Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

Reports that the decentralized exchange Hyperliquid could be the next target of North Korean hackers have resulted in massive capital outflows and a significant drop in the value of its recently airdropped token $HYPE.

On December 22, the well-known crypto analyst Taylor Monahan provided evidence that wallet addresses tied to the North Korean government were executing transactions on the exchange.

Monahan, who also works as a developer for the crypto wallet MetaMask, said that this is part of the classic modus operandi of hackers from the DPRK that consists of interacting with a certain crypto protocol to identify potential flaws that they can exploit.

He blasted Hyperliquid for having multiple points of weaknesses that these sophisticated hackers can take advantage of including a small network composed of 4 validators that can easily be corrupted to create false records and drain money from the protocol.

“DPRK doesn’t trade. DPRK tests,” he argued. Among the evidence provided by Monahan, he claims that North Koreans have already lost around $700,000 in their trades. That kind of commitment shows that they are engaged in a relentless pursuit to identify Hyperliquid’s flaws.

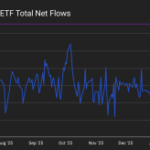

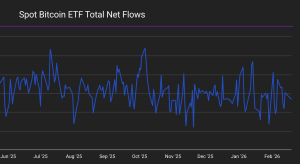

The market picked up on these rumors and reacted quite negatively as indicated by the behavior of the exchange’s total value locked (TVL). According to data from DeFi Llama, the value of the assets held with the exchange has dropped from a peak of $3.44 billion on December 17 to $2.28 billion as of today.

However, it is worth noting that this decline can be partially attributed to the overall weakness that the crypto market has experienced in the past week. That said, data from Dune Analytics confirmed that USDC outflows – a stablecoin whose value does not fluctuate – totaled $61 million in December 23.

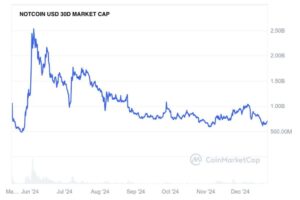

In addition, the value of the recently airdropped $HYPE token declined from $35 to $28.3 shortly after Monahan shared his findings. As a result, around $1.2 billion of the token’s market cap evaporated in just a few days.

The $25 level seems to be the most relevant area of support for the token at the moment. Any drop below this level may indicate that investor’s confidence in the exchange’s safety continues to erode.

Meanwhile, the $35 peak is the most important resistance to watch if Hyperliquid manages to assure the community that they have the situation under control.

Hyperliquid Claims That No Vulnerability Has Been Reported

Hyperliquid responded to these allegations in its Discord channel stating: “We are aware of reports circulating regarding activity by supposed DPRK addresses. There has been no DPRK exploit – or any exploit for that matter – of Hyperliquid. All user funds are accounted for. Hyperliquid Labs takes opsec seriously. No vulnerabilities have been shared by any party.”

North Korean hackers are a serious threat to the crypto industry. Various government-sponsored collectives are known for systematically targeting exchanges, bridges, multi-chain protocols, and decentralized finance (DeFi) applications to steal money that the state can use to fund the development of weapons of mass destruction.

A recent report from the BBC noted that North Koreans have reportedly siphoned approximately $1.3 billion via crypto hacks just this year. This means that they doubled their bounties compared to last year.

Some high-profile incidents include the loss of $300 million from the Japanese exchange DMM and another $235 million from the Indian crypto exchange WazirX.

Although Hyperliquid has confirmed that no protocol vulnerabilities have been reported, investors have been spooked by these rumors either way as evidenced by a 19% drop in the value of $HYPE.

This Solana Layer-Two Protocol is Safe and is Attracting Millions in Its Presale

A new era could be about to start for the Solana ecosystem with the arrival of Solaxy – a layer-two (L2) protocol that aims to guarantee the scalability of this popular network at a point when transaction volumes are climbing fast.

Solaxy’s native token $SOLX is currently in presale and the developing team has managed to raise over $5 million from investors already as the practical utility of this digital asset is hard to overlook.

The goal of Solaxy is to decongest the Solana mainnet by bundling transactions offline. This reduces the number of blocks that need to be processed by the Solana blockchain, which results in fewer errors and delays.

The $SOLX token is available at a discounted price of $0.001578 for early buyers but this offer expires in less than 48 hours.

After this period ends, late buyers will have to pay a higher price to get their hands on the token and will likely miss a portion of the returns.

Buying the token is easy.

Users simply need to connect their wallet or download the Best Wallet app if they don’t already have one. For those without crypto, a bank card can also be used to get started.

The $SOLX token has a maximum supply of 138.05 billion while the Solaxy project has been audited by Coinsult.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.