Triumphs are fleeting in China’s fast-changing economy. Earlier this month Colin Huang, the founder of Pinduoduo, a Chinese e-commerce darling, became the country’s richest man. The company, founded in 2015, rose to success by offering a gamified shopping experience where users can buy in groups to secure lower prices. Today it is China’s third-largest e-commerce firm by sales, behind only JD.com and Alibaba.

Mr Huang’s time atop China’s rich list was, however, brief. On August 26th Pinduoduo’s share price cratered by nearly 30% after it reported sales for the quarter from April to June that fell short of the market’s lofty expectations and gave warning that a long-run decline in profitability was “inevitable”. Mr Huang’s net worth plunged by $14bn, to a meagre $35bn; he is now only China’s fourth-richest person.

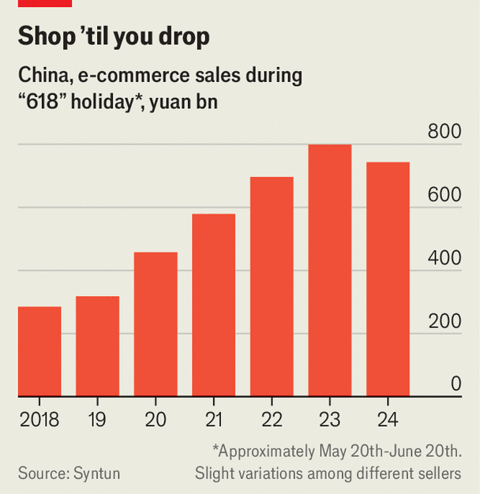

Pinduoduo’s woes are set against a backdrop of weakening consumer spending in China. In June sales from the “618” shopping festival fell for the first time since the annual e-commerce event began in 2010, despite a number of platforms extending their sales periods this year (see chart). Industry analysts expect e-commerce sales in China to continue slowing. eMarketer, a research firm, forecasts that annual revenue growth will fall from 8.3% this year to 6.5% in 2028.

A vicious price war is adding to the trouble. Visit any Chinese e-commerce site and you will be battered by signs advertising huge discounts and promising the cheapest deals online. Algorithms promote sellers with the lowest prices. Competition has grown more intense because of forays into e-commerce by short-video apps such as Douyin (TikTok’s Chinese sister company) and Xiaohongshu (China’s answer to Instagram).

Mutinous merchants are piling yet more pressure on the industry. Some Chinese e-commerce companies juice their sales by fining merchants for late deliveries or product mismatches. Last month hundreds of suppliers surrounded the offices of Temu, Pinduoduo’s foreign offshoot, in the southern city of Guangzhou to protest against such penalties. Dozens broke into the building. In response, Pinduoduo said on its earnings call that it would invest 10bn yuan ($1.4bn) to reduce fees for merchants and create “a healthy and sustainable platform ecosystem”.

Pinduoduo may be hoping that international expansion will rescue it from deteriorating conditions at home. That will not be straightforward. Although the number of people perusing Temu, which launched in America in 2022, has rocketed, owing in no small part to the vast amounts it has spent on advertising, turning that into revenue has proved trickier. eMarketer reckons Temu will capture less than 2% of e-commerce sales in America this year, compared with more than 40% for Amazon.

What is more, America’s e-commerce titan is fighting back against the Chinese upstart. During its Prime Day sale in July it offered discounts of up to 70% on some products. It is also reportedly planning to launch a discount section on its site which will feature cheap items shipped directly from factories in China. Cash-strapped consumers may celebrate the growing range of cheap goods on offer. For China’s e-commerce star, however, the future no longer looks as bright. ■

To stay on top of the biggest stories in business and technology, sign up to the Bottom Line, our weekly subscriber-only newsletter.