Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

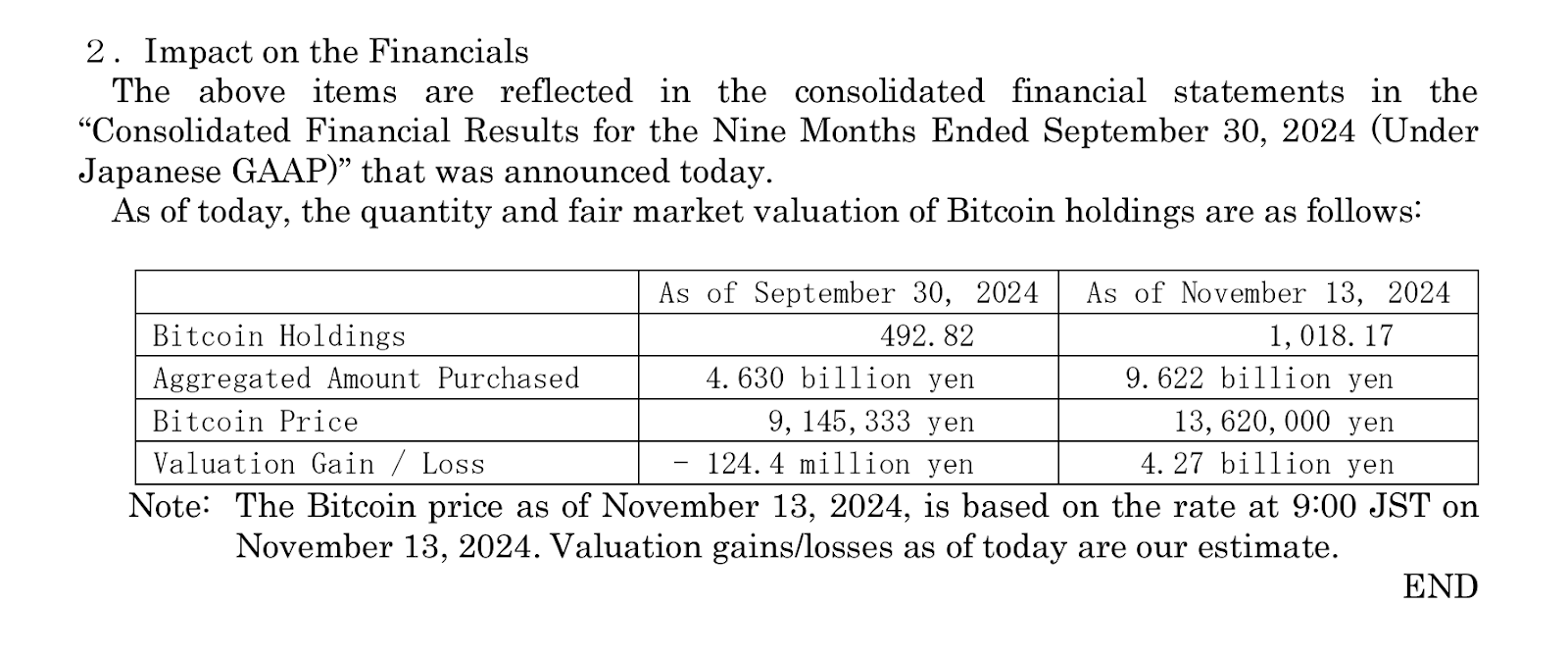

Japanese investment firm Metaplanet has reported a $28M valuation gain in its Bitcoin holdings after its continued investment in the leading cryptocurrency, bringing its total to over 1,000 BTC.

The surge follows a focused acquisition strategy, initiated mid-year, that mirrors the approach of MicroStrategy, a U.S.-based firm known for accumulating large Bitcoin reserves.

This valuation surge places Metaplanet as one of Asia’s prominent Bitcoin corporate holders, surpassing the $64 million investment mark, even as ongoing expenses impact the company’s financials. Despite this gain, Metaplanet’s stock saw a slight decline in trading.

Metaplanet’s strategic decision to adopt Bitcoin as a treasury asset began in May.

The firm aimed to hedge against the declining value of the Japanese yen and mitigate economic pressures from prolonged low interest rates and high government debt.

Metaplanet doubled its BTC holdings in just a few months, hitting 1,018.17 BTC by late October, with cumulative investment nearing $64 million.

Metaplanet acquired Bitcoin incrementally, securing additional capital through stock issuances and bond offerings, including a recent 10 billion yen loan to finance BTC purchases.

By September’s close, Metaplanet’s total BTC holding stood at 492.82, which expanded by 156 BTC in October to reach its present level.

In October alone, Metaplanet spent around $10 million on Bitcoin, capitalising on a period of crypto market optimism driven by Bitcoin’s rally to $87,000.

While Metaplanet continues to grow its BTC reserves, it simultaneously generates premium income through options trading on its Bitcoin holdings, allowing the firm to boost returns beyond capital appreciation.

While Metaplanet’s BTC holdings appreciated by $28 million, bringing significant value to its balance sheet, the company has also faced operational challenges that impacted its bottom line.

The firm reported a net operating loss of $2.1 million for the first three quarters of 2024.

Despite a 46.3% revenue increase year-over-year to $1.7 million, gains were offset by rising operational costs in areas such as the hotel business, leading to a total operating loss of 183 million yen ($1.23 million).

Additionally, the company recorded Bitcoin valuation losses in prior periods, although current gains largely offset these earlier impairments.

New Performance Indicator Amid Share Price Decline

To keep investors informed of its Bitcoin acquisition strategy, Metaplanet has adopted a Key Performance Indicator (KPI) known as “BTC Yield,” inspired by MicroStrategy’s reporting practices.

BTC Yield represents the change in Bitcoin holdings per fully diluted share.

With BTC Yield reaching 155.8% in recent quarters, the company views this metric as a way for investors to gauge the alignment of its treasury policy with shareholder value.

Despite the rise in Bitcoin holdings, Metaplanet’s share price saw a 5% dip, closing at 1,766 JPY ($11.41) in Asian trading hours.

This reflected investor caution amid mixed earnings reports and significant cryptocurrency market volatility.

Following its consistent acquisitions, Metaplanet has become one of Asia’s top Bitcoin corporate holders and is now the 19th-largest in the world.

CEO Simon Gerovich emphasized that the company remains committed to its “Bitcoin-first, Bitcoin-only” approach.

He reiterated Metaplanet’s intention to continue purchasing Bitcoin as opportunities arise.

As the company pursues further BTC accumulation, Gerovich remarked,

“We intend to continue increasing our Bitcoin holdings through capital market activities and operational income as deemed appropriate.”

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.