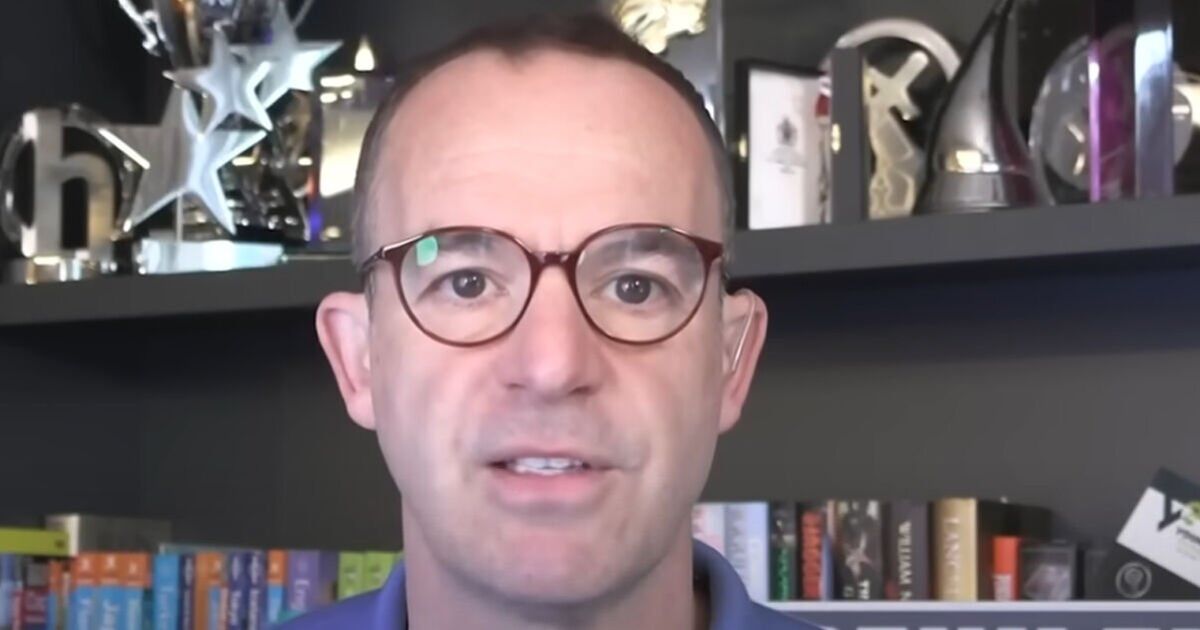

Martin Lewis has urged drivers to plan ahead and put a key date in their diary as they could get up to 50% off their car insurance quote.

The money expert spoke on his podcast about an analysis of some 18 million insurance quotes, that found the “sweet spot” to search for a new insurance deal is 26 days before when you want your new contract to start. He urged people to put the date in their diary and to get their quotes then.

Speaking on his BBC podcast, the founder of Money Saving Expert said: “You always want to be getting quotes around 26 days before you want the new policy to start. If it’s anything between about 18 days and 28 days, you’re pretty fine. 26 is the sweet spot.”

For example, following the 26-day rule if you have a policy that expires at the end of March, and you wanted a new policy from April 1, you would want to be look at quotes on March 6.

Mr Lewis pointed out that this is different from the renewal price that your provider may send you. He explained: “Your insurance is going to send you a renewal note, it might be two weeks before, it might be a month before.

“That’s your renewal, that price is irrelevant of when they send it you. It’s about the price when you go and get quotes across the market. When you go on to a comparison site, that’s the 26-day date.”

The reason for this date is because insurance prices are based on averages for how people behave and the likelihood that they will make a claim, meaning those groups who are more likely to put in a claim have to pay more.

Mr Lewis said: “What insurance data shows, is that people who renew on the last day are riskier. You’re riskier if you are insuring at the last minute.

“You can sort of understand how that behavioural trend works. People who insure at the last minute haven’t put that much practice in, and aren’t as prepared, and aren’t as organised as everyone else.

“That translates into actuarial risk and the amount of claims. What you have to do is shift yourself into the risk category where people are the lowest risk, and the lowest risk is around three to four weeks before renewal.”

Mr Lewis added that this can make a 50% difference in the amount you pay for your insurance, saying that many people had got in touch to say they had secured huge savings thanks to shopping around earlier.

One person wrote in to say they had seen a best quote price at 21 days before their expiry date, at £340. Yet for the same quote the day before expiry, it would have cost them £637.

Another driver contacted the show to say they only get their quote from their provider 14 days before the expiry date. Mr Lewis had a firm reply saying “I don’t need your excuses” and that this doesn’t justify their inaction.

Mr Lewis urged the individual: “Go and check when your car insurance renewal policy ends. Go and put in your diary 26 days before, or maybe four weeks before that so that so you give yourself a couple of days if you’re busy, that it’s time to go and get those quotes.”

He suggested another way to set yourself a reminder of the all-important date. Mr Lewis said: “Send yourself a delayed send email. That is my new organisational system, I do it all the time. I send myself emails and reminders.”