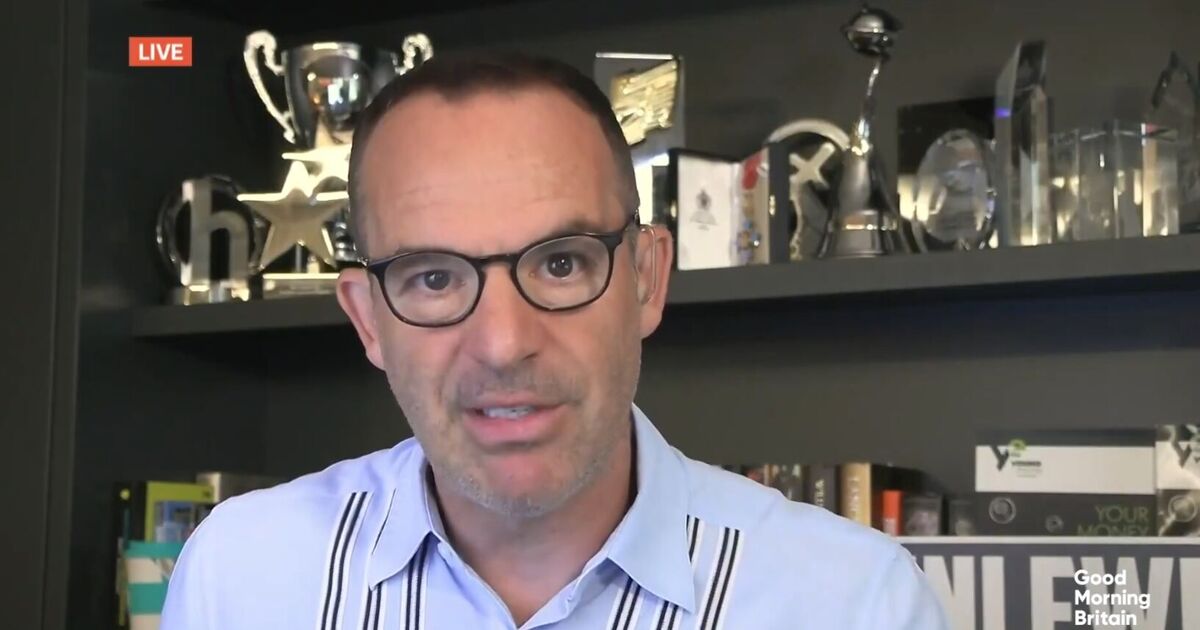

Money expert Martin Lewis is urging state pensioners to get an £11,300 handout by making one phone call.

It’s going to be a tough winter for many state pensioners this year after the Winter Fuel Allowance was changed to be means tested, so many who used to get the £300 handout will no longer receive it.

Coupled with the axeing of the £300 Cost of Living payment for pensioners, it will leave many with hundreds of pounds less to make it through the winter with.

That’s why Martin Lewis is now urging pensioners to check if they are eligible for Pension Credit to at least get £300 back this winter by making one single phone call.

Martin Lewis says: “It’s become more crucial than ever [to claim Pension Credit] because that Winter Fuel Payment that up to £300 payment that did to go every pensioner is now dependent on Pension Credit.

“So, Pension Credit, now I’ve been shouting about this here and everywhere and on my site for many years and it is chronically underclaimed.

“So the most important thing I can say to everybody watching who may be eligible is those over 66 but also right across society, is many of our most vulnerable people are not claiming this crucial payment and we collectively have a responsibility to try and let them know about it.”

Martin said that single pensioners on less than £235 a week and couples on less than £350 should check as they could possibly get the payment.

Someone with no state pension who was able to claim Pension Credit to the tune of the full amount would then be handed £218 a week, or £11,300 a year.

He added: “If you’re a single pensioner and you have total weekly income under £218 a week, you will likely get it, if it’s under £235 a week you will maybe get it but it’s still worth checking.

“If you’re a couple – both of you are state pensioners living together – then my rule is you should check if it’s under £350 total weekly income.

“Under £333 you’re likely to get it, under £350 there’s a chance.

“If you’re a state pensioner and your partner isn’t a state pensioner you can’t get it this way but you may still be eligible if your partner is claiming Universal Credit.

“The most complicated thing is, total weekly income is any money from work, private pension, state pension and any benefits are included, plus if you have over £10,000 savings or investments, then for every £500 you are over that they count that as £1 a week income.

“Which actually works out at a 10 percent return, chance’d be a fine thing.”

Martin then urged pensioners to follow his ‘really simple’ advice.

He stressed: “Let’s make this really simple: if you’re a low income pensioner and you don’t get pension credit, just go online and do the calculator. Or if online scares you, just call up the pension credit hotline and just talk to someone.

“You will not be told off for asking if you’re due pension credit. If you’re not due pension credit, they’ll just tell you you’re not due it.”