Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

MicroStrategy, a business intelligence company and one of the largest corporate holders of Bitcoin (BTC), is continuing to stack BTC despite the cryptocurrency surging to new all-time high prices above $106,000.

MicroStrategy acquired 15,350 Bitcoin, valued at approximately $1.6 billion, bringing the company’s total Bitcoin holdings to 439,000 Bitcoin (currently over $46 billion), MicroStrategy co-founder, chairman and former CEO Michael Saylor said in a statement on X from Dec. 16.

This latest investment was made at an average price of $100,386 per Bitcoin, including fees and expenses, significantly higher than the company’s average purchase price of $61,725 across its holdings.

MicroStrategy has acquired 15,350 BTC for ~$1.5 billion at ~$100,386 per #bitcoin and has achieved BTC Yield of 46.4% QTD and 72.4% YTD. As of 12/15/2024, we hodl 439,000 $BTC acquired for ~$27.1 billion at ~$61,725 per bitcoin. $MSTR https://t.co/SaWLNBVkrl

— Michael Saylor⚡️ (@saylor) December 16, 2024

The purchases took place between Dec. 9 and Dec. 15, according to the company’s SEC 8-K filing. To fund it, MicroStrategy sold an additional 3.88 million shares during the same period, raising $1.5 billion.

MicroStrategy is now the holder of approximately 2.1% of bitcoin’s total supply of 21 million coins.

Buying the Top, Not the Deep

The latest acquisition underscores MicroStrategy’s ongoing strategy of using Bitcoin as a primary treasury reserve asset. Despite recent market volatility, the company remains bullish on the long-term prospects of the cryptocurrency.

From Dec. 2 and 8, MicroStrategy also acquired 21,550 Bitcoin for $2.1 billion at an average price of $98,783 per coin.

🚀 @MicroStrategy has made another significant move in its Bitcoin accumulation strategy, purchasing 21,550 BTC for approximately $2.1 billion#Bitcoin #MicroStrategyhttps://t.co/5wcBUv8OsE

— Cryptonews.com (@cryptonews) December 9, 2024

Moreover, on Dec. 2, the company purchased 15,400 BTC for approximately $1.5 billion, paying an average price of $95,976 per Bitcoin.

MicroStrategy’s Bitcoin holdings have proven to be a profitable investment thus far. According to the company’s SEC 8-K filing, the company has realized a 46.4% return on its Bitcoin investment quarter-to-date and a 72.4% return year-to-date.

MicroStrategy Stock Surges as Bitcoin Proxy Joins Nasdaq-100 Index

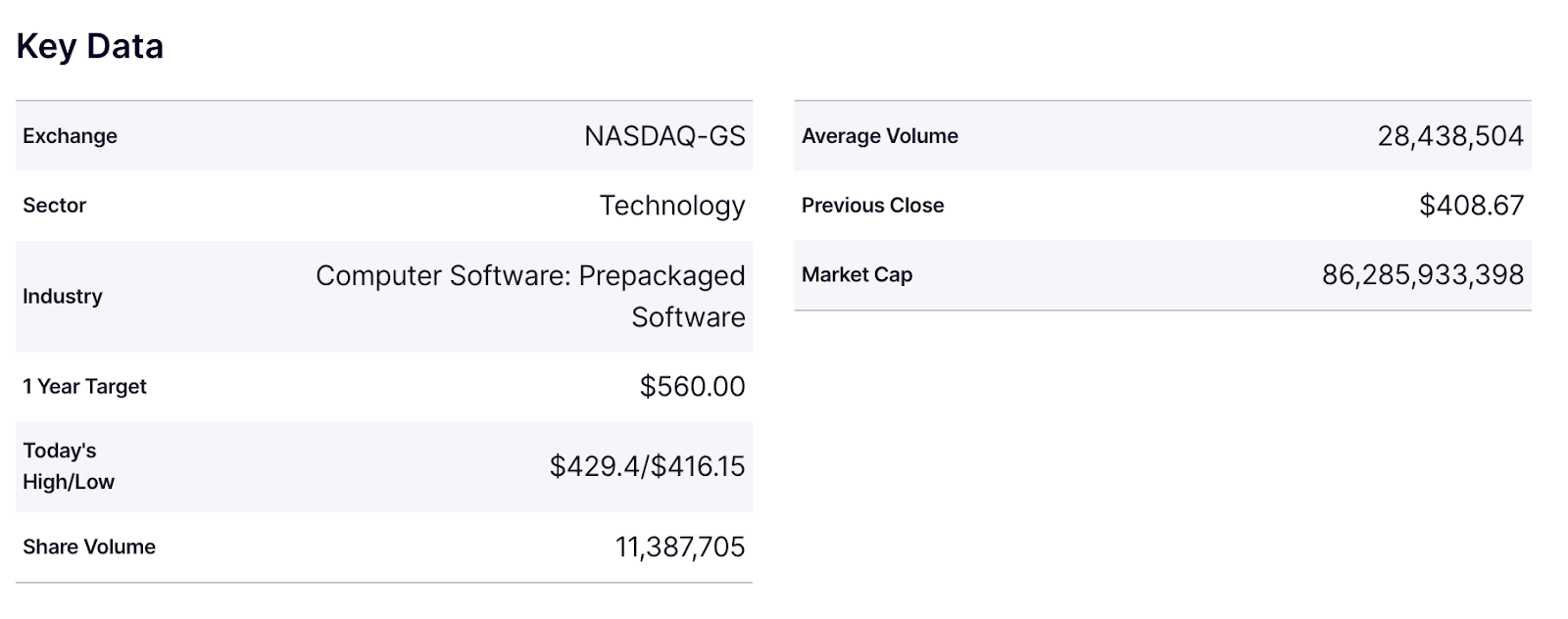

Shares of MicroStrategy (MSTR) soared on Monday, Dec. 16, following Nasdaq’s announcement that the business intelligence firm will join the tech-heavy Nasdaq-100 index.

MicroStrategy would be the 40th-largest company in the Nasdaq 100.

This inclusion, effective Dec. 23, comes as MicroStrategy’s stock has surged more than 519% year-to-date and more than 16% in the last 24 hours, fueled by the company’s active Bitcoin acquisition strategy and the cryptocurrency’s rise to all-time highs.

The inclusion in the index will also add MicroStrategy to one of the world’s largest ETFs, Invesco’s QQQ Trust (QQQ) with more than $300 billion in asset under management (AUM).