Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Pi Network has plunged by 8.5% in the past 24 hours, with its fall to $1.57 coming as the crypto market suffers a 2% drop today.

Its dive also happens to come on Pi Day, an international and annual commemoration of the mathematical constant π, from which the altcoin takes its name.

Yet this little fact doesn’t seem to have helped PI, which is also down by 12.5% in a week and by 47% since reaching an ATH of $2.99 on February 26.

However, a PI bull would argue that these declines put the new token in a strong position to rebound in the coming weeks, with Pi Network’s price prediction for the longer term continuing to look promising.

Pi Day is Here – Will Pi Network Price Explode or Keep Crashing?

It probably isn’t surprising that Pi Day hasn’t incited a massive Pi Network rally, given that the two aren’t directly related.

That said, some traders and platforms have made an effort of making a connection, with Bitget, for example, running a promotion to coincide with the mathematical celebration.

Yet probably the most relevant thing happening with the Pi Network today is that it’s the final deadline for passing the KYC necessary to migrate mined tokens over to the platform’s mainnet.

In fact, the deadline expired at 8:00am UTC (or 4:00am EST), meaning that any early PI miners who haven’t verified their tokens have now lost them.

Reports are already arriving that some PI holders have had to forfeit their tokens, although exact figures aren’t clear at this point.

This is damaging to Pi Network insofar as it makes the transition to its mainnet seem less-than perfectly handled, although bulls could argue that the burning of unverified tokens is good for deflation.

Either way, it seems that the market isn’t entirely happy about PI today, judging by how it has fallen harder than the rest of the market.

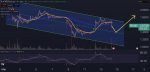

Its chart today shows a strong loss of momentum, with the 30-period average (orange) threatening to drop below the 200-period (blue).

However, once its relative strength index (purple) touches or falls below 30, we could then see the Pi Network price recover.

Based on its recent action, and depending on just how many tokens end up being forfeited, we could see it return to $2 by the end of April.

And assuming that the wider macroeconomic situation stabilizes (not very likely at the moment), it could hit $3 by H2.

Early-Stage Altcoins Showing Strong Potential

As popular as Pi Network has become, it has yet to prove that it has staying power, with the coin suffering a strong loss of momentum since its mainnet went live on February 20.

As such, many traders may prefer to look to even newer alternatives, with several presale coins looking as though they could also rally big when they list in the coming weeks.

One of these is Meme Index (MEMEX), an ERC-20 token that has now raised over $4 million in its soon-to-be-ending ICO.

Meme Index has been so successful in its presale because it’s offering something which no other project has offered to date, which is a decentralized meme index platform.

In other words, its platform will operate several indexes that will track varying baskets of meme coins, and which MEMEX holders can invest in.

It will offer four such indexes at launch, with each differing in its respective risk profile.

For instance, its flagship Titan index will track the biggest tokens such as Dogecoin and Shiba Inu, while at the other end of the scale its Frenzy index will track the newest meme coins.

By offering this, Meme Index provides investors with a means of spreading their risk across multiple tokens, while also increasing their exposure to potential gains.

And because MEMEX is the only way of investing in these indexes, it could attract substantial demand.

MEMEX’s presale will end in 17 days, with investors still able to join it by going to the Meme Index website.

The coin is now selling at its final presale price of $0.0166883, but this could rise much higher when it lists.