Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Cryptonews Podcast host Matt Zahab sat down for a wide-ranging, exclusive interview with Pascal Gauthier, the Chairman and CEO of the French startup Ledger, the tech company that makes the eponymous hardware crypto wallets.

Gauthier discussed the signs of crypto evolution in the context of the Stax and Flex launch.

He talked about self-custody catching up with the best UX and UI out there, claiming private property online for the first time in history, and why customers should upgrade to Flex and Stax.

Testimony of Crypto Evolution

Ledger introduced its touchscreen hardware wallets, Ledger Stax and Ledger Flex, earlier this year.

“We are trying to change the way you do self-custody,” Gauthier told Matt.

People typically name self-custody as the biggest issue – it’s hard to use.

Therefore, said the CEO, Ledger focused on the user experience (UX) and user interface (UI) for the previous products – Nano S Plus and Nano X – then “doubled down” for the new ones.

The team designed the products with a larger screen for two interconnected key reasons.

The first one is simple: customers asked for it.

Importantly, they need larger screens because they’re now completing larger transactions. This is the second reason.

Actually, argued Gauthier, this is where the market is going.

“Hardware outlets evolve as a testimony of crypto itself evolving,” he remarked.

Speaking of which, he remembered, the wallet started with BTC and ETH support, gradually moving to thousands of coins.

Beyond just the sheer number of coins, there are also new, complex types of transactions, with “DeFi on top of everything.”

Therefore, there is also the security aspect to consider – and reinforce – with each layer.

That said, the company didn’t just bring two wallets to the market, but also Clear Signing. This ensures that “what you see is what you sign.”

Ledger introduced the Clear Signing initiative, inviting Ethereum and other blockchains, as well as dapps and wallets, to join the protocol.

“So now you will be able to sign everything with your Ledger Stax and Ledger Flex and see exactly what you sign on your secure screen,” Gauthier said.

You might also like

Self-Custody is Catching Up with Best UX and UI Available

If you compare custody to self-custody, Gauthier argued, self-custody is actually the easier of the two.

Custody drags with it all sorts of factors that make “the experience extremely painful.” It is slow, requires KYC, it’s not necessarily available 24/7, and so forth.

Therefore, “self-custody is catching up very quickly with even the easiest custody interfaces,” the CEO said. “In no time, there will be no difference between the UX and UI of self-custody versus custody.”

The difference that will remain is the benefits provided by the self-custody option.

Also, the Ledger wallet is connected directly to all blockchains and all transactions without an interface between the user and the blockchains.

“You connect directly. This is the real future,” Gauthier said.

You might also like

History First: Claiming Private Property Online

Per the CEO, the end of 2024 and the beginning of 2025 will see significant market growth.

Certain development played a key role, such us BlackRock joining the game. That was “an earthquake,” Gauthier said.

This shifted the perception, as the question is no longer ‘Are you going to go into BTC.’ It’s ‘when’?

Therefore, TradFi people need to understand that, when entering crypto, there is a paradigm shift in terms of security.

The security needed to be fully revamped – deconstructed from the ground up.

“We had to reinvent security to protect secrets,” Gauthier said. Bitcoin is a blockchain that requires a private key – and those are secrets.

With this approach, you start with the things hardest to secure. Everything else becomes easier to protect.

This is why Ledger launched Flex and Stax with the passkey feature, which allows passkey storage as well.

The CEO stressed this is huge. Everyone must remember that when they store their passkeys and data in Google and Apple accounts, these are not actually their accounts.

They’re only given a right to access them by the real owners – Google and Apple.

Thus, “the big news is you can now claim private property online, which never existed before,” Gauthier said. “And you have the tool to do it. Ledger.”

This means that users can have their passkeys as their digital property. Only they can have it.

“And then you can decide to open the website in a simple type of Flex and Stax on your phone. It’s a thing of beauty.”

You might also like

‘A Happy Company’

Gauthier apologized for the prolonged wait for the new products. However, he said, in the end, they came at the right time.

The market was slow in the last two years. But now that the market’s moving, “you’re going to need these screens more than ever.”

The company shipped all the pre-orders, and customers can order Stax and Flex on the website.

These wallets are geared towards the next generation of users, the CEO said.

Some in the old generation prefer to do their own security, but “very few people on the planet can do that. [That’s] not very scalable.”

The wallets are a solution for everybody else.

Existing customers “should upgrade to a Stax and Flex, because it’s really so much better in terms of UX/UI,” Gauthier said, but advised them to keep their S Plus and X as a great backup.

Notably, he said, even though Flex is pricier than X, the team is selling “ten Flex compared to two X” when users can see and touch them.

“So now we’re going to present the product physically to our users so they can touch and see the difference,” Gauthier said.

Regardless of the market, he added, in Ledger, “we control our destiny. We got our new products. We’re shipping them, and we are a happy company.”

____

That’s not all.

In this interview, Gauthier also discussed:

- Nano S Plus and Nano X compared with Stax and Flex;

- launching not one product but ‘a tree that hides the forest’;

- Ledger raising $100 million in 2023 to keep investing in products, R&D, and services;

- Ledger’s growth amidst its tenth anniversary;

- big shift in the tech industry: product first, technology second;

- self-custody, security, and the right to economic freedom;

- AI and blockchain’s relationship— why proof-of-you is crucial;

- the future of hardware.

You can watch the full podcast episode here.

__________

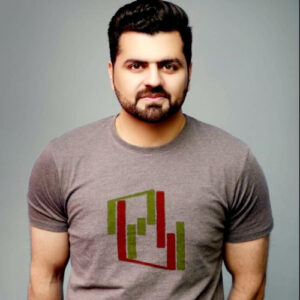

About Pascal Gauthier

Pascal Gauthier is the Chairman and CEO of the French startup Ledger, the tech company that makes the eponymous hardware crypto wallets.

Since taking these positions in 2019, Gauthier has expanded the company’s product line with Ledger Live, an intuitive digital asset management app, and Ledger Stax, a next-generation consumer device.

He also started Ledger Enterprise, the company’s B2B product enabling companies to secure their digital assets at scale. Gauthier began his career at Kelkoo, later acquired by Yahoo, and was COO at Criteo.

He also worked as a Venture Partner at London-based VC firm Mosaic Ventures and is non-executive chairman at digital data analytics provider Kaiko.