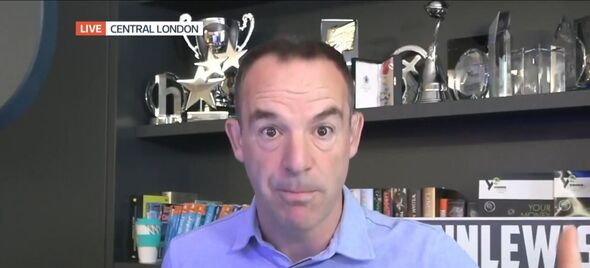

Money expert Martin Lewis has issued a warning to everyone with a mortgage as rates are about to fall again.

The eyewatering rates we saw on the market in the weeks and months following the disastrous Liz Truss mini-budget are almost a thing of the past and while the likes of 1-1.9 percent rates are probably never coming back, some increasingly attractive mortgage deals are starting to drop onto the market.

And in fact rates are expected to reduce even further by the end of the year, with rates as low as 3.5 percent on a five year fix within reach.

But, Martin Lewis has warned that waiting too long to grab a better deal may actually end up costing you money.

Martin said on his The Martin Lewis Podcast on BBC Sounds and Spotify: “The market is saying, we think interest rates are dropping and dropping longer in the long term, so we’ve seen fixed rate mortgages come down.

“The consensus is they think we’ll have a rate cut in November that’s not a prediction, that’s what the market thinks at the moment, things can change, and some of that has already been priced into the market now.

“So as mortgage rates come down it’s starting to look like those people who are on standard rates or who are coming off their fixes are going to be able to get decent deals.

“The big question people would ask is, should I fix now or should I wait cos it might get even cheaper.”

Martin added: “I’ve spoken to a lot of mortgage brokers about this and most people are saying while mortgage rates may shave down towards the end of the year, noone is really expecting them to be a substantial step change in rates from where they are now are they – we might go from 3.7 to 3.5 percent fix over five years.”

But waiting to grab a better deal may not be worth it if you have to stay on the notoriously expensive variable rates for too long.

Martin added: “If you wait there may be a small marginal gain, but if you’re waiting and the fix has come to an end, then the small gain in waiting is massively outweighed by the cost of the variable rate so you mayaswell go and get your cheap deal now anyway, because you do not want to be on the expensive standard variable.”