Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

MicroStrategy Incorporated (Nasdaq: MSTR), a business intelligence software company, has continued its active Bitcoin (BTC) acquisition strategy, further bolstering its position as a major corporate holder of the cryptocurrency.

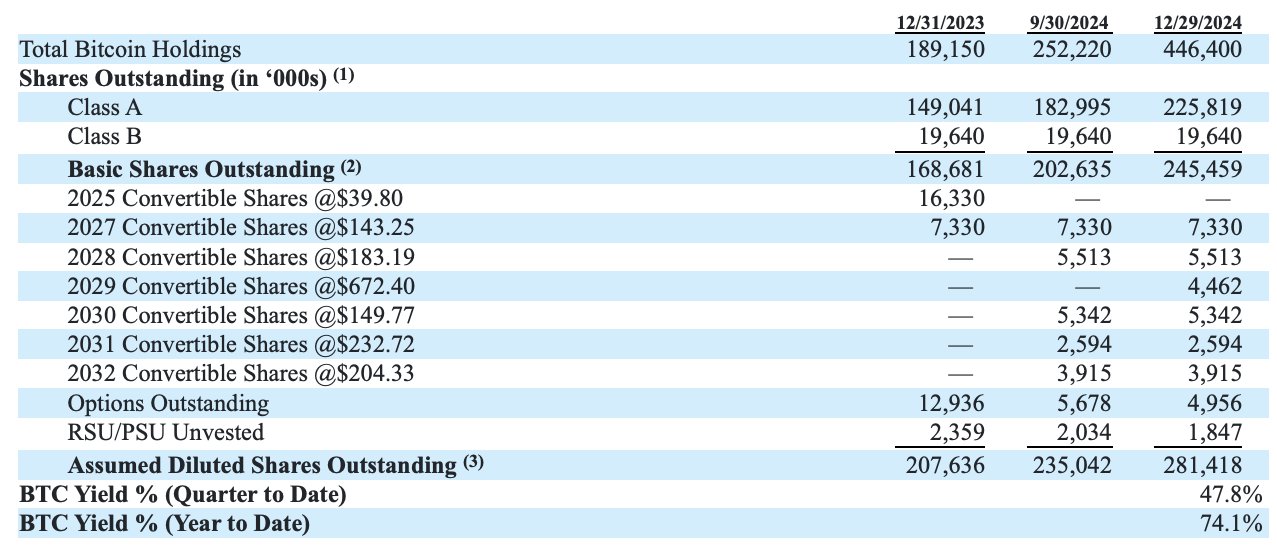

The company purchased 2,138 Bitcoin for approximately $209 million between Dec. 23 and 29. The tokens were purchased at an average price of approximately $97,837 per Bitcoin, inclusive of fees and expenses.

As of Dec. 29, MicroStrategy holds a total of 446,400 Bitcoin, acquired at an average price of $62,428 per token.

MicroStrategy has acquired 2,138 BTC for ~$209 million at ~$97,837 per bitcoin and has achieved BTC Yield of 47.8% QTD and 74.1% YTD. As of 12/29/2024, we hodl 446,400 $BTC acquired for ~$27.9 billion at ~$62,428 per bitcoin. $MSTR https://t.co/58aXM7g6u2

— Michael Saylor⚡️ (@saylor) December 30, 2024

MicroStrategy financed this latest Bitcoin purchase through its existing at-the-market (ATM) equity offering program. This program allows the company to sell shares of its stock gradually without the need for a full-fledged public offering.

As of Dec. 30, MicroStrategy still has approximately $6.8 billion worth of shares available for sale from its planned $21 billion equity offering and an additional $21 billion in fixed-income securities.

MicroStrategy Reports Strong YTD Bitcoin Yield, Plans Share Increase

MicroStrategy has consistently demonstrated its commitment to Bitcoin, actively acquiring cryptocurrency through various means, including stock sales.

This latest acquisition follows a period of strong Bitcoin performance, with MicroStrategy reporting a robust Bitcoin yield of 47.8% for the current quarter and 74.1% year-to-date, according to the form-8 K submitted to the US Securities and Exchange Commission (SEC).

Earlier this month, MicroStrategy CEO Michael Saylor hinted that the company might rethink its investment strategy once the company hit its $42 billion Bitcoin buying goal.

Shortly after, Saylor announced a shareholder meeting to vote on proposals for a significant increase in authorized shares, both common and preferred, providing MicroStrategy with greater flexibility to finance ongoing Bitcoin purchases.

MicroStrategy’s 21/21 Plan Drives Record Bitcoin Purchases

Since launching its “21/21 Plan” on Oct. 30, MicroStrategy has acquired over 194,000 Bitcoin, worth approximately $18 billion, representing about 42% of its planned investment. This latest purchase marks the eighth consecutive week of Bitcoin acquisitions for the company.

On Dec. 23, MicroStrategy also made its debut on the Nasdaq 100 index. This inclusion is a significant milestone for the company, as it is now included in the popular Invesco QQQ exchange-traded fund (ETF). According to Bernstein analyst Gautam Chhugani, this inclusion is expected to trigger roughly $2.1 billion in net buying of MicroStrategy shares as investment funds adjust their portfolios to reflect the change.

2024 has been a strong year for MicroStrategy stock, delivering a remarkable 382% return. This outpaced Bitcoin’s impressive 165% gain and significantly surpassed the S&P 500’s 26% return.