Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

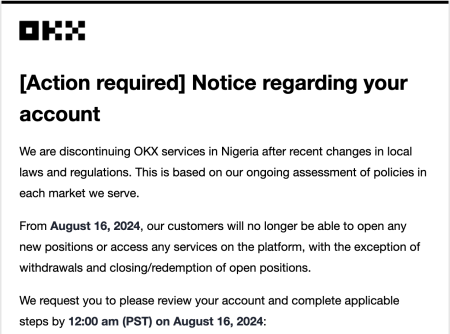

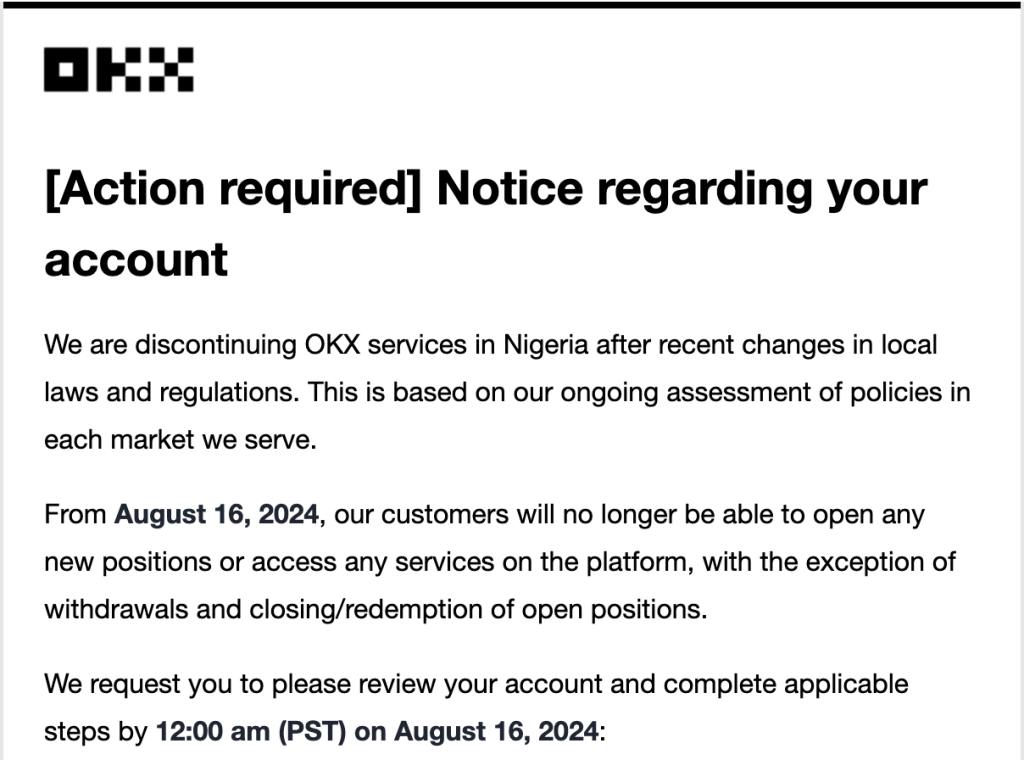

OKX, a prominent cryptocurrency exchange, has announced its decision to discontinue services in Nigeria, citing recent changes in local laws and regulations.

This move follows similar exits by other major exchanges, such as Binance and KuCoin, marking another major shift in the Nigerian crypto landscape.

The decision, which takes effect on August 16, 2024, is part of OKX’s ongoing assessment of its global operations in response to tightened regulatory environments against crypto companies.

The development has sparked concern within the Nigerian crypto community, particularly among the youth, who have heavily relied on digital currencies as a source of financial empowerment.

Nigeria Crypto Ecosystem Crumbling as OKX Exit

The Nigerian government’s tightening grip on cryptocurrency operations has led to the departure of several major exchanges from the country.

OKX is the latest to join the line, following in the footsteps of Binance and KuCoin, which also cited regulatory pressures as the reason for their exit.

In an email sent to its Nigerian users, OKX outlined the steps they must take before August 16, including closing open positions and withdrawing funds.

The exchange emphasized that users would only be able to withdraw assets after this date, and all other services would be discontinued.

This decision reflects the broader regulatory challenges cryptocurrency platforms face in Nigeria, where digital currencies have played a crucial role in providing financial inclusion and economic opportunities.

The government’s stance, however, seems to be in the opposite direction. It has imposed restrictions, making it increasingly difficult for these platforms to operate.

The departure of OKX is a significant blow to the Nigerian crypto market, which has grown significantly in recent years.

The exchange’s exit is particularly concerning for the younger generation, many of whom have found financial stability and success through cryptocurrency trading and investments.

The community’s sentiment is one of disappointment and frustration, with many fearing that the loss of these platforms could stifle the country’s burgeoning crypto ecosystem.

OKX Exit: A Major Loss for Nigerian Users?

The withdrawal of OKX from Nigeria is more than just the loss of a major exchange; it represents a broader trend of increasing regulatory scrutiny that could reshape the country’s financial landscape, with some suggesting a worsening situation.

As OKX prepares to exit, it has assured users that their funds remain secure and accessible but urged them to withdraw or transfer their assets before August 30, 2024.

After this date, users may face further restrictions in accessing their funds, depending on local laws and OKX’s terms of service.

For the Nigerian youth, who have found cryptocurrency a viable alternative to traditional employment and a means of wealth creation, the exit of OKX and other exchanges poses a significant setback.

“The only reason why Nigeria youths are quiet and peaceful is because of how crypto, fx, and bet has made many wealthy.”

The concern is not only about the loss of access to trading platforms but also the broader economic implications.

With fewer opportunities to engage in cryptocurrency, there is fear that this could lead to increased unemployment and economic hardship, particularly among the tech-savvy youth who have leveraged digital currencies to improve their livelihoods.

OKX’s exit could also affect the global perception of Nigeria as a hub for cryptocurrency activities, as it risks losing its status as a leading market for digital currencies in Africa.