Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

According to local news outlet Kompas, over 60% of Indonesia’s crypto investors are aged between 18 and 30, highlighting a strong youth presence in the country’s crypto landscape, based on recent data from the Indonesian Commodity Futures Trading Regulatory Agency (Bappebti).

Young Indonesians Fuel Crypto Market Growth

According to the Monday report, 26.9% of Indonesian crypto investors fall between 18-24 years, while 35.1% are aged 25-30.

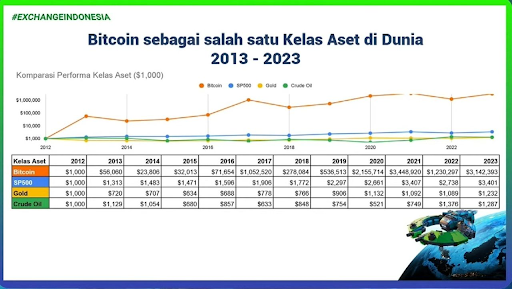

This trend reflects cryptocurrency’s rising popularity as an investment among young Indonesians, who are showing a stronger focus on digital assets.

Bappebti’s head, Ir. Kasan, stressed the importance of financial literacy for young investors. “Financial literacy, including an understanding of crypto, is very important,” Kasan stated.

He added, “This ensures the younger generation can make informed investment choices and avoid unnecessary financial risks.”

The Indonesia Millennial and Gen Z Report (IMGR) 2024 highlights that 38% of Millennials and 41% of Gen Z regularly budget their finances, prioritizing saving and investment.

Additionally, 32% of Millennials and 26% of Gen Z set aside part of their income specifically for investments, underscoring the growing financial awareness and planning among young Indonesians through cryptocurrency and other assets.

Regulatory Developments for Indonesian Crypto Exchanges

With a rising number of young investors entering the market, Indonesian regulatory bodies are enhancing oversight to ensure a secure investment environment.

Recently, Bappebti extended the compliance deadline for Indonesian crypto exchanges to meet the standards needed for a Physical Crypto Asset Traders (PFAK) license.

This extension, effective until late November 2024, is part of Bappebti’s ongoing commitment to investor protection and market integrity under Regulation No. 9 of 2024.

This regulatory update marks the third amendment to Bappebti’s framework for the physical trading of crypto assets since 2021, reflecting Indonesia’s adaptive approach as the market evolves.

Indonesia Strengthens Collaborative Efforts to Tackle Crypto Fraud Amid Transaction Surge

In recent efforts to combat crypto fraud, Bappebti has partnered with Binance’s Financial Intelligence Unit (FIU) and the Indonesian exchange Tokocrypto to collaborate with Indonesia’s Criminal Investigation Agency, Bareskrim.

This joint operation resulted in multiple arrests and the recovery of approximately $200,000 in fraudulent assets, highlighting Indonesia’s proactive approach to protecting crypto investors.

This enthusiasm is also evident in Indonesia’s transaction volumes. As of September 2024, Indonesia’s crypto transactions reached IDR 33.67 trillion ($2.13 billion), a slight decrease from August.

Year-to-date, however, cumulative transactions from January to September totaled IDR 426.69 trillion ($27.10 billion), marking a substantial 351.97% increase compared to the same period in 2023.