Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

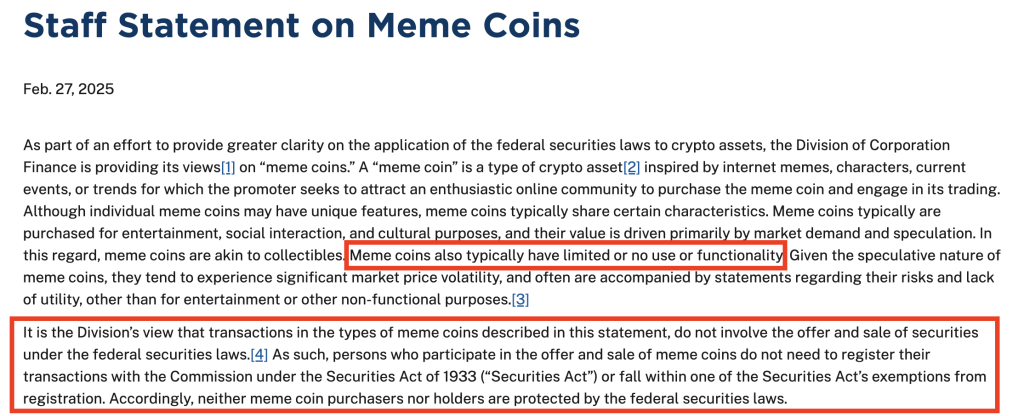

The US Securities and Exchange Commission (SEC) published a staff statement on Thursday confirming that meme coins don’t fall under securities.

The guidance comes as an effort to provide greater clarity on federal securities laws’ application on the burgeoning meme coin sector.

“[Meme coins] do not involve the offer and sale of securities under the federal securities laws,” the agency confirmed. “As such, persons who participate in the offer and sale of meme coins do not need to register their transactions with the Commission.”

Further, the commission stressed that buyers and holders of these coins aren’t protected by federal securities laws.

Meme Coins are crypto assets based on viral internet memes or inside jokes. The SEC’s Division of Corporation Finance says that these “typically have limited or no use or functionality.”

As a result, these asset classes do not meet the definition of an “investment contract” under the security-defined Howey Test.

Regulator Classifies Meme Coins Under Collectibles

Meme tokens, including the original Dogecoin, typically started as just-for-fun projects, purchased for entertainment. Their value is driven primarily by market demand and speculation.

“In this regard, meme coins are akin to collectibles,” the staff statement read. “Given the speculative nature of meme coins, they tend to experience significant market price volatility, and often are accompanied by statements regarding their risks and lack of utility, other than for entertainment or other non-functional purposes.”

The agency explained that these crypto value depends on speculative trading and the collective market sentiment, “like a collectible.”

A collectible refers to an asset worth far more than it was initially sold for due to its popularity.

Early this month, crypto czar David Sacks defined non-fungible tokens (NFTs) and meme coins as “collectibles.” In an interview with Fox Business, he called them “like a baseball card or a stamp.”

“People buy it because they want to commemorate something,” he added. “There’s a few different categories here, so defining the market structure is important.”

Hester Peirce, who is spearheading the SEC’s newly-created Crypto Task Force, earlier noted that meme tokens do not fall under the agency’s purview.

In an interview with Bloomberg, Peirce addressed concerns over regulatory jurisdiction.

“We always have to look at the facts and circumstances, but many of the memecoins that are out there probably do not have a home in the SEC under our current set of regulations,” Peirce said.

She added that meme coin’s scope is something that the CFTC would want to address. “But many of those, I think, are probably not within our jurisdiction.”